Ask even a semi-informed person and they will tell you that lobbying has a direct economic relationship to a company’s bottom line.

“Why would they do it otherwise? It’s common sense.”

Every now and then we read about how large corporations influenced policy to their benefit (e.g. GE has been famously notorious for avoiding billions of dollar in taxes). (1)

Not a bad return on investment, considering they “only” spend tens of millions on lobbying.

Lay of the “K Street” Land

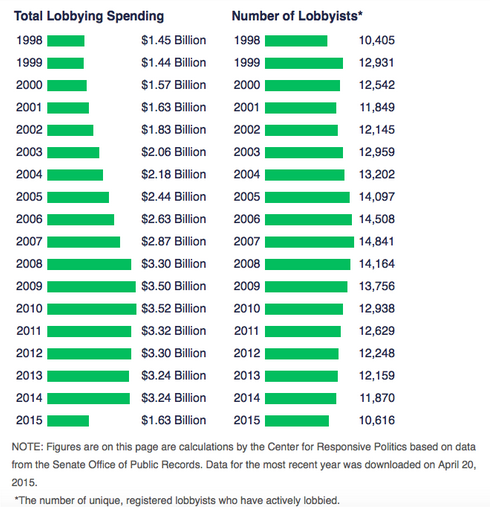

Before we go any further with Wall Street, it is important to understand K Street. From 1998 to 2008, total lobbying expenditures increased from $1.45 billion to $3.30 billion, a whopping 127% increase. To put this into perspective, cumulative inflation during that period was 32% in the United States. What’s so special about 2008? In many ways, we can divide recent history into two large parts: pre-2008 and post-2008. In the post-2008 era, several important events took place:

- The first black president won an emotionally charged U.S. election, marking the end of the “9/11 legacy” presidency;

- The financial world saw its biggest collapse since the Great Depression;

- The emergence of the Tea Party had a far-reaching impact on political and lobbying strategies (details about Boeing to come);

- Hundreds of thousands of large and small businesses either faltered or vanished;

- The Arab Spring revolutions spread across the Middle East.

- …and China has since failed to return to its glory days of consistent 10%+ GDP growth.

Also what is interesting is that since 2008 the official lobbying expenditure has stagnated while the number of registered lobbyists has gone down by 25%.

The above numbers are, of course, only true for registered lobbying figures on paper. Professor James Thurber of American University, who has studied lobbying for more than 30 years, estimates shadow lobbying expenditures to be as high as $9 billion, and the unofficial count of lobbyists to be as high as 100,000. (2)

A “Did You Know?”-worthy fact: many lobbyists are actually “revolving doors”, meaning they switch between private and public jobs. Opensecrets.org documented (as of August 2015) that close to 30 current White House and more than 20 current Department of Treasury staff have a direct lobbying past from the private sector! No wonder they are so effective.

Back to Wall Street

Let’s look at how some big companies spend their lobby money. At this point it is important to differentiate between direct and indirect lobbying. Indirect lobbying (e.g. the Tea Party) influences legislative decisions by stimulating debates or urging citizens to call legislators to action. Direct lobbying, on the other hand, is when companies or organizations directly interact with legislators to influence policy. It is also important to note that lobbying doesn’t mean bribing. At least, in theory. Given that many cross over between private sector jobs and acting as congressional staffers, it is not very difficult to see how boundaries are crossed every now and then.

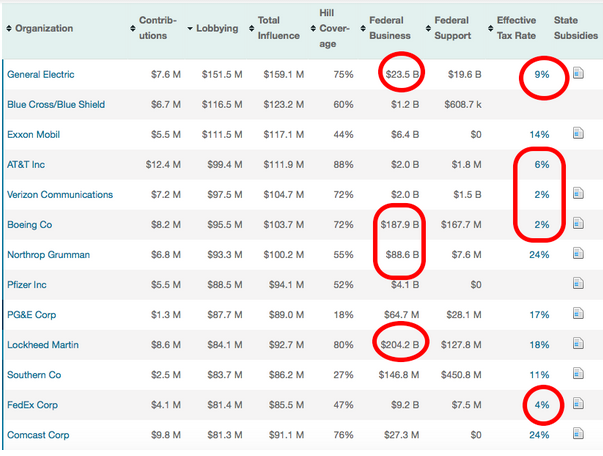

Lobbying data is known to be notoriously difficult to parse and I am guessing this is done on purpose. Between 2007 and 2012, the Sunlight Foundation conducted research on lobbying, tax rates, and federal contracts. The full report can be found here. The report tries to create a relationship between lobbying expenditures, government contracts, and lower taxes.

