Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Teva Pharmaceutical has taken the first position on the list as the embattled firm has the confidence of legendary investor Warren Buffett. Home Depot is second on the list, as the retailer recently reported disappointing results. National Grid, a gas utility firm yielding a high dividend, and Cisco Systems close the list.

Find out which stocks have been added to the Best Dividend Stocks List here.

Buffett Adds to Teva holding

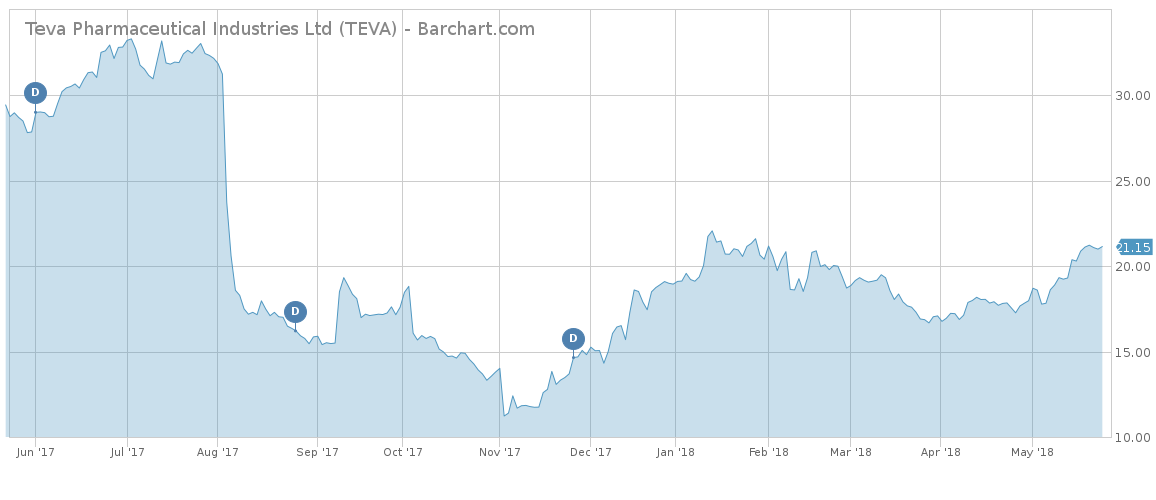

The trust of Warren Buffett’s Berkshire Hathaway in a particular company almost always has the effect of lifting a sagging stock price. Troubled Israeli-based pharmaceutical company Teva Pharmaceutical (TEVA) has experienced a rising stock price after Berkshire nearly doubled its stake in the firm to 40 million shares or 3.5% of total. As a result, Teva has seen its viewership jump 166% in the past week.

Teva’s shares have been slowly recovering from a host of issues relating to competition from generic drugs, a pricing probe for its multiple sclerosis therapy and lack of permanent management. The company now hopes its new migraine treatment will improve its fortunes by returning it back to growth. It aims to launch the drug as soon as September, immediately after receiving the green light from the Food and Drug Administration (FDA). The U.S. regulator is on track to make its decision on September 16.

Perhaps because of the new drug in the pipeline and Buffett’s increased confidence in the company, the stock has surged as much as 20% in the past month, bringing year-to-date performance in positive territory to 12%. For the past two years, however, the debt-laden firm’s stock remains down 59%.

Teva suspended its dividend last year after experiencing troubles. The payout suspension was accompanied by a detailed turnaround plan focusing on cutting workforce and costs and simplifying its organization.

Home Depot Blames Weather Headwinds for Poor Results

Home accessories company Home Depot (HD ) has seen its viewership rise as much as 65% this week, as the firm’s financial results disappointed analysts in a rare earnings miss. A buoying U.S. economy marked by a strong housing market has boosted Home Depot in recent years, with the firm one of the few retailers withstanding competition from Amazon (AMZN).

However, Home Depot’s same-store sales for the quarter fell 4.2%, lower than the 5.4% dip expected by analysts. In the U.S., the picture was grimmer, with sales advancing 3.9% compared to forecasts of 5.5%. The firm blamed bad weather for its miss, saying a long and snowy winter discouraged customers from visiting its shops.

Excluding a severe hit to its garden business, the company’s sales would have risen by 6.5%, according to Chief Financial Officer Carol Tomé. This is in line with Home Depot’s performance in recent years.

