Microsoft Corporation (MSFT ), once known as the pioneer of the software industry, has now established itself as a major player in the Cloud Computing space. Microsoft develops and licenses software products in three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing.

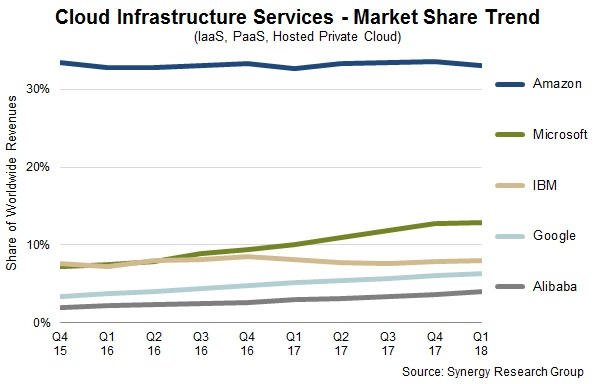

In 2014, the company saw a major rebound when it turned to the current CEO, Satya Nadella – who was heading Microsoft’s Cloud division – to take over the reins from the previous CEO, Steve Ballmer. Nadella took the company’s main focus away from the dying ‘Windows first’ business model and took a chance with Cloud computing, which is now paying off. Today, Microsoft is the second largest player in the Cloud services space, just a notch behind Amazon Inc. (AMZN).

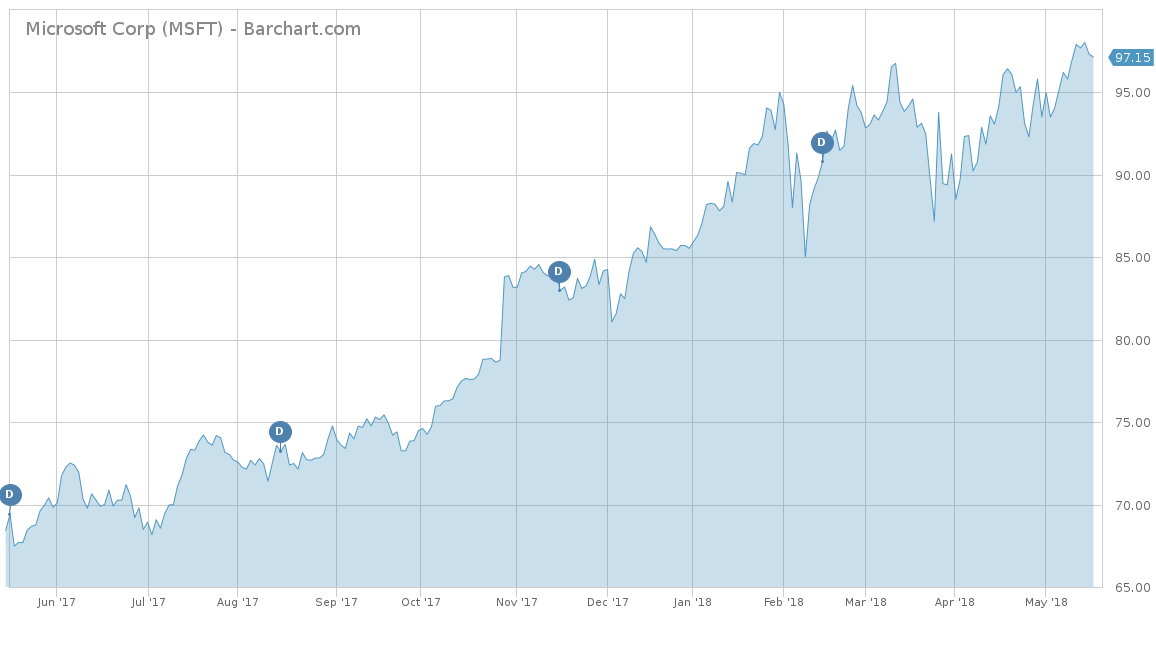

For 2018, Microsoft has gotten off to a great start and is up around 14%. It has also been one of the best-performing stocks for the trailing year, up nearly 40%. Microsoft beats the S&P 500 in both these time periods, with the S&P up 1.83% YTD and up just over 13% for the trailing year. Microsoft has also outperformed the S&P 500 over the longer term, up almost 185% versus the S&P’s 65% rise for the trailing five years.

Microsoft is a member of the Dow Jones Industrial Average. Click here for a complete list of the Dow 30 dividend stocks.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, MSFT has a steady revenue growth rate of around 4%, which was only dragged down in 2016 after the company had a serious decline in PC sales. Fiscal 2018, which runs from July 2017 to June 2018, has gotten off to a great start. For the third quarter in a row, revenue came in higher than expected at $26.82 billion thanks to all three segments increasing by double digits on a year-over-year basis. Overall, revenue grew 16% on a year-over-year basis. The nine-month revenue for the current fiscal year has almost surpassed the full-year revenue of 2017, suggesting that Microsoft will break through to new record revenue highs even if the last quarter doesn’t perform as expected. However, analysts expect Microsoft to finish out the year with a total of $108.9 billion in revenue. This would be more than a 12% increase from 2017. Analysts expect Microsoft to do the same, with a 2019 estimate of $119.7 billion, which would be a 9.9% increase.

