It