Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week, our readers’ attention turned to streaming giant Netflix, which saw its stock drop after a disappointing earnings report and guidance. GlaxoSmithKline, the U.K.-based pharmaceutical giant, has risen to the second spot in the trends’ list this week from “fourth last week.” Omega Healthcare, which sports a very high dividend yield, and Costco close the list.

Check out our previous edition of trends here.

Netflix Over-Promises and Under-Delivers

Streaming giant Netflix (NFLX) has had better days. The Wall Street darling has seen an abrupt reversal of its fortunes after woefully under-delivering on subscriber growth in the second quarter of this year. Netflix, which was up 108% year-to-date into the earnings call, fell as much as 5% following the disappointing data, prompting the company to acknowledge that it had “over-forecasted” global net additions of subscribers. Netflix has seen its viewership rise as much as 33% this week.

The company added 5.15 million subscribers in the second quarter, well below estimates of 6.2 million provided in April. Around 4.5 million international streaming users were added in the quarter and 670,000 at home. The company had forecasted it would add 5.9 million internationally and 1.2 million at home. Despite the drop in net subscriber additions, Netflix reported a profit of $384 million, or 85 cents per share, beating consensus of 79 cents per share. Meanwhile, revenues advanced to $3.91 billion from $2.79 billion a year ago.

Netflix’s long-term prospects are unlikely to deteriorate, although a merger between Time Warner and AT&T will increase competition in the streaming sector. Meanwhile, Disney’s acquisition of 21st Century Fox and its aim to launch its own streaming service while pulling out content from Netflix may also have a negative impact. Despite not having a big moat, Netflix already has a hefty head-start in the streaming wars and its bold bet on content creation will likely continue to attract users.

A dividend payment is not in sight given the firm is in strong growth mode.

GlaxoSmithKline

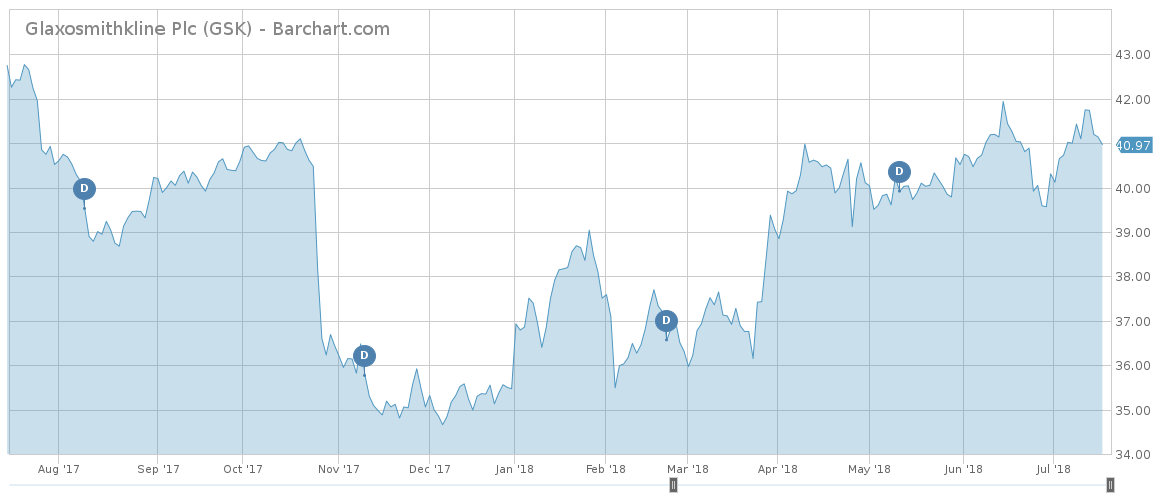

GlaxoSmithKline (GSK ) has seen its viewership rise 23% this week, with the company trending for the second consecutive time. With a solid dividend of nearly 5% and good growth perspective, income investors’ love for the stock is unsurprising. Year-to-date, GlaxoSmithKline shares are up more than 15%, although they remain down more than 2% for the past 12 months.

GlaxoSmithKline gradually hiked its dividend between 2000 and 2014. Since then, the dividend has remained the same, although it fluctuated in dollar terms given its London listing. With some new drugs in its pipeline, including an asthma treatment, and the recent acquisition of a Novartis stake in the consumer healthcare joint venture, the group may restart increasing its dividend in the near future.

Still, GlaxoSmithKline faces a number of headwinds, such as slowing growth in the consumer segment and fiercer competition from generics. The firm is trying to offset lower profitability with new drug launches.