Note: I am not implying that every government contract acquired by these companies is a direct result of lobbying. In many cases, they probably are the best candidate for doing certain high-tech work.

Let’s take a look at the details of a couple of companies from the above list:

GE (GE )

- Direct Lobbying Expenditures: More than $230 million in the last 10 years. (3)

- Where Does the Money Go: GE’s lobbyists argue in favor of cheaper labor, lower importing restrictions, tax rebates, lenient environmental restrictions and friendlier immigration laws. GE is by far the biggest direct lobbying contributor in manufacturing (even bigger than groups like NAM and companies like P&G and 3M). It is also the biggest corporate lobby spender in the U.S.

- Famous “Revolving Door”: David Plouffe has served as Obama’s campaign manager, senior advisor to the President, and also as a management consultant to GE. CEO Jeffrey R. Immelt himself led the President’s Council on Jobs and Competitiveness. (4)

- It is not surprising to see that GE is one of the top companies to receive government contracts. The company has secured government contracts worth more than $26 billion in the last 10 years. (5)

- GE usually pays very little in taxes — either because they receive refunds or they can park their profits outside of the U.S. (6)

Boeing (BA)

- Direct Lobbying Expenditures: More than $150 million in the last 10 years. (7)

- Where Does the Money Go: 99% of the money goes to Defence Aerospace. Northrop Grumman (NOC ), Lockheed Martin (LMT ), and United Technologies (UTX ) compete for the same lobby target market as Boeing. Boeing’s lobbyists try to influence Armed Services committees, and are the most generous campaign contributors. They have long favored the republicans, but the tables turned at the halfway mark of 2008 (the emergence of the Tea Party divided the usual conservative consensus on defense spending).

- The company has enough power to change government budget allocations so that it can meet its revenue targets. (Just google fighter jets and government budgets and you will know what I am talking about.)

- Boeing has received close to a billion dollars in tax rebates and has barely paid any taxes in the last 15 years. In fact, in 2013 it paid no federal income tax even after making almost $6 billion in profits!

The Bottom Line

Lobbying is highest in sectors where massive capital investments are needed to run the business (e.g. aerospace, manufacturing), and there is strong dependency on the government for research funding, debt, and policies. And yes, lobbying does help companies to pay lower taxes, win government contracts, hire the best-skilled people, reduce import risks and costs, and future-proof their long-term investments, all of which have a direct impact on their bottom lines.

If you are thinking it’s better to get rid of lobbying altogether, think again. Lobbyists act as a funnel for voices, organizing them into logical groups before they reach lawmakers. Getting rid of this funnel would not only be unconstitutional (since everyone has a right to be heard), but also result in a complete paralysis of government decision making. Without lobbyists, the process would be akin to making decisions based on the noise coming from a classroom full of screaming kids.

There is, however, hope for the ordinary citizen. Thousands of small, but effective, advocacy groups regularly lobby successfully on important issues. For example, even though the CEO of Comcast golfed with President Obama, and spent $17 million lobbying in 2014, the company still couldn’t pull off the monopolistic merger with Time Warner.

Footnotes

(1) http://www.reuters.com/article/2014/02/26/us-usa-tax-corporate-idUSBREA1P04Q20140226

(2) http://www.thenation.com/article/shadow-lobbying-complex/

(3) https://www.opensecrets.org/lobby/clientsum.php?id=D000000125&year=2014

(4) https://www.whitehouse.gov/administration/advisory-boards/jobs-council/members/immelt

www.politico.com/news/stories/0211/49842.html

(5) http://www.militaryindustrialcomplex.com/totals.asp?thisContractor=General%20Electric

(6) http://www.reuters.com/article/2014/02/26/us-usa-tax-corporate-idUSBREA1P04Q20140226

http://ctj.org/ctjreports/2015/06/general_electric_routinely_pays_little_or_no_state_income_taxes.php

(7) https://www.opensecrets.org/lobby/clientsum.php?id=D000000100

Image courtesy of Vichaya Kiatying-Angsulee at FreeDigitalPhotos.net