A dividend is defined as a payment made by a corporation to its shareholders. Usually these payouts are made in cash (called “cash dividends”), but sometimes companies will also distribute stock dividends, whereby additional stock shares are distributed to shareholders. Stock dividends are also known as stock splits.

Cash Dividends

Cash dividends are normally paid to shareholders each quarter, or four times per year. However, some companies pay dividends annually (once per year), semi-annually (twice per year), or even monthly (12 times per year). Each company sets its own payout schedule and determines the dividend dates on which the dividends will be made. Some companies will even pay a special (one-time) dividend every so often. These special payouts are separate from the company’s regular payout schedule and are not factored into the stock’s dividend yield.

Not every company pays dividends, and companies can change their dividend policies at any time. As investors become increasingly hungry for yield, however, more and more companies are initiating new dividends and raising their existing dividends.

Quick Facts About Dividends

- The term “dividend” derives from the Latin term dividendum, or “thing to be divided.” In other words, companies divide their profits up among shareholders.

- Companies have been paying dividends to shareholders for over 400 years. The first company to ever pay a dividend was the Dutch East India Company in the early 1600s.

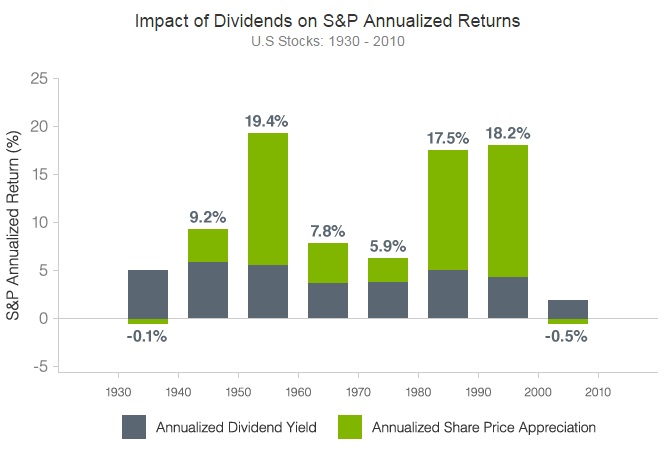

- Dividends alone have accounted for over 40% of the S&P 500’s total returns since 1929.

Why Do Companies Pay Dividends?

Companies sell stock shares to the public to raise money, which they then use to fund existing operations and expand their businesses. In essence, a dividend is a reward given to shareholders for owning stock in the corporation. So, dividends are a key way for companies to attract investors to buy their stock.

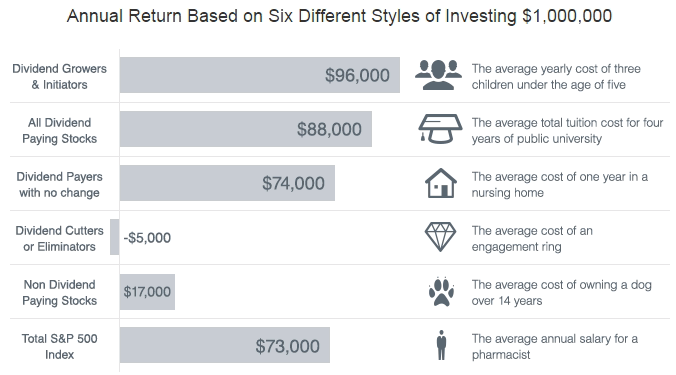

What Could Investing Returns Buy You?

Now let’s take a look at what those various investing returns could buy you, based on historic average annual return.

From the early days of stock markets through the mid-20th century, dividends were the primary method of returning value to shareholders. Price appreciation was considered more of a bonus, as people bought stocks mainly because of their sizable dividends.

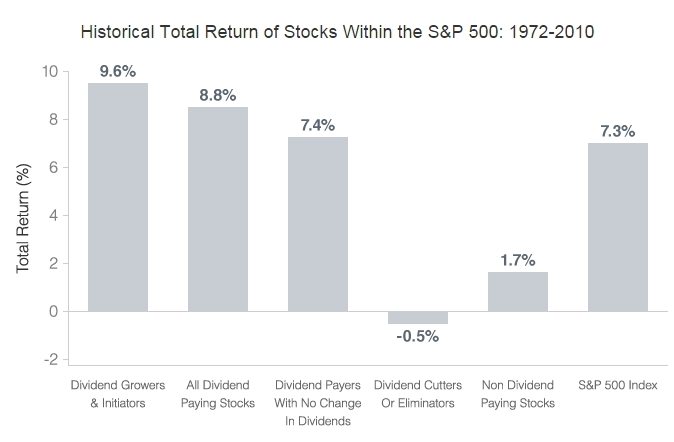

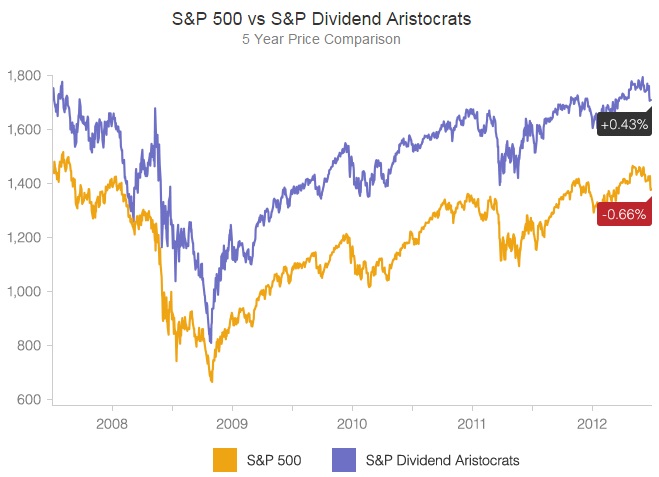

In more recent times, dividends have come back into vogue. For the past five years, dividend stocks have easily outpaced the price performance of non-dividend stocks.

