Every year, thousands of current and prospective students and their families struggle with how they are going to pay for tuition, fees and the other expenses that come with higher education. The true cost of going to college encompasses a great deal more than the money that actually goes to the educational institution, especially if the student attends a university away from home.

Aside from tuition, there are a number of other expenses that college students will face each year. We look at some of the additional expenses that most students can expect to face:

- School Supplies – This only begins with textbooks. Lab fees, drawing and art supplies, specialized equipment, computer college dormitory programs, website memberships and other classroom costs can add up to as much or more than textbook bills in many cases.

- Dorm Room Items – Bedspreads, comforters, sheets, bath towels, lamps, etc. – and furniture for an apartment or house for those who live off campus.

- Electronics/Appliances – Computers, tablets, TVs, iPods, mini-refrigerators, microwaves, etc.

- Clothes/Food – Even if a student is on a food plan or some sort in their dorm, there will still be times when food costs need to be factored in. Try to keep close tabs on this category, as this is where credit cards are frequently used.

- Cable/Cell Phone/Transportation/Parking/Utilities – Fixed monthly costs can and should be estimated realistically. Don’t forget that the electric bill can also get quite high for those with flat screen or plasma TVs who watch them continuously.

- Orientation/Sorority/Fraternity – Annual fees that can add up.

- Social Events – This is the silent killer in many students’ budgets. Two nights a week on the town with friends watching the game and then a party or two on the weekend can drain hundreds of dollars out of a student’s pocket over the course of a month. This is another major area of credit card use.

- Student Loan Interest – This expense is frequently omitted from the standard list of incidental educational expenses, but in many cases, this cost alone will exceed all of the others in this list combined, especially for students who attend costly graduate schools such as medical school. A student who incurs $100,000 of student loan debt charging 4% for 20 years will pay almost $50,000 in interest, of which only some or even none may be deductible, depending upon the type of loan taken and future tax laws.

- Travel Expenses – A student who lives on the East Coast and is accepted by Arizona State can most likely expect to spend at least a few thousand dollars in air fare as well as the cost of moving his or her belongings across the country and back.

- Opportunity Cost – Although it is usually a worthwhile trade-off, going to college deprives students of working full-time for however many years of study that they undertake, and this factor should at least be considered in some cases, such as if the student is majoring in a field that does not pay very well. If the degree is not going to lead to materially higher pay, then the student should probably weigh whether the remaining benefits to be had from getting the degree are worth the cost [see also Best Financial Advice for Young Adults].

No Change in Sight

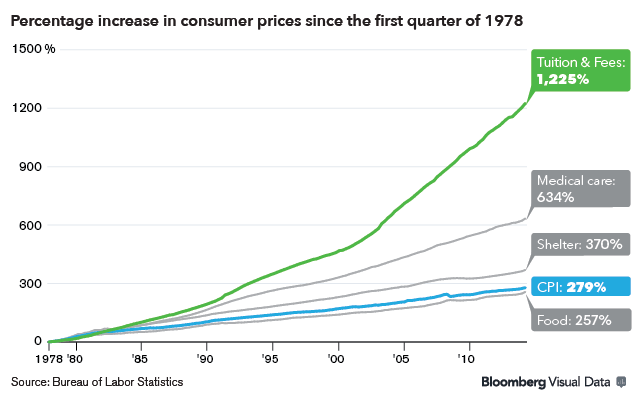

The cost of education continues to rise at a pace that exceeds both the general rate of inflation and the average family’s income, and this shows no sign of slowing. The College Board indicates that tuition, fees, room and board at four-year public colleges jumped 46% in the past decade, from an average of $10,440 in 1999-2000 to $15,210 in 2010. It is no surprise that a survey done by the Princeton Review that year also showed that 86% of students and parents say financial aid is absolutely necessary. This has caused many students to compare colleges based on cost when it comes time for many students to make decisions about their future.

The image below, courtesy of Bloomberg, shows how college tuition has changed over the years.

Of course, one of the main culprits behind this trend has been the ease with which students can get loans to pay for their schooling. As long as the educational institutions know that their fees will be ultimately covered by federal subsidies, then why shouldn’t they continue to raise tuition?

Possible Solutions

Students and their families have several options available to them when it comes to paying for college. Some of those alternatives include:

- Working part-time while attending school – This common solution is used by the majority of students as a means of earning at least a small portion of their total college expenses. Even students who are able to make enough to pay for their basic living expenses while in school can save money in the long run.