Shares in Home Depot have dropped slightly in the past five days and are down more than 2% since the start of the year.

The company pays a solid annual dividend of $4.12 per share, representing a yield of 2.23%. It typically returns to shareholders less than half of its profits.

National Grid Bets on Clean Energy

National Grid (NGG ) has seen its traffic surge 59% in the past five days, as the U.K.-based energy company is moving forward with a plan to install super-fast charging points for electric vehicles across Britain’s highways.

The company, which pays a dividend yield of 6.9%, is in discussions with the government and other stakeholders regarding its proposal and estimates the implementation of its plan will cost anywhere between 500 million pounds and one billion pounds. Under the scheme, a series of superchargers will be installed at 50 strategic sites along the motorway, enabling drivers to charge their cars in six to eight minutes.

National Grid’s main business is operating Britain’s high-voltage power grid, but it has operations in North America as well. For the past year, the company said profits rose 4% to 2.68 billion pounds, largely thanks to a boost from the North American business. Shares in National Grid are roughly unchanged since the start of the year but are down more than 18% for the past 12 months.

Cisco Systems

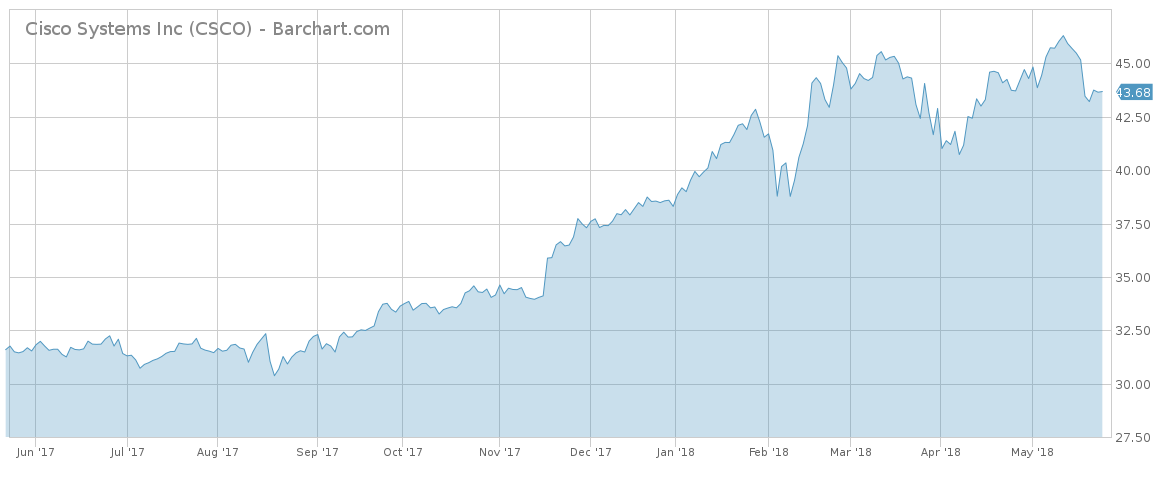

Cisco Systems (CSCO ) has taken the fourth spot on the list with a rise in viewership of 28%. The network gear, which has an annual dividend yield of around 3%, trended after it reported downbeat forecasts for its business.

Cisco is now in the process of moving away from supplying switches and routers to focus on high-growth areas such as software, cloud and cybersecurity. The company’s widely watched security sector saw its revenues advance 11% in the third quarter to $583 million, although it missed estimates of $584 million. Income from the traditional business increased by 3% to $3.16 billion, again below estimates of $3.24 billion.

For the next quarter, the firm expects profit to come in between 68 cents and 70 cents per share, roughly in line with expectations of 69 cents.

Cisco shares have soared more than 37% in the past 12 months as investors were upbeat about CEO Chuck Robbins’ plan to increase focus on software.

The Bottom Line

Teva Pharmaceuticals’ shares were boosted by Berkshire Hathaway’s doubling of its stake, in a sign of confidence the embattled company’s fortunes will improve. Home Depot posted disappointing results for the latest quarter due to a long winter, while National Grid is moving forward with its plan to install superchargers for electric cars across Britain’s highway. Finally, Cisco posted downbeat earnings results.

For more news and analysis, subscribe to our free newsletter.