Everyone loves a good deal and buying things on sale. In investing, we can use a variety of metrics to determine just how good of a deal we are getting on various asset classes. And right now, the bond market could be signaling that we have entered a so-called buyers’ market, full of deals and bargains.

According to asset manager Guggenheim, a variety of metrics are placing the spotlight on bonds as being a top asset class for the next few years, with values growing among a variety of fixed income subsectors.

For investors, Guggenheim’s latest report is just another bullet point as to why bonds should have a prominent place in your portfolio going forward.

Widening Credit Spreads

We all know what happened. Surging inflationary pressures required the Federal Reserve to act on interest rates. Several hikes later, and here we are with benchmark rates at 5.25%. And in that tightening, the overall bond markets fell, with the Bloomberg U.S. Aggregate Bond Index dropping by over 13% in 2022. This year has been essentially flat for the Agg.

However, that dip may signal an opportunity for investors in more way than one. That’s the gist according to a new report from Guggenheim Investments.

The dip in bond prices and rise in interest rates have ‘reset’ the sector, putting it back to more historic norms and, in this case, at cheaper levels. According to the asset manager, when looking at investment-grade corporate bonds—via the Bloomberg U.S. Investment-Grade Corporate Index—and high-yield bonds—through the ICE BofA High-Yield index—are currently yielding 5%+ and 8%+, respectively. Those are yields not seen since 2009/2010 and the Great Recession. 1

Guggenheim believes these yields offer plenty of opportunity and adequate reward for investors, particularly when looking at credit spreads. Credit spreads are basically the difference in ‘extra’ yield/compensation investors are looking to have when compared to risk-free assets.

Because of the growing risk in the economy—recessionary pressures, the debt ceiling issues, banking crisis/failures—investors have flocked to Treasury bonds and the shorter end of the curve. This uncertainty and flight to safety have pushed credit spreads in a variety of other fixed income assets to wide levels. According to Guggenheim, investment-grade spreads are on the wide side of history, while investment-grade securitized credit has seen spreads wider only 20% of the time going back to before the pre-2008 financial crisis.

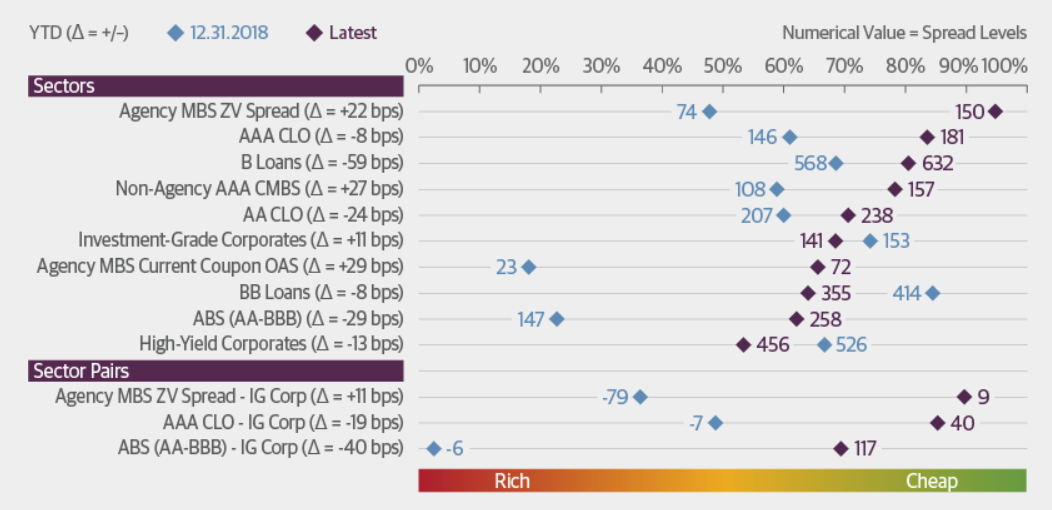

Looking at 2018 and the last tightening cycle, credit spreads are even better for a variety of asset fixed income asset classes. This chart from Guggenheim highlights the cheapness of many bond types. Focus on the purple diamonds and how far they are on the right side of the chart.

Source: Guggenheim

Attractive Yields to Weather Risk

According to Guggenheim, the wide credit spreads indicate that investors may be too worried about the market’s current risks and have been focusing too much on cash, short-term bonds, and Treasuries. Yes, recessionary pressures and inflation are still risks. However, the historically wide spreads and high current yields indicate that there is a large margin of safety baked into much of the fixed income market.

To that end, investors have their pick of the litter when it comes to building a bond portfolio. Guggenheim suggests that now is the time to move into other bond varieties, but with a quality tilt. That tilt can take many forms including “sector preference, seniority in capital structure, and prioritizing certain lending terms.”

Ultimately, bonds are in a buyers’ market with those investors willing to take the plunge having the best selection of issues. And here, there is plenty of opportunity for income as well as capital gains. While the Fed has indicated it will raise rates further, any recessionary pressures will have them cutting and that provides plenty of upside for bonds given the wide credit spreads.

Buying the Buyers’ Market

Given the wide spreads and current cheapness of bonds when compared to Plain-Jane Treasuries, investors may want to expand their opportunity set and move into other bond segments. There’s a lot of choice to be had within Guggenheim’s chart.

For indexers, that means betting on mortgage bonds, investment-grade bonds, junk bonds, and CLOs/ABS bonds via vehicles like the iShares MBS ETF, iShares iBoxx $ Investment Grade Corporate Bond ETF, VanEck CLO ETF, and iShares Broad USD High Yield Corporate Bond ETF makes adding these other bond segments easy. With low costs and easy one-ticker access, anyone can participate in the buyers’ market.

Here's a list of indexed fixed income ETFs

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| iShares Broad USD High Yield Corporate Bond ETF | USHY | ETF | No | $6.92 billion | 2.9% | 0.15% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD | ETF | No | $34.5 billion | 2.5% | 0.14% |

| VanEck CLO ETF | CLOI | ETF | No | $100 million | 2.5% | 0.4% |

| iShares MBS ETF | MBB | ETF | No | $21.4 billion | 0.9% | 0.04% |

But as we’ve said before, fixed income is a great place for active management and Guggenheim’s report underscores this fact. Finding bonds outside the index constraints could be better. Guggenheim’s High Yield Fund is rated four stars and has been a top performer, while the PIMCO Mortgage Opportunities and Bond Fund has the ability to buy MBS 7 CMBS bonds it feels are trading for discounts to the market. The JPMorgan Strategic Income Opportunities Fund could be used as an all-in-one bond choice given that its managers can buy any bond in any duration to provide a strong return.

Here's a list of active fixed income choices

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| Guggenheim High Yield Fund | SHYIX | Mutual Fund | Yes | $197 million | 1.4% | 0.85% |

| PIMCO Mortgage Opportunities and Bond Fund | PMZIX | Mutual Fund | Yes | $7.9 billion | 0.4% | 0.68% |

| JPMorgan Strategic Income Opportunities Fund | JSOAX | Mutual Fund | Yes | $9.25 billion | -1.2% | 1.02% |

The Bottom Line

Thanks to the drop in bond prices and rising interest rates, investors have now entered a buyers’ market for bonds. With the focus on Treasuries and cash, a variety of other bond asset classes are now trading for peanuts. Investors may want to follow Guggenheim’s advice and look toward sectors like junk and MBS to gain valuable yields and capital gains potential.

1 Guggenheim (June 2023). Fixed Income Is Now a Buyer’s Market