Philip Morris International Inc. (PM ) is an American multinational tobacco company that sells products in over 180 countries. In March 2008, the company was spun off from its parent firm, Altria Group (MO ). PMI’s operational headquarters are in Lausanne, Switzerland, but the company still maintains its corporate office in New York City, NY.

The company’s most recognizable and leading brand has been Marlboro, which has been the number one selling cigarette brand since 1972. In 2013, Philip Morris introduced the rebranded, more modern Marlboro 2.0, which is now available in over 100 countries outside the U.S. Other popular brands of PMI include L&M – which is the third-highest selling cigarette brand – Chesterfield, Parliament and Bond Street. Overall, PMI owns six of the top fifteen cigarette brands sold across the world, which led to over $26 billion in revenue for 2017.

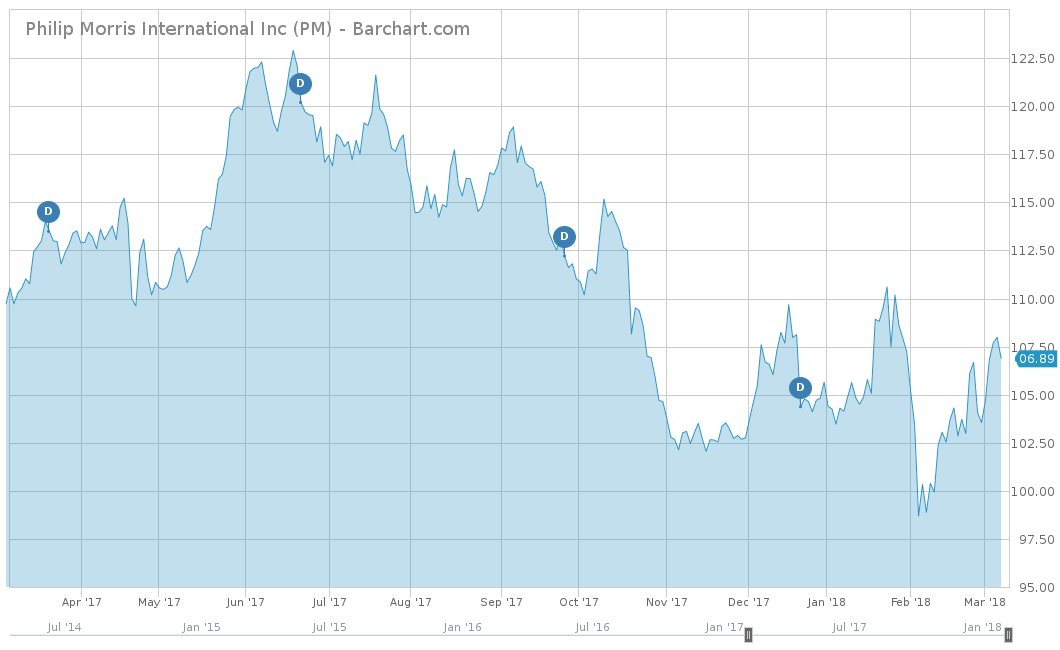

On a year-to-date basis, PMI’s stock price is up 1.17%, slightly underperforming the S&P 500’s year-to-date performance of 1.99%. Compared to Altria, Philip Morris International is outperforming, as MO is down 10.28% on a year-to-date basis. However, over the last five years, PMI has seen only a cumulative return of around 16.43%. This is considerably below the returns of the S&P 500’s 76.58% and MO’s 88.66% for the same time period.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, PMI has seen a declining rate of revenue, with an average growth rate of -1.73%. With 2017 revenues coming in at $28.75 billion, PMI saw an increase of 7.72% from its 2016’s figures. Analysts expect PMI to turn the corner with the five-year average in both 2018 and 2019. For 2018 analysts estimate $31.91 billion, and for 2019 analysts estimate $34.11 billion. This would be equal to an increase of 10.99% and 6.90% respectively.

