It’s no secret that fewer and fewer Americans are able to retire comfortably after reaching the age of 65. Many people in their 40s, 50s, and even 60s simply don’t have enough savings or the right investments in place to allow them to exit the workforce when they may have expected to do so.

As such, below we’ve compiled our list of the best financial advice for young adults, spanning from personal finance to investing tips:

7 Retirement-Planning Musts for Young Investors

As a young adult, it’s easy to get discouraged (if not altogether frightened) about retirement and investment planning when you hear about all of the difficulties and challenges facing so many hard-working Americans today. However, when it comes down to it, young adults actually boast a tremendous advantage over their older counterparts; simply put, young investors have more time to plan and make savvy financial decisions that will benefit them in their old age.

1. Make Education a Priority

While this may be the last thing that recent college graduates want to hear, education and knowledge regarding financial markets is one of the most valuable assets you can arm yourself with. There is no better way to retire comfortably than by learning about everything that goes into it while you’re as young as possible. By being aware of the nuances, tips, and tricks that others before you have uncovered, you stand to make more educated decisions when it comes time for you to cross those very same bridges.

If you haven’t already, start by reading our Free Lunch on Wall Street Guide – this piece offers straightforward advice on how you can make (and keep) more money, and the best part is that it’s all advice you can put to work today.

Whether it’s reading about different tax-advantaged savings accounts, opening an IRA, or learning to make the most of free resources to help manage your money, take the plunge today and start educating yourself about the challenges and decisions you’re likely to face tomorrow.

Be sure to check out the 50 Free Resources to Help Manage Your Money.

2. Develop Healthy Habits

Taking the time to set up a basic spreadsheet with broad categories for tracking your expenses can prove to be tremendously valuable down the road. The benefit of doing this is two-fold: first and foremost, it will prompt you to really analyze your spending habits as you are forced to write down each purchase at the end of the month. Second, by bringing transparency to your budget, you can have a better sense of what money-saving goals are feasible for you, and better yet, you can hold yourself accountable each and every month after you update the spreadsheet.

3. Save ASAP

You must’ve seen this piece of advice coming from at least a mile away. The truth is that the most surefire way to ensure a comfortable retirement is by saving enough, and more importantly, starting to do so as early as possible. Being able to take advantage of the power of compounding returns is undeniably one of the most fundamental money-management principles that every great investor has tapped into.

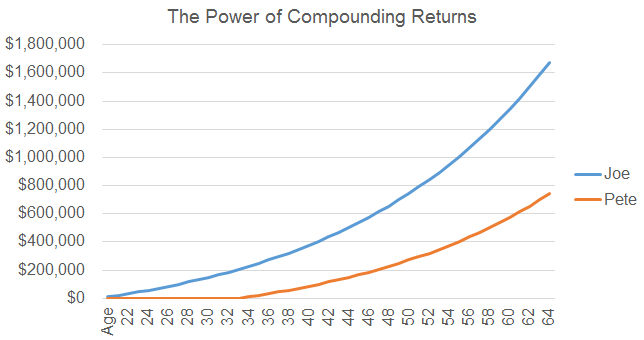

To illustrate the importance of starting to put away money for your retirement as early as possible, please consider the following example. Joe and Pete, both age 21, start their first job with the same salary; now suppose that Joe saves $10,000 every year right away, while Pete waits until he’s 35, before he starts to save the same amount.

When they both reach age 65, Joe’s nest egg has grown to $1,676,852, assuming an annual rate of return of 5%, while Pete’s has grown to $742,988; the difference is more than double, once again showcasing the importance of saving enough and starting to do so as early as possible.

4. Have Your “Buy List” Ready

Portfolio management is as hard as you want to make it. Instead of pulling your hairs out trying to pick the next penny stock before it rallies 1,000%, start by making a list of well-known, fundamentally-sound companies you want to have in your portfolio some day. If you don’t know where to start, consider our Best Dividend Stocks list for inspiration – the securities featured here may help you to refine your own list of “must-own” stocks.

The second, and much harder, part of this step is to actually put your “Buy List” to use when the time is right. Instead of giving into fear and selling out when the next crash rolls across Wall Street, you’re better off tapping in your portfolio’s cash reserves and picking up some high-quality stocks you had on your list when the rest of the herd is selling out of them.

