Pfizer Inc. (PFE ), the second-largest biopharmaceutical company in the world, discovers, develops, manufactures and markets a wide variety of medicines, vaccines and other healthcare products.

The company is known for some of the most brand-recognizable products in the pharmaceutical industry, like Viagra, Lipitor, Lyrica and Zithromax. Pfizer has seen success because it has one of the largest economies of scale in the pharmaceutical industry. Pfizer has four strategic imperatives it has based its company on: to innovate and lead, maximize value, earn greater respect and own their culture. With these four imperatives, Pfizer has established itself as a global leader with 96,500 employees across 160 countries.

At the beginning of 2017, the company had 96 assets in their current drug pipeline, with 63 manufacturing sites worldwide. It also had five FDA product approvals, six regulatory submissions and thirty-nine compounds in their advanced pipeline in 2016, which helped the company generate over $52.8 billion in revenue.

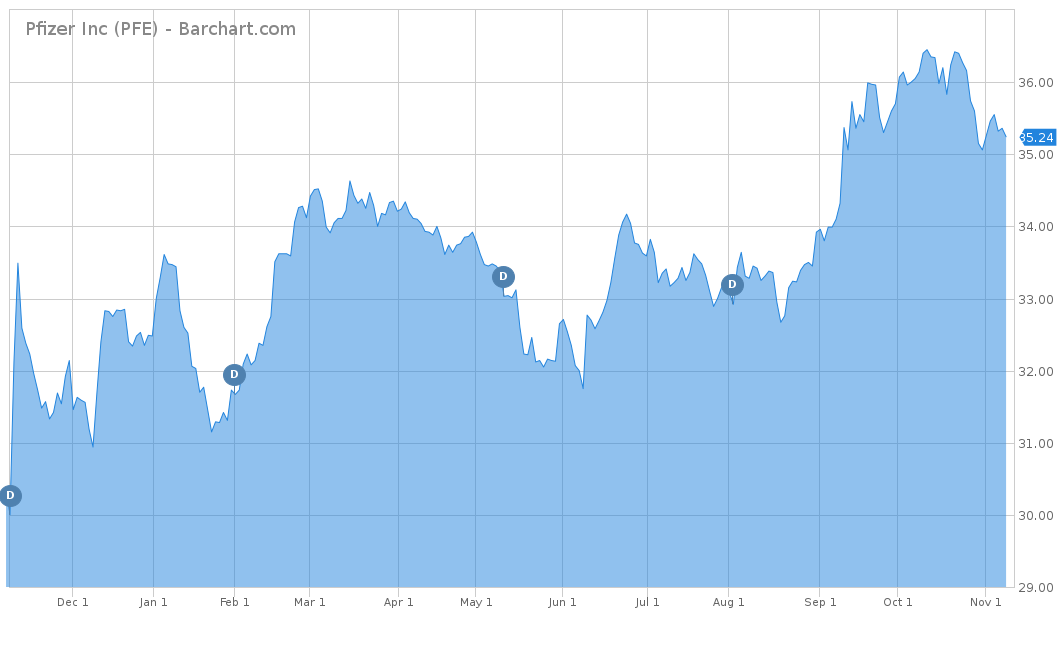

Pfizer’s stock price is up slightly in comparison to most of the major indices. On a year-to-date basis, Pfizer is up 8.08%, with most of the gain coming in the last three months, up 5.48% in that time. For the trailing one-year and five-year, Pfizer has also underperformed against the indices and is up only 9% and 43%, respectively. To more accurately compare Pfizer’s performance, the PowerShares Dynamic Pharmaceutical ETF (PJP) is the largest pharmaceutical ETF, in terms of assets under management. On a year-to-date basis, PJP is up 11.61%, outperforming Pfizer by 3.53%. For the trailing-one-year, PJP is up only 12.61% but is up 84.37% for the trailing five-years.

Fundamentals

Over the last five years, Pfizer has struggled to maintain a growing revenue stream, with the exception in 2016. Over the last five years, Pfizer has had an average growth rate of -2.9% but recently rebounded from 2015 to 2016 with an increase of 8.1%. Analysts expect Pfizer to see a slight drop in its revenue growth, with average estimates at $52.72 billion, which would be a 0.19% drop from 2016. However, analysts do expect more in 2018, with estimates averaging at $54.14 billion, which would be a 2.7% increase from 2017.

On an earnings-per-share basis, Pfizer hasn’t performed well either. On a five-year average, the company only has an earnings per share growth of 3.4%. In 2014 and 2015, the company struggled and saw a decline in earnings of 55.5% and 21.8%, respectively. However, like its revenues, EPS growth bounced back in 2016 with an increase of 5.4%. Based on its first three quarters of 2017 and unexpected high sales from Prevnar, analysts expect a big jump in EPS growth for Pfizer. Estimates have Pfizer ending the year with a $2.56 EPS, making it a 118% increase from 2016. Analysts also expect Pfizer to maintain the high earnings per share with an estimate of $2.76 in 2018, which would be a 7.8% increase from 2017.

