AbbVie Inc (ABBV ) is a biopharmaceutical company that engages in the discovery, development, manufacture and sale of pharmaceutical products. The company focuses on treating a variety of chronic autoimmune diseases like cancer, hepatitis, Parkinson’s disease and many others. The company is also known for its leading immunosuppressive drug, HUMIRA, which can help treat arthritis, plaque psoriasis, ankylosing spondylitis, Crohn’s disease, and ulcerative colitis.

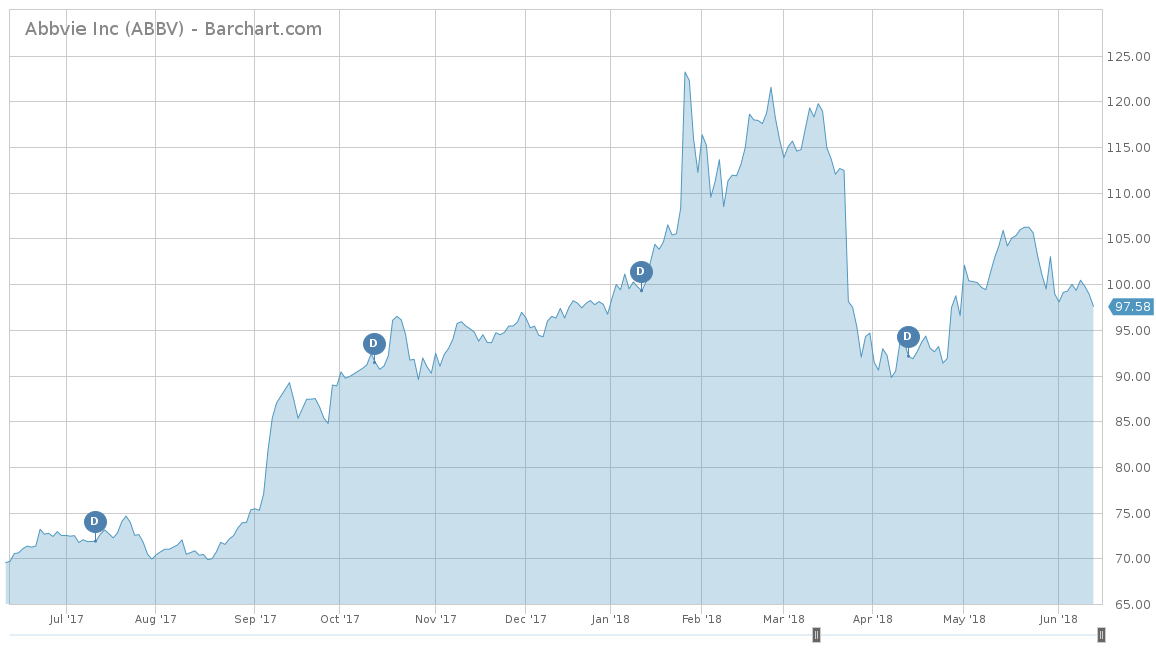

For 2018, AbbVie has been pretty flat with a slight gain of 0.90%. However, for the trailing one-year, AbbVie was one of the best performers with a gain of just over 40%. ABBV has also performed well over the long run, with a total return of 126.14% for the trailing five-years. One of AbbVie’s competitors is Merck & Co. Inc. (MRK ), which has performed much better than AbbVie on a year-to-date basis with a return of 11.23%. However, AbbVie very much outperformed Merck in the longer run.

Click here to learn how biotech firms, especially the established ones like ABBV, stand to benefit from the rise in healthcare spending in the developed parts of the world.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, AbbVie has sustained steady growth at a pace of 9% on average. In fact, every year since 2015, Abbvie has seen double-digit revenue growth thanks to its blockbuster drug, HUMIRA, which has grown its revenue from $9.2 billion in 2012 to double that in 2017, with over $18.4 billion. The first quarter of 2018 has also been successful for ABBV, as the company beat revenue expectations by posting $7.9 billion in revenues. Analysts are very optimistic about 2018’s revenues for AbbVie, with estimates coming in at $32.92 billion, which is 16.7% higher than last year’s. For 2019, analysts expect AbbVie to slow down with a 5.10% revenue growth to $34.95 billion.

On a completely different path, AbbVie’s earnings-per-share average over the last five years is a disappointing negative 0.3%. Earnings were strong in both 2015 and 2016, with a growth of 184.5% and 16.0%, respectively. However, after a one-time mandatory repatriation charge of $4.5 billion from the Tax Cuts and Jobs Act in 2017, AbbVie saw its revenues decline 9.1%. In the first quarter of 2018, AbbVie made big waves by reporting $1.74 earnings per share – an almost 65% jump from the same quarter last year. For the remainder of the year, analysts see AbbVie finishing with a total of $7.48 per share, a very large 77.5% gain. Analysts are excited about the 1L CLL opportunity, which would be an additive for targeting a younger population that is not currently on Imbruvica monotherapy. Even in 2019, analysts still expect a 14.6% gain to $8.57 per share.