- Junior college – The number of accredited junior colleges that offer high-quality education is growing rapidly. And while these schools often provide first-rate undergraduate coursework in many fields, they typically charge far less than state-sponsored institutions and only a small fraction of what a private school costs.

- Two-year schools – Those without the resources to pay for four years of education or qualify for financial aid may be able to obtain an associate’s degree. This in turn can get them a job that may enable them to pay for school.

- Employer assistance – Many firms provide some form of assistance to their employees who desire to obtain higher education. The amount of aid that is offered and the conditions under which it is granted vary from one company to another, but it is a key benefit that many larger firms offer as a means of retaining employees and motivating them to become better educated, which in turn can qualify them for better jobs higher up in the company and thus allow the employer to hire from within [see also Working Past 65: The New Normal].

- The military – This is perhaps the best alternative for many young people who wish to go to college. The Montgomery G.I. Bill will pay for more than $46,000 worth of higher education costs-and the student can still get a paycheck and even full benefits from the military while they study. This alternative combines tuition assistance with a kind of real-world experience that cannot be found elsewhere.

- Full time work – Those who don’t have any other alternative can simply find full-time employment after high school and get in a few years on the workforce. Although this is obviously the least exciting proposition of those listed here, it can still provide the prospective student with some real-world experience before they go to school, which can help them to get more out of what they learn and also give them a greater appreciation for their opportunity to get a degree when it comes.

A Guide to Effectively Dealing with Student Debt

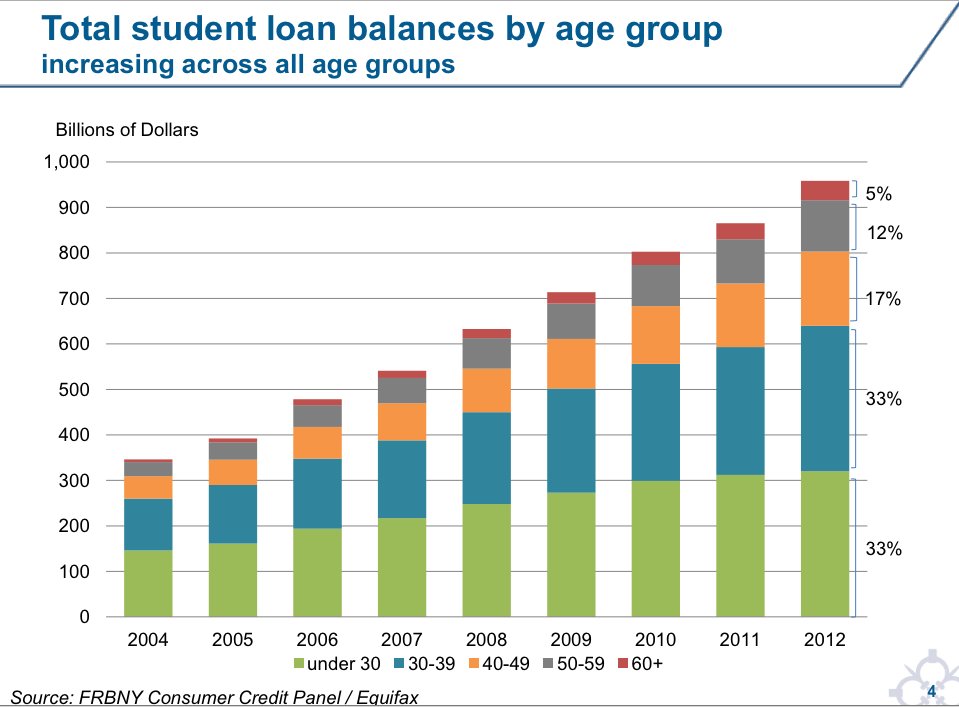

With the average cost of college rising, so too has there been a rise in average student loan debt, as more and more people take out loans in order to complete their degrees. The chart below, courtesy of Business Insider, shows how student debt has grown by age group over the last few years:

One of the most practical steps that those with student loan debt can take is to move back in with mom and dad after graduation. While this may not sound like a lot of fun, it is something that a surprisingly large number of graduates are opting for in today’s slow economy. A recent survey out from marketing and research firm Twentysomething Inc. said that 85% of college seniors planned to move back home and live with their parents after they graduate college. This allows graduates to save money on rent and get a head start on their loan payments, retirement savings and the purchase of a car if they do not have one already.

Graduates may also have more time to find the right job – one that will pay enough for them to be able to make their loan payments without running the risk of defaulting. And students whose parents charge them rent can at least be consoled with the fact that their rent money is going back into the pockets of the parents who raised them – helping the whole family become debt-free. After you have finished college, it can be difficult to land your first job. Get some tips in A Guide To Landing Your Dream Job.