On a price over earnings multiple, Pfizer currently has a 25.9, which is in line with the S&P 500’s 25.89. Pfizer’s P/E is slightly above its competitors, like Johnson & Johnson (JNJ ) and AbbVie Inc. (ABBV ), which both have a P/E of 24.62 and 23.18, respectively. However, the five-year average for Pfizer’s P/E is 22.3, so the recent increase is most likely attributed to the stellar growth in earnings the company is seeing in 2017.

Strengths

Pfizer’s largest strength is its massive size, which allows the company to maintain a diverse basket of drugs that can produce a consistent cash flow. This cash flow helps fund the research and development of Pfizer’s pipelines, in hopes of establishing new blockbuster treatments, especially in cancer, heart disease and immunology. The company also maintains patent protection with many of these drug brands, which allows them time to spend on carefully testing each of their new pipeline drugs and compounds.

Pfizer also has a powerful distribution network that reaches over 160 countries in the world. Unlike smaller pharmaceutical companies that specialize in the creation and development of drugs only, Pfizer does not need to partner with other companies to market and distribute its product line. The company has a global salesforce with entrenched relationships with doctors and health organizations. Pfizer has also seen an increase in its emerging market sectors, which have become increasingly wealthy over the last decade. Pfizer believes it will be the dominant pharmaceutical provider for countries like Brazil, Russia, India, China and Turkey in the near future.

Growth Catalyst

Pfizer has seen the recent earnings growth be mostly attributed to higher-than-expected sales of Prevnar, its blockbuster pneumonia vaccine. Pfizer sold $1.52 billion of Prevnar in the third quarter and now it accounts for 11.5% of the company’s total revenue. If Prevnar continues to deliver growing sales, expect Pfizer to deliver on earnings and an uptick in the stock price.

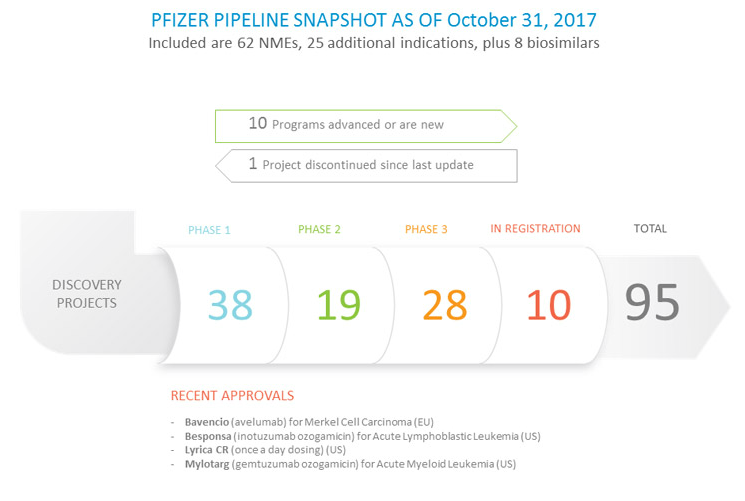

As with most other pharmaceutical companies, much of Pfizer’s growth could be tied to the next blockbuster drug it has in its pipeline. As of October 31, 2017, Pfizer had 95 total projects in its pipeline, with ten in registration and twenty-eight in Phase 3. Its most anticipated new drug is Ibrance, which is the first FDA-approved medication in a class of therapy called CDK 4/6 inhibitors. Taken in combination with certain hormonal therapies, Ibrance works to slow the cell growth and division in hormone receptor-positive, HER2 metastatic breast cancer. Although its competitor, Eli Lilly and Company (LLY ) is also coming out with its own CDK 4/6 drug, the medical industry is finding the testing results for Pfizer’s Ibrance is more effective for breast cancer treatments.

Dividend Analysis

Pfizer currently has the third-highest dividend yield among the major drug manufacturers, closing in behind GlaxoSmithKline PLC (GSK ) and Sanofi SA (SNY ). Pfizer currently pays an annual dividend of $1.28, which is equal to 3.63%. Even though Pfizer has had rocky fundamentals, it has been able to raise its dividend for the last seven years in a row. This has been a priority for the company’s management, as illustrated by it rewarding shareholders with over $12.3 billion in dividends and share repurchases in 2016 alone. As earnings are expected to more than double in 2017, expect the management to reward shareholders with another potential dividend hike.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

One major risk to Pfizer’s bottomline is the expiration of many of the patents it currently is benefitting from. For instance, Pfizer’s popular Viagra drug is slated to face competition as generic drug manufacturer Teva Pharmaceuticals (TEVA) is expected to bring out a generic version of the drug in December 2017. In 2018, another one of Pfizer’s moneymakers, Lyrica, is also losing its patent protection. With both Viagra and Lyrica facing competition from generic labels, Pfizer needs to develop a pipeline of new blockbuster drug to help offset the eventual loss of revenue.

The Bottom Line

Although relatively stagnant over the last few years, Pfizer is finally looking to make a comeback thanks to outstanding sales from its blockbuster Prevnar drug. The company showed growth in 2016 and looks to more than double its earnings in 2017. Even if Pfizer cannot immediately deliver a new blockbuster drug to offset the loss of its Viagra and Lyrica patents, it should be able to rely on its Prevnar sales for immediate growth.

Check out our Best Dividend Stocks page by going Premium for free.