Strengths

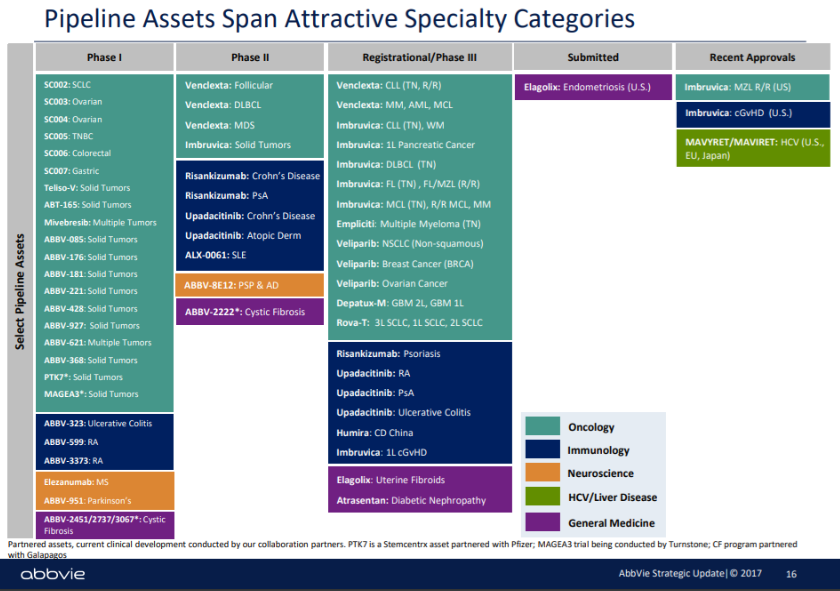

AbbVie has a very strong portfolio because the company is an innovation-driven, patient-focused company. The bulk of the company’s revenues comes from its immunology segment, specifically HUMIRA, which made up 65% of total revenue as of last quarter. However, AbbVie hopes to expand this segment to a portfolio with late-stage assets like Upadacitinib and Risankizumab.

The second-largest segment is AbbVie’s oncology, which has strong blood treatments like Imbruvica and Venclexta. Imbruvica is AbbVie’s second-best revenue-producing drug but seriously lags behind HUMIRA with only 8.8% of total revenues. AbbVie is looking to Imbruvica to help reduce the company’s dependence on HUMIRA and expects the drug to exceed sales of over $6 billion in the near future, more than double its current level. In fact, AbbVie wants to establish Imbruvica as the standard of care across many B-cell malignancies, which would make it the most successful hematologic oncology brand ever.

Click here to find out how ABBV is one of the beneficiaries of the newly reformed Tax plan.

Growth Catalyst

The growth from AbbVie will come from its other three segments that have diverse pipeline drugs. AbbVie’s neuroscience segment plans on fueling sales growth by 2025 by finding treatments for disorders like Alzheimer’s disease, Parkinson’s disease and multiple sclerosis. In this segment, AbbVie has two late-stage drugs that could lead the most growth, Risankizumab and Upadacitinib. Risankizumab has reported Phase 3 psoriasis data that has led to high levels of complete skin clearance. This data, along with Phase 2 data in Crohn’s disease and Phase 3 starting in ulcerative colitis, is why AbbVie is expecting four indications to be launched by 2023, starting in 2019. Upadacitinib has had very strong data in Phase 3 studies for rheumatoid arthritis and expects six indications to launch by 2022, with the first starting in 2019.

In AbbVie’s virology segment, the company sees HCV as a major global market that will sustain well into 2020. As such, AbbVie has had a recently approved treatment named Mavyret that has cure rates varying from 92% to 100%, based on the subtype of Hep C and previous treatment experience.

The third segment is the focused investments unit, which is currently focused on women’s health. This area has developed Elagolix, which treats late-stage programs in endometriosis and uterine fibroids.

Dividend Analysis

AbbVie stock has a yield of 3.92%, which is a higher yield than the Best Drug Manufacturers Dividend Stocks average of 2.13%. The company pays its shareholders $3.84 per share on an annual basis. AbbVie also has a consistent history of raising its dividend every year since 1973, for 45 years in a row. With both earnings and revenues expected to rise in the next two years, expect its dividend to soon follow.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend-Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend-Increasing Stocks page.

Risks

The biggest risk for AbbVie is its very large dependence on HUMIRA. As mentioned, HUMIRA currently makes up 65% of total revenues as of the last quarter. HUMIRA has been seeing competition from other treatments that have been approved in the rheumatoid arthritis, psoriasis and Crohn’s disease areas. However, AbbVie has been expecting this for a while since they lost the patent in the United States in 2016 and will lose Europe this year.

The Bottom Line

AbbVie has lagged on a year-to-date basis but should return to its long-term form with growth in the near future. The company has bounced back in the first quarter of the year and should have no issue breaking through to new highs in 2018. However, once the HUMIRA sales start to stutter, AbbVie needs to find its replacement soon or it will never meet analysts’ expectations. For investors looking for a stock with some short-term gain potential, AbbVie is most certainly a buy recommendation thanks to its dependence on HUMIRA. Unless AbbVie can develop one of its current pipeline drugs to replace the eventual drop off from HUMIRA, expect AbbVie to be a growth stock for the next one to two years at the most.

Check out our Best Dividend Stocks page by going Premium for free.