Omega Healthcare Investors

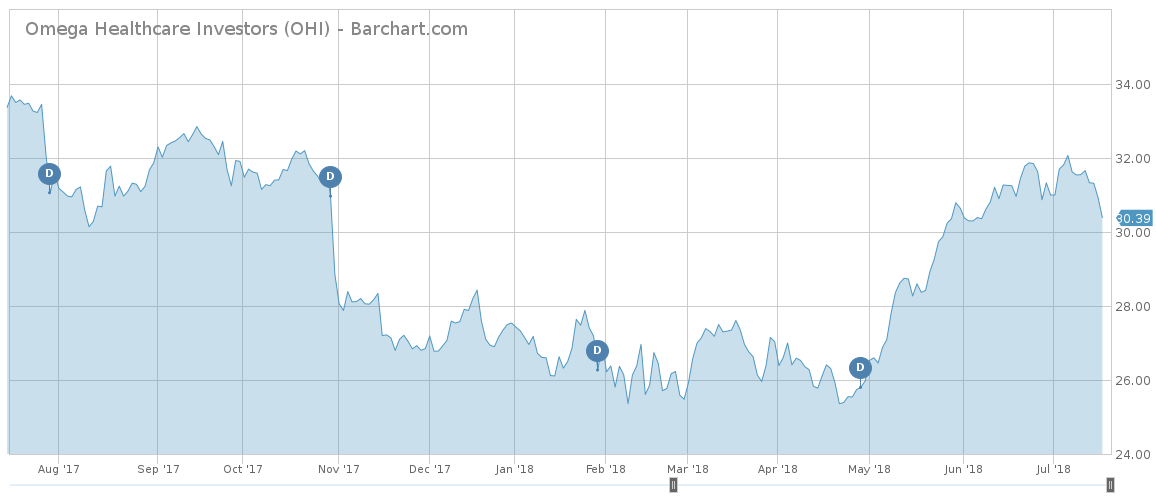

Omega Healthcare Investors (OHI ) has taken the third spot in the trends’ list this week, as the company’s stock swooned in the past five days. Omega Healthcare, a real estate investment trust (REIT) renting properties to skilled nursing facilities (SNF), has seen its shares drop more than 4% in the past week, trimming year-to-date gains to less than 11%.

Although Omega pays a handsome dividend yield of nearly 8.5% annually, investors fear that issues in the SNF industry will further impact the company’s earnings. In the past two years, the stock slipped gradually as some of Omega’s tenants struggled to pay rent. After Orianna and Signature hit the skids, Omega had to restructure the deals, and now the two SNFs will pay a lower price for rent, although it remains unclear whether they will be able to meet even these commitments.

After the restructuring, the stock shot up, but now there are fears the Orianna and Signature debacles are not isolated incidents. Indeed, a report by the National Infrastructure Commission showed that occupancy has continued to head down in the past eight years, from around 87% in 2011 to 82% in the middle of 2017.

Costco

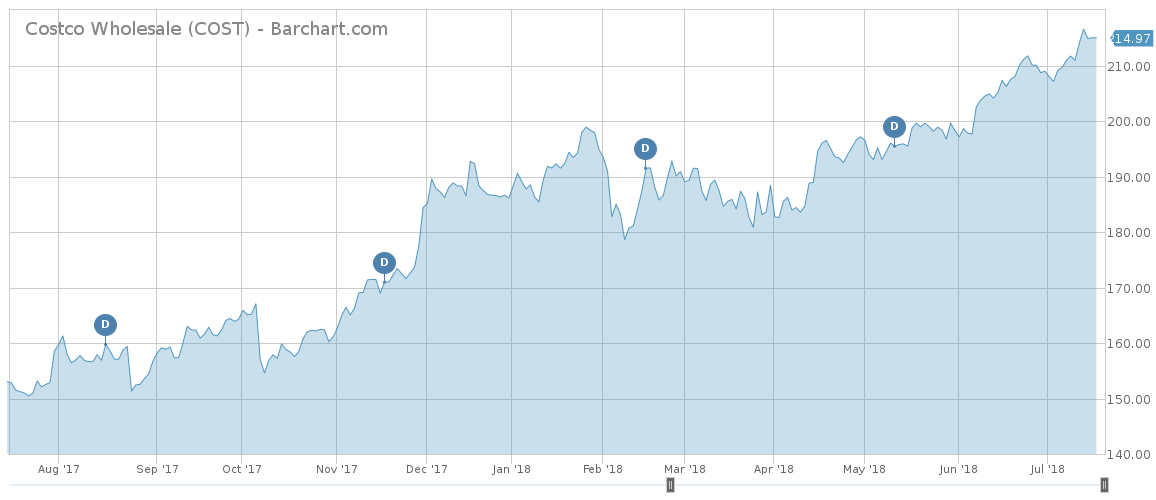

Despite ongoing competition from Amazon (AMZN), which plagued the entire retail industry, Costco (COST ) not only has survived but thrived. Costco shares have risen more than 15% since the beginning of the year as the company’s sales continue to improve. For the month of June, the discount retailer said same-store sales rose 9.7%, lower than the 11.7% growth registered in the previous month. E-commerce growth was also impressive at 27.7% in June, although that was still down from 33.3% in May.

Costco pays an annual dividend of a little more than 1%, but the payout ratio is just 33%, indicating the company is still in growth mode. In the past five years, shares are up more than 83%.

The Bottom Line

This week was all about Netflix’s blunder. The company admitted that it had raised expectations too much and missed its own estimates for subscriber growth in the second quarter. GlaxoSmithKline may restart to increase its dividend again after a four-year hiatus, although that depends much on whether its strategy is successful. Omega pays a handsome dividend but there are fears its tenants will fail to pay their rent as the skilled nursing facility industry faces headwinds. Costco has so far weathered the advance of Amazon and is competing well with the online retailing juggernaut.