Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Cigarette manufacturer Philip Morris International is first in the list as the company received a boost following an analyst upgrade. Machinery maker Caterpillar placed second, because the firm recently increased its dividend. Real estate asset manager Rithm Capital has taken the third spot, while business development company Main Street Capital closes out the list.

Don’t forget to read our previous edition of trends here.

Philip Morris Seeks to Become ESG Stock

Philip Morris International (PM) has taken the first spot in the list this week, seeing an advance in viewership of 29%. Philip Morris, an American multinational tobacco company, may be primed for a rally. The stock is down 5% so far this year and trades at a relatively weak price-to-earnings ratio. In addition, Philip Morris may soon become an ESG stock, which could lead to higher demand from large institutional investors, including ESG funds themselves.

The stock yields a strong 5.3%, in no small part thanks to the depressed valuation. And the company’s sales have been on an upward trajectory for the past five quarters, as the company’s next-generation tobacco products like IQOS have proven popular and experienced rising demand.

Unsurprisingly, analysts at Citi upgraded the stock recently, citing the high-growth non-smoke category.

Source: Barchart.com

Caterpillar Raises Dividend

Caterpillar (CAT) has taken the second position in the list, seeing its traffic climb 26% during the past fortnight. Caterpillar has been in the news after the company raised its quarterly dividend by 8% to $1.30 per share. The dividend is payable on August 30 to shareholders of record as of July 20.

The construction machinery manufacturer has seen strong revenue and profit growth in the past five quarters. The first quarter ending in March was much stronger than the same period last year, but well below the prior quarter. Net income, however, was one of the strongest in the past year at nearly $2 billion.

The new dividend will yield about 2.2%, as the company pays out to shareholders only a third of its net income. The company has been increasing its dividend for 31 consecutive years.

Source: Barchart.com

Rithm Capital Stock Unnecessarily Punished

Rithm Capital (RITM) is third in the list with an advance in viewership of 25%. Rithm, which yields a high dividend of nearly 11%, has declared its regular dividend recently, which was unchanged from the previous quarter. Last time Rithm increased its dividend was in 2021.

As a mortgage REIT, Rithm stock may have been unnecessarily punished following the collapse of Silicon Valley Bank. The company appears to be on strong footing and unlikely to be forced to cut its dividend. One reason for that is that it is more geared towards mortgage servicing rights, which usually are less hit by rising interest rates than owners of mortgages.

Source: Barchart.com

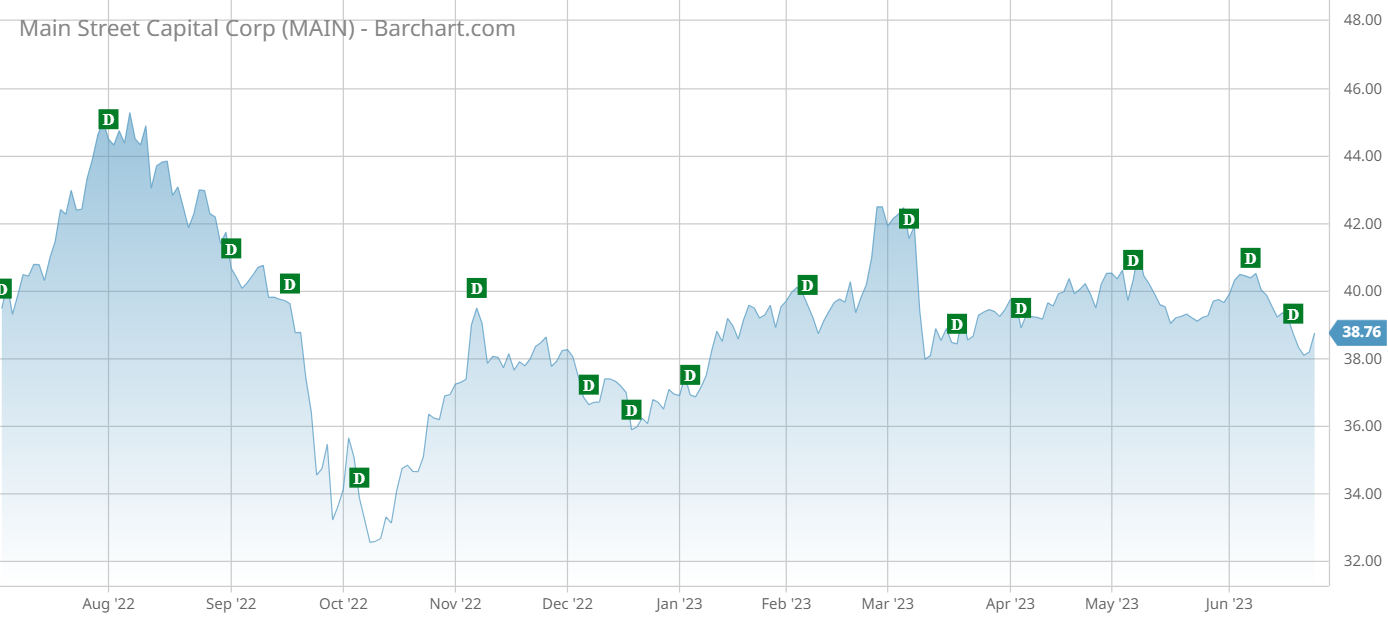

Main Street Capital Benefits From Rising Interest Rates

Main Street Capital (MAIN) is last in the list, seeing a rise in viewership of 23%. Main Street is another high-yielding stock, with the dividend standing at about 7.1% on a payout ratio of 72%. Main Street is a private equity firm that buys companies with revenues between $10 million and $150 million. It operates in many sectors, including technology, manufacturing and healthcare.

Shares in Main Street have gained 5% this year. The stock is largely stable, although it had plunged during the coronavirus pandemic. The stock has been on its way to recovery ever since. Higher interest rates are actually positively impacting the company’s results, as its interest income rises in tandem with base rate changes. Its interest expenses have also increased but have a much smaller impact to the bottom line. If interest rates were to fall, Main Street would suffer.

Source: Barchart.com

The Bottom Line

Philip Morris could get a boost from higher sales of smoke-free tobacco products. Construction machinery maker Caterpillar increased its dividend as its results continued to improve. Rithm Capital’s stock is unnecessarily punished by the stock market, while Main Street Capital’s high dividend and stable business are beneficiaries of high interest rates.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.