Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Enterprise Products Partners took the first position in the list, as the company again raised its dividend. Second in the list is Cisco Systems, which closed one of the largest deals in tech in 2023. Third is Pepsico, which has performed well but the stock faces challenges. The list is closed by JP Morgan Chase, one of the best-performing banks last year.

Don’t forget to read our previous edition of trends here.

Enterprise Hikes Dividend by 3%

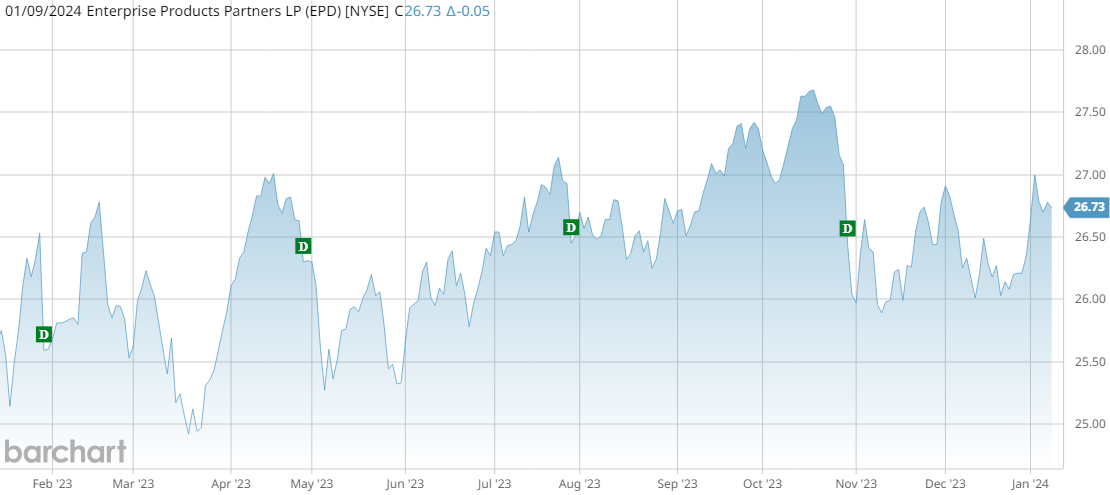

Enterprise Products Partners (EPD) has taken the first position in the list this fortnight, seeing its viewership increase by 29.9%.

Readers were attracted to the company, as Enterprise increased its dividend by 3% for the fiscal third quarter of 2023. The dividend will be paid on February 14 to shareholders of record as of January 31. Since 2022, Enterprise has hiked its dividend every two quarters, compared with every four previously. This has largely been possible thanks to the company’s strong results. In fiscal 2022, revenue shot up 43%, while net income increased 18% thanks to higher oil and gas prices.

In 2023, revenues began to fall as commodity prices fell but remained stable. The stock performed decently, up about 5% over the past 12 months. The dividend yields an annual 7.5%.

Source: Barchart.com

Cisco Systems' Ongoing Focus on Software Business

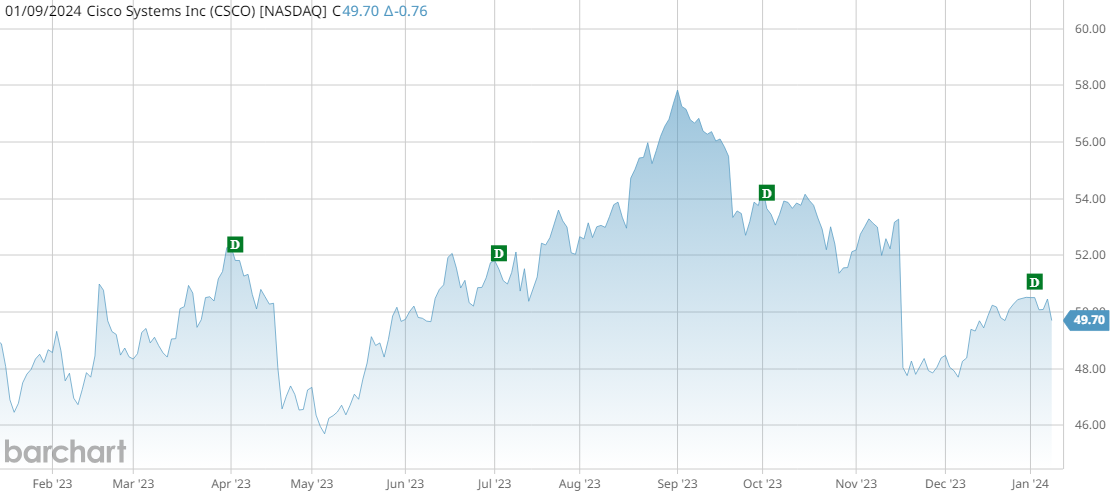

Cisco Systems (CSCO) is second in the list with an advance in traffic of 14.9%. Cisco shares have been trading sideways for most of the past year, as investors were struggling to figure a bearish or bullish case.

Cisco’s legacy switch and routers business has performed well, but might be struggling somewhat going forward given competition and falling IT budgets at large corporations. However, Cisco has been making acquisitions in the software space to diversify away from its legacy hardware business.

Late last year, Cisco acquired cloud networking company Splunk for a whopping $28 billion. For the time being, the acquisition is unlikely to significantly boost the bottom line, but could help it in its quest of becoming a software-focused firm.

Cisco pays a quarterly dividend of 39 cents per share and it is very likely to boost it again this year by one cent, as it did in previous years. The dividend yields 3.1% annually.

Source: Barchart.com

Pepsico Sees Products Withdrawn From Carrefour

Pepsico (PEP) has taken the third place in the list with an advance in viewership of 9.1%.

Pepsico has been in the news lately after its products were removed from the shelves of supermarket giant Carrefour over what it says are unacceptable price increases. Carrefour, which has over 29,000 stores worldwide, said a lot of sellers have been increasing prices too fast and too much, so it decided to remove all Pepsi products like Lay’s and Dorritos. However, for now it is hard to see how the dispute will have a material impact on the stock.

Shares in Pepsi have declined about 4% over the past week, extending annual losses to around 7%. Since reaching an all-time high in May 2023, the stock has declined about 15%. Pepsi’s dividend yields about 3%, and the company has been increasing it in each of the past 52 years.

Source: Barchart.com

JP Morgan Chase Is 2023’s Best-Performing Bank

JP Morgan Chase (JPM) has taken the last spot in the list with a rise in viewership of 8.8%. JP Morgan has been the best performer from all the U.S. major banks last year, outperforming the second-best performer Wells Fargo by 8 percentage points.

JP Morgan and its CEO Jamie Dimon were able to extinguish a potential banking crisis in 2023 by swiftly agreeing to acquire First Republic, which could have gone under just like Silicon Valley Bank. The deal was not only good for the financial system, but also for JP Morgan itself, which recorded a one-time post-tax gain of $2.6 billion as a result of the acquisition.

JP Morgan pays an annual dividend of $4.20 per share, equal to a yield of about 2.5%. The bank raised its dividend in September 2023 by 5 cents per quarter.

Source: Barchart.com

The Bottom Line

Enterprise Products has raised its dividend by 3%, as the company’s strong results allowed it to increase the frequency of the hikes. Cisco is continuing its journey toward becoming a software company. Pepsico’s products have been withdrawn from a large supermarket after it instituted another price increase. Finally, JP Morgan is the best-performing banking stock of 2023.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.