On an earnings-per-share basis, PMI hasn’t performed well and declined an average of 0.6%. Philip Morris disappointed Wall Street and missed its year-end 2017 goals and reported $3.88 per share, resulting in a 24.55% decline from 2016. Like most companies, the new tax reform hit PMI hard, with a decline of $1.6 billion in net income, which was the equivalent of $0.88 per share. However, like its revenue estimates, analysts believe that PMI can right the ship back to positive territory. For 2018 analysts estimate $4.74 per share, while for 2019 analysts estimate $5.4 per share, representing a 13.9% increase.

On a price-over-earnings multiple, PMI currently has a 22.72, which is below that of the S&P 500’s 25.48. However, PMI has a higher P/E than Altria Group, which currently has a multiple of 16.24.

Strengths

Until the cigarette business is banned worldwide, Philip Morris International will always be in the top tier thanks to its immensely popular brands like Marlboro, L&M, Parliament and Chesterfield. PMI’s customers have maintained brand loyalty with these cigarettes, even if prices have steadily increased over the years. Marlboro alone attributed to 35% of the company’s 2017 total cigarette volume and is the world’s number one cigarette brand. These seven international cigarette portfolios contributed approximately 75% of PMI’s cigarette shipment volume in 2017.

Outside of its successful brands, PMI has best-in-class operational efficiency, reinforced by strong cost control and productivity improvements. The company purchases tobacco leaves of various types, grades, and styles through independent tobacco suppliers worldwide. PMI also contracts directly with more than 350,000 farmers in 28 countries, allowing the company to control its pricing and quality at the same time.

Growth Catalyst

Philip Morris International has made its focus for the future being a smoke-free company, working on newer technologies to develop safer, healthier alternatives to cigarettes. Since 2008, PMI has invested over $4.5 billion and has employed over 400 world-class scientists, engineers, and technicians. With this new initiative, PMI is looking to develop and test products that deliver nicotine in a customer-satisfying way without the harmful effects of smoke.

The company’s current smoke-free product portfolio contains four products in various stages of development and commercialization. IQOS is the first of these products and is already available in many markets around the world and used by over 5 million customers. Unit volume in 2017 increased to 15.7 billion units, mostly in Asia, where the Japanese market has gotten to a terrific start. On a worldwide basis, PMI only sold about 1.7 billion units, suggesting that there is plenty of upside in this untapped market of smoke-free tobacco.

Dividend Analysis

Philip Morris International stock has a yield of 3.98% and has one of the highest yields in the cigarette industry. The company pays its dividend on a quarterly basis to equal a total annual amount of $4.28 per year. PMI is also a company that likes to grow its dividend, as evidenced by its 10-year track record of dividend hikes.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

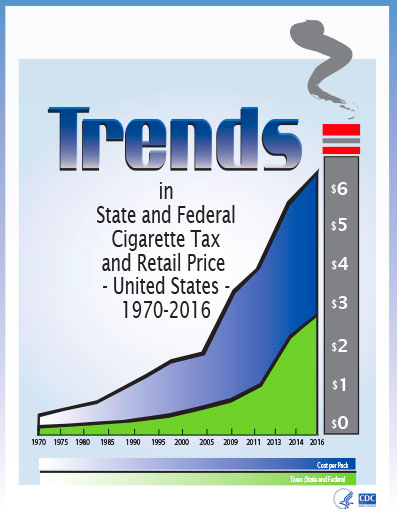

The biggest risk to Philip Morris continues to be the decline of cigarette smokers around the world. In 2016, the company’ cigarette shipments declined 4.1% compared to the previous year to 812.9 billion units. With the U.S. constantly raising state and federal cigarette taxes, other countries could follow suit and employ a similar strategy to cigarette companies. Increasing cigarette prices could devastate Philip Morris International’s sales, especially in countries that have a lower economic standard of living.

For instance, the average tax (including federal, state and local taxes) per cigarette pack in the U.S. increased by almost 15 times to reach $2.85 in 2016 compared to the level in 1970.

The Bottom Line

With management’s focus on the future of a smokeless company, Philip Morris International is finally facing the music that the cigarette industry has an expiration date. If the company does not capture some of the market share with IQOS and its other smokeless options, it could see only downside for its shareholders.

Check out our Best Dividend Stocks page by going Premium for free.