On an earnings-per-share basis, Microsoft has also shone with an average five-year growth of 6.3%. If it wasn’t for the 43.7% decline in 2015 after a $7.5 billion accounting charge stemming from the troubled acquisition of Nokia, things would have looked better. However, 2017 and the first quarter of 2018 both saw earnings get back on track. For the second quarter of 2018, Microsoft took a hit to its earnings after the new Tax Cuts and Jobs Act (TCJA) caused a one-time charge of $13.8 billion, creating negative earnings of $0.82 per share. However, this was not a necessarily accurate estimate for the company, as non-GAAP diluted earnings per share were $0.96. For the third quarter, Microsoft came right back on track with earnings of $0.95 topping the $0.85 per share estimates. Even with the decline in the second quarter, analysts expect Microsoft to close out 2018 with a $3.62 per share estimate, equal to a 28.75% gain. Analysts expect another strong gain in earnings in 2019, with another 8.84% increase to $3.94 per share. This is most likely attributed to strong revenue growth as well as the considerably lower taxes that Microsoft will pay in the upcoming years under the new tax plan.

Strengths

Microsoft has shifted its focus from the ‘More Personal Computing’ division, which still produced $9.9 billion in the last quarter, to the ‘Productivity and Business Processes’ and ‘Intelligent Cloud’ divisions. Both of these divisions saw growth of 17% on a year-over-year basis, bringing in $9.0 billion and $7.9 billion in revenues, respectively. These divisions offer two of the company’s greatest opportunities – in the form of Azure and Microsoft 365. Microsoft 365 is the repositioned platform that bundles Office 365, Windows 10 and the Enterprise Mobility + Security (EMS) platforms. Microsoft expects this to be the largest productivity platform in the world, providing developers with extreme flexibility among all its services.

Another strength of Microsoft is its upcoming Intelligent Edge technology, which is arguably the natural evolution of remote computing in the intelligent Cloud space and local computing on Internet of Things (IoT) devices and consumer electronics. Microsoft has invested over $5 billion in this venture and is adapting it to the various Azure services – called the Azure IoT Edge – that will be open-sourced, helping developers examine how the runtime works and extend it to a greater level than ever before.

Growth Catalyst

As we discussed recently, the undoubted future of Microsoft is tied to its Azure public Cloud service, which is the number two player in the space behind Amazon Web Service (AWS). Azure has several benefits that make it superior to AWS. For instance, Azure has stronger PaaS capabilities, which is a significant part of the Cloud infrastructure. Azure is considerably more compatible with the .NET framework, allowing it to work well with both old and new applications developed using this framework. Azure has also incorporated the Security Development Lifecycle (SDL), which is a software development process that helps developers build more secure software while reducing development costs. Moreover, Azure offers an integrated environment for developing and testing Cloud apps, which helps users adapt to a much faster learning curve. Finally, Azure comes with the Microsoft Enterprise Agreement, which gives pricing discounts to users for other Microsoft products.

With these advantages, it’s clear to see why Azure recently saw revenue growth of 93% this recent quarter. It has also led Microsoft to continually increase its market share in the Cloud services space from 10% to 13%. Although this is significantly lower than the 33% that Amazon currently holds, Microsoft is certainly gaining ground.

Dividend Analysis

Microsoft stock has a yield of 1.73% and has a higher yield than the Technology Sector Dividend Yield average of 1.10%. The company pays its shareholders $1.68 per share on an annual basis. Microsoft also has a great history of raising its dividend every year since 2004, for 14 years in a row. With the company on track to see record increases in revenues and earnings, expect Microsoft to see a dividend hike for its 15th year in a row.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend-Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend-Increasing Stocks page.

Risks

The biggest risk for Microsoft continues to be the rapid decline of its hardware business, now that companies like Apple Inc. (AAPL ), Samsung and Sony Corp. (SNE ) have really taken hold of the consumer electronics and smartphone markets. With Xbox and Surface as its only products in this segment with a bright future, Microsoft needs to focus on its other segments with more potential.

The Bottom Line

With Microsoft consistently beating expectations quarter after quarter, the company looks to be on a roll. The Azure, Intelligent Edge and Microsoft 365 platforms are all key revenue drivers with very bright futures. With the stock up over 13% on a year-to-date basis and expectations through the roof, analysts expect Microsoft to continue soaring to new heights well past the $100 per share mark.

Check out our Best Dividend Stocks page by going Premium for free.