The advice here is simple but powerful: make a list of stocks and other securities you want to own for the long-haul, then make sure to review that list periodically and especially after market corrections, because attractive buying opportunities can evaporate rather quickly.

5. Take More Risks

At Dividend.com, we’re fairly conservative when it comes to security selection. We tend to favor larger, U.S.-based companies with long track records of raising dividends more so than securities that boast lucrative growth potential. For young investors, however, it’s critical not to be overly conservative when it comes to your portfolio allocations; that is to say, don’t focus only on buying dividend-paying stocks that have been around for a while. Instead, go outside your comfort zone and consider investments that bear more risk, because at the end of the day, your long-term horizon is an asset in itself that you should strive to take advantage of.

Be sure to also see the Ultimate Guide to Blue Chip ADRs.

For example, instead of sticking only to Dividend Aristocrats, consider opportunities in small caps, or perhaps foreign equities; young investors need to resist their home country bias and spread their assets around the globe in an effort to more favorably position their portfolios for growth, 20, 30, and even 40 years from now .

Consider the table below which summarizes the Historical Asset Class Returns data compiled by Invesco:

| Asset Class | Average Annual Return (1994-2013) |

|---|---|

| Large-Cap Value | 11.33% |

| Large-Cap Growth | 11.18% |

| Mid-Caps | 13.20% |

| Small-Caps | 11.07% |

| Real Estate | 12.26% |

| International Equity | 7.81% |

While these average returns are bound to change over time, the point here is that there are other asset classes aside from large-cap, U.S. dividend stocks that are worth considering, especially if you have a long-term horizon.

6. Ride the Biggest Trends

Wall Street is a noisy place and the countless pundits out there make it even harder for young investors to navigate the financial markets without distractions. Do your best to ignore stock tips from mechanic, penny stock newsletters claiming to have uncovered “the next Apple,” as well as “hot tickers” permeating the headlines. Instead, try to focus your efforts on identifying and scaling into big trends with clear and definitive saying power; this means focusing on the long-term macroeconomic outlook and not the most recent earnings season.

One example of a “big trend” is the demographic transformation taking place at home as well as overseas. At home, baby boomers are retiring in droves while a young working population is embracing new spending habits online. Overseas, there is a rising middle class with a growing disposable income that is moving into cities, buying cars, and shopping for luxury goods for the first time in many instances.