How Do I Collect a Dividend?

If you buy a dividend-paying stock and meet the eligibility requirements (determined by its dividend dates), you’ll receive dividends. These dividend payouts are issued on a per-share basis. For example, if an investor purchases one share of stock XYZ, which pays 25 cents quarterly, the investor will receive 25 cents for each share he or she owns, four times per year.

Dividends are most commonly deposited into a shareholder’s brokerage account. However, if an investor buys shares directly from a company itself (through a direct investment plan like a DRIP, for example), then the dividends can be automatically reinvested to buy more shares. Investors may also choose to have dividend checks mailed to them.

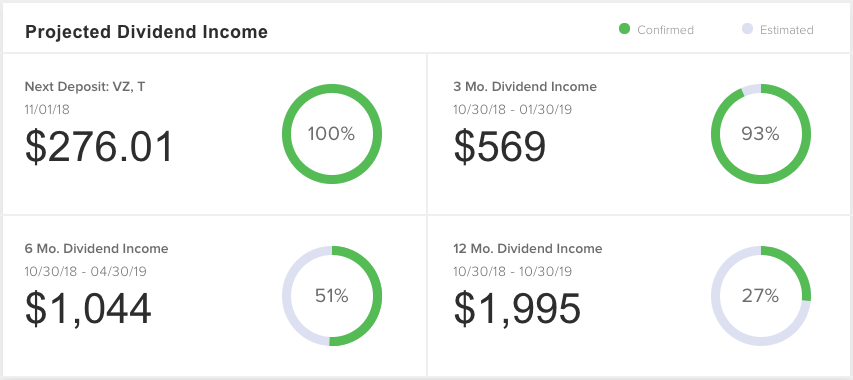

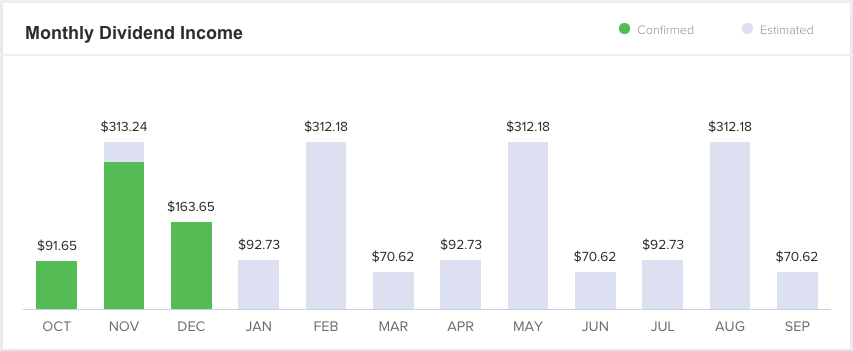

To better estimate your future dividend income, be sure to check out our Dividend Assistant tool. It’s free to use. The Dividend Assistant tool allows you to link your brokerage account or manually add your holdings in order to organize and track all dividend income for the upcoming 12 months. Investors can visualize the size of their dividend payments, which holding(s) the payment is from, and the certainty of the payment (confirmed vs estimated). Check out the sample portfolio screenshots below.

What is Dividend Yield?

A stock’s dividend yield refers to the expected return of a stock — in dividends — over the course of a calendar year. Yield is presented on a percentage basis of the stock’s current price. For example, if stock XYZ is trading at $100 per share, and it pays a total of $5 in dividends this year, then its dividend yield is 5% (since $5 is 5% of $100).

Since a stock’s price will change on a daily basis, so will its dividend yield. Dividend yield will move up or down inversely to the share price. So if a stock’s price goes up, its yield goes down — and vice versa.

Dividend Investing

Dividend investing is one of the most popular strategies for traditional, buy-and-hold investors. Typically dividend investing involves selecting companies which feature an attractive and sustainable dividend yield. This approach also puts value on consistency; for example, a company that has increased dividends for more than 10 or 25 consecutive years is regarded as a good dividend investment, as these stocks are more likely to continue to increase distributions.

In addition, dividend investors also focus on a number of fundamentals besides dividend yield and consistency. A stock’s valuation, performance history, and earnings growth should also be considered before any investment decisions are made. Other more subjective factors can also be used, such as a company’s current business environment, its future plans, and even industry or broader market trends.

Overall, dividend-focused portfolios can provide a significant source of income for all investors, whether in retirement or not. Additionally, this strategy can also feature compelling long-term returns, as typically dividend paying stocks are some of the most reliable and resilient companies on Wall Street.

To view Dividend.com’s Highly Recommended list of stocks, be sure to check out our Best Dividend Stocks List. The list features Dividend.com’s top-rated dividend stocks, geared toward traditional long-term, buy-and-hold investors. All stocks on this list are rated using Dividend.com’s proprietary Dividend Advantage Rating System – DARS™. Refer the below screenshot of our partial list, which gets updated each week.

Related Articles

Also, check out Dividend.com’s tools. Our tools help investors make sound investment decisions. Investors can narrow down their stock investment search by screening, comparing and analyzing the vast universe of dividend-paying stocks.