Loan Consolidation

Borrowers who have more than one student loan and are struggling to keep up with the payments may be able to get some relief by consolidating their loans into a new, single extended payment plan with a lower monthly payment. Of course, the drawback to this plan is that they will pay more interest over the course of the loan than they probably will now. However, if the borrower expects his or her income to increase substantially within a reasonable period of time, then this may be a wise strategy to avoid a possible default in the present. Borrowers may also want to consider an income-based repayment plan that limits the monthly payment to a certain percentage of their discretionary income [see also Most Important Retirement Tips For Baby Boomers].

Loan Forgiveness for Public Servants

One good option for borrowers looking for student loan debt relief that are still uncertain about their calling in life might be public service of some sort. This encompasses a wide range of occupations, including teachers, police, fire and rescue professionals and other occupations that are classified as serving the public good. Employment at any 501(c )3 organization that is not religious or political in nature will generally qualify. Those who work as public servants can have their remaining student loan debt forgiven after 10 years if they make all of their payments on time during that period and also meet certain other criteria (this program is only available for federal loans). This is often referred to as student debt forgiveness [see also Considerations When Retiring Early].

The key to this strategy is to negotiate as low a payment as possible to begin with; a loan consolidation may be a wise way to begin this program. However, this will also effectively reset the clock on the forgiveness schedule. If the borrower was making payments for three years prior on three different loans, and then consolidated them, then he or she must make 120 on-time payments on the consolidation loan before applying for forgiveness. Furthermore, the amount of debt that is forgiven will be reported to the borrower on Form 1099-C. The borrower must then report the amount shown on this form as taxable ordinary income for that year.

Stay in Touch

If you are in danger of falling behind on your loan payments, contact the lender immediately and notify them of this. Explain your situation to them and outline your plan to get current again if at all possible. Staying current on student loan payments is vitally important for graduates, because failure to do so can have a substantial adverse impact on their credit scores.

Borrowers typically cannot escape their loan obligations by declaring bankruptcy; student loans are exempt from discharge for both Chapter 7 and 11 filers, unless a judge determines that the borrower meets certain strict requirements for financial hardship. If you completely defaulted on a loan at some point in the past, then contact the lender to set up a repayment schedule as soon you can, because your default will continue to further damage your credit score until you do this [see also How To Reduce Your Retirement Costs].

Deferment and Forbearance

If you are simply not going to be able to make your payments, then try to get either a deferment or forbearance on your loan so that you can preserve your credit history. Either of these options will release you from having to make payments for a specific period of time. A deferment is superior to forbearance because interest does not continue to accrue during the deferred period, whereas this is not the case with forbearance. When you apply for either of these, you will have to tell your lender what year you first took out a student loan (any loan, regardless of whether it was with this lender), because it is the basis for the calculation that determines the length of deferment or forbearance for which you qualify.

How to Help Pay for Your Children's or Grandkid's college costs

If you are fortunate enough to have built up a large nest egg for your retirement, you can help pay for your child or grandkids’ college costs, but you need to do it right. There are certain accounts that allow you to contribute specific amounts ever year, and there are often tax advantages for helping out your children or grandchild with their higher education.

One way to help your child or grandchild is to give cash gifts every year. Each year, because of the annual Gift Tax exclusion, you are able to give $14,000 per year, tax-free, to anyone you choose. Prior to 2013, the limit for tax-free gift giving was $13,000. In addition to the $14,000 annual Gift Tax exclusion, there is a 100% exclusion when you make direct payments for someone’s tuition expenses. The catch is that you have to pay the bill directly to the school. You cannot give the money to the child or grandchild and have them pay it. Some grandparents may elect to pay the school directly, then give a gift up to $14,000 to help the child or grandchild pay for school expenses. Neither of these payments is reportable for gift tax purposes, as long as you follow the proper procedures.

Before you move forward with any plans to do the plan mentioned above, sit down with a tax professional to review the options you have and also to find out of the gift tax exclusion limits have been updated. One way to ensure you’re in a position to fund your grandkids’ college expenses is to build up your own wealth. Learn more in How To Create An Effective Financial Plan.

Here are some more ways to reduce education expenses and how to find out if your child qualifies for financial aid.

College Savings Plans and Additional Funding

Choosing the right plan for your child is something you’ll want to thoroughly research. 529 Savings Plans are a type of investment guaranteed by a state or financial institution that allows for parents to save for their child’s education. These plans have tax advantages when used for higher education, have no income limitations, and are easily transferable to another beneficiary if needed.