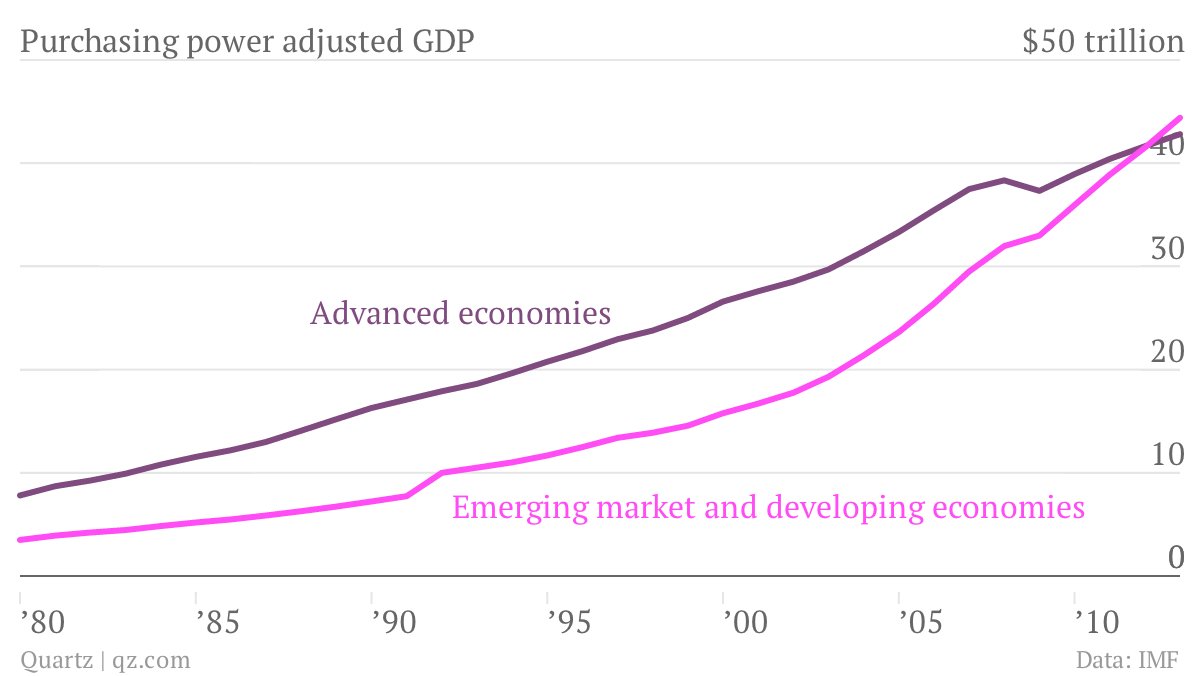

To put this shift into perspective, consider the chart below which compares the combined GDP of emerging and developed markets, adjusted for purchasing price parity:

According to the IMF, 2013 was the first year in which the GDP of emerging markets eclipsed that of developed markets; what this means is that emerging markets will account for a larger share of global GDP growth going forward, once again showcasing the lucrative opportunity to diversify overseas.

7. Invest Today

Aside from getting educated (see tip #1), actually starting to invest in your retirement account is undeniably one the best steps you can take towards ensuring a more comfortable retirement for yourself. If your employer offers to match your contributions to your retirement plan, make sure you take them up on it; this is effectively “free money” that you’d otherwise be leaving on the table. If your job doesn’t have a 401k or IRA plan, then take the plunge and open a retirement account for yourself and make sure to contribute to it.

Suppose you have your retirement account and “Buy List” ready, but you’re still wary of jumping onto Wall Street. Don’t burden yourself with trying to time the market; instead, simply put your money to work right away. There is a plethora of academic research that demonstrates that most investors are better off investing immediately as opposed to trying, and usually failing, to correctly navigate the ups and downs in the market.

Saving and Retirement Planning When You’re in Your 30s

Everyone knows that the sooner you start saving the better, but when you’re young, paying off student debt and working an entry-level job, it can seem overwhelming to also be planning to buy a house or for retirement. Once you get to the point where you are able to start putting away money (ideally in your late 20s or early 30s), there are some key things to keep in mind that will help you in setting up a realistic and successful financial life.

Before You Start Saving

To begin saving you need to work out what and when you want to be able to do things. You’ll want to look at what your goals are, and then at what age you hope to do these things. Some main financial goals would be:

- Buying a house

- Buying a car

- Paying off other debts

- Retiring

After you’ve considered what your financial goals are, you’ll want to set up some realistic dates for when you want to achieve these goals. What you need to consider is:

- Your age

- Your income

- Your current outstanding debts and financial obligations

- Your tax rate

- Your monthly expenses

Once you have constructed an image of your current financial situation and your future financial goals, you can begin to create a financial plan that will allow you to achieve these goals. After you have a good understanding of your finances, you can start looking at what saving and investment options are available, and which ones best fit your goals.

Be sure to read the 40 Things Every Dividend Investors Should Know About Dividend Investing.

Savings and Investing Options

Savings Accounts

Savings accounts are flexible savings options, where you are able to add to and withdraw from them, but they don’t provide much of a return over the long-term. Banks will be giving low percentages for using your money (online banks are usually able to give more than brick-and-mortar banks), so it’s best to use these accounts for short-term savings, and have your savings for long-term goals in investing vehicles that give a better ROI. Go over the terms of a savings account carefully, as there are sometimes fees or penalties for too many withdrawals during a month.

Certificates of Deposit

Certificates of deposit (or CDs) are a low-risk investing option that provide similar security to a savings account. Because of the security provided, CDs also offer a limited return on your investment. CDs have more rigid withdrawal guidelines than a savings account, however, and the bank expects that you will leave your CDs in the bank for a specific amount of time, and make no withdrawals. The terms of a CD are agreed upon when you start this savings vehicle with your bank, and you are guaranteed an interest rate over the life of your CD. As well, CDs are insured up to $250,000 by the FDIC. In general, the larger your CD and the longer you leave it in, the better return rate you can get. CDs will usually have a withdrawal penalty if you wish to cash out before the CD’s term is up, so make sure you understand all terms and conditions before investing.

To learn more about CDs and using a CD laddering strategy, be sure to check out An Introduction To Certificates Of Deposit.

Investing Portfolios

Here at dividend.com, we recommend that instead of going with a savings account or CDs, you use a dividend investing portfolio for your long-term financial goals. You can also include dividend stocks in your retirement portfolios (if you have the option of choosing what investments to include). Our Dividend University has many articles that can teach you the ins and outs of dividend investing, and our Dividend Tools give you up-to-date info to help you choose the stocks you want to invest in.

Keeping an Emergency Fund

Though we’ve mostly discussed short- and long-term savings options in this article, don’t forget to have an emergency fund that can cover 6-12 months of expenses if there are unexpected events that could force you to tap your savings. You want to avoid any possible penalty of needing to use money out of your retirement accounts. Your “emergency” money should be kept in a liquid account, preferably a money market account or short-term CD that is penalty-free for early withdrawals.

For a millennial, it’s very tempting to spend money on unnecessary goods and various forms of entertainment, but it’s important to keep the future in mind. Though it’s easy to justify frivolous spending, putting money away for retirement is much more effective if it is done early in life. Below, we highlight 20 expenses that millennials can avoid and outline how that money would be better invested at a 4% compounding return over 30 years.

(Note: This article assumes a 6% return and a 2% inflation rate, totaling a net return of 4% per year)

Flat Screen TV

- Average Cost: $1,919

- Value if Invested for 30 Years: $6,224

By holding off on the purchase of a flat screen TV, which averages a total cost of $1,919, an investor could invest that amount for 30 years, turning the original investment into about $6,224.

Ticket to an NFL Game

- Average Cost: $200

- Value if Invested for 30 Years: $648

By staying at home and watching the game in your living room instead of attending the game, the $200 that would have been spent on a ticket could be invested. After 30 years, you will have around $648.

Macbook Pro

- Average Cost: $2,000

- Value if Invested for 30 Years: $6,486

By holding off on purchasing a new Macbook Pro, an investor could invest the $2,000, turning it into $6,486 by the time it is withdrawn after 30 years. Be sure to also read How Does Apple Stock React to Product Releases?.

A Week in London

- Average Cost: $2,500

- Value if Invested for 30 Years: $8,108

That week in London may seem like a great vacation choice, but for a millennial thinking about saving, it may be a better move to invest that money. The $2,500 in travel costs would be worth about $8,108 in 30 years.

Night at the Bar

- Average Cost: $50

- Value if Invested for 30 Years: $162

On average, a millennial spends around $50 for a night out at the bar. If one bar trip is avoided and the $50 is invested for 30 years, the value will be about $162.

A Year of Starbucks

- Average Cost: $1,000

- Value if Invested for 30 Years: $3,243

Coffee addiction? It’s probably costing you. On average, consumers that visit Starbucks (SBUX) daily spend about $1,000 a year on coffee. If this money was invested, it would be worth about $3,243 in 30 years.

A Year of Ordering Out

- Average Cost: $1,500

- Value if Invested for 30 Years: $3,243

The average American spends about $1,500 more per year on ordering out than they would if they cooked food at home. If the extra $1,500 was invested, it would be worth about $3,243 in 30 years.

The Importance of Savings

The importance of saving is something that many millennials do not realize to its full extent. Compounding returns work best if money is invested as early as possible. Even the small expenses add up. While it is tempting to spend money on entertainment, millennials should pay attention to all expenses and realize the potential of the returns if the money was invested instead.

The Bottom Line

There are no shortcuts when it comes to accumulating wealth. However, for young investors, one of the most encouraging things about this otherwise intimidating milestone is that time is on their side. If you want to retire more comfortably down the road you need to take advantage of your time today. Simply put, the best piece of advice is to start to educate yourself about finance and start saving and investing as early as possible.

Be sure to follow us on Twitter @Dividenddotcom.