The type of 529 Plan differs by state, but usually there are savings and pre-paid plans available. The 529 Savings Plan is like normal, low-risk investments, but they usually provide tax deductions, while pre-paid plans allow you to pay for future tuition costs in today’s dollars, thus saving you money when tuition increases in the future. Another benefit of most 529 Savings Plans is that you can contribute more tax-deductible dollars to them than for other plans like the Coverdell Education Saving Account. There are both pros and cons for a 529 Savings Plan, so look further into it before you decide if it’s for you.

There are of course other ways to save for college, including the Coverdell ESA and Roth IRA. The Coverdell ESA allows per-year contributions of $2,000 made in your child’s name. This is below what is allowed for the 529, but the Coverdell allows you more flexibility with how to spend the money in the account. Whereas the 529 is to be used for college only, or else be subject to taxes when taken from the account, the Coverdell ESA is more liberal in it definition of education, making the account available for private schools before college. Before deciding on a savings plan for your child, research the options available in your state, and come up with a plan for how much you to want to contribute yearly.

Aside from the college savings plan you start for your child, there are also scholarships and grants available to offer loan-free additions to your child’s college fund. Some good places to start looking for scholarships (there are a lot of these out there) are www.collegeboard.org and www.salliemae.com/scholarships. In addition, your child’s school will have its own scholarships available.

How to Cut College Costs

When looking for the right college, first figure out where you’d get the most bang for your buck. Instead of just looking at high cost out-of-state options, consider in-state and community colleges to make sure you’re not overpaying elsewhere for what you can get cheaper right at home. As well, go over the options available with your child – if your child believes he or she is expected to go to an expensive out-of-state school, explain the alternatives and their benefits.

Nearly every college has on-campus work opportunities for students, and this can also help offset some tuition costs — and give your child some spending money so they don’t have to bug you for cash.

Does Your Child Qualify for Financial Aid?

To make the most out of a school’s free resources, on-campus students should hit up their financial aid office to see if they’re eligible for any specialized scholarships, grants or work-study positions.

Submitting a Free Application for Federal Student Aid (FAFSA) form can help you potentially qualify for federal and state grants and loans. Federal loans are cheaper, more readily available and have better repayment terms than private student loans. Check out www.finaid.org as a great resource for information there.

Eligibility for federal student aid is based on financial need and several other factors. The financial aid administrator at the college or career school you plan to attend will determine your eligibility. Here is the criteria from the Federal Student aid site as well as the Expected Family Contribution Formula rules from SavingforCollege.com.

To receive aid from federal programs, you must demonstrate financial need (except for certain loans). When it comes to this requirement, the Expected Family Contribution (EFC) counts the following financial resources as being available to pay college expenses:

- 20 percent of a student’s assets (money, investments, business interests and real estate).

- 50 percent of a student’s income (after certain allowances).

- 2.6 percent to 5.6 percent of a parent’s assets (money, investments, certain business interests and real estate, based on a sliding income scale and after certain allowances);

- 22 percent to 47 percent of a parent’s income (based on a sliding income scale and after certain allowances).

- Have a high school diploma or a General Education Development (GED) certificate, pass an ability-to-benefit (ATB) test approved by the U.S. Department of Education, meet other standards your state establishes that the Department approves, complete a high school education in a home school setting that is treated as such under state law, or have satisfactorily completed six credit hours or the equivalent course work toward a degree or certificate.

- Be enrolled or accepted for enrollment as a regular student working toward a degree or certificate in an eligible program. Note: You might be able to receive aid for distance education courses as long as they are part of a recognized certificate or degree program.

- Be a U.S. citizen or eligible noncitizen.

- Have a valid Social Security Number.

- Register with the Selective Service if required. You can use the paper or electronic FAFSASM to register, you can register at www.sss.gov, or you can call 1-847-688-6888. (TTY users can call 1-847-688-2567.)

- Maintain satisfactory academic progress once in school.

- Certify that you are not in default on a federal student loan and do not owe money on a federal student grant.

- Certify that you will use federal student aid only for educational purposes.

Additional Resources for Student Debt

Here are some additional resources for those looking to learn more about student debt and how to manage it:

The Bottom Line

Although there are many benefits to getting a college degree, the real cost of getting a degree involves considerably more than mere tuition and books. If you need help paying for your education, consult your local financial aid office or your financial advisor. And remember, a good income-producing portfolio can help when planning for college’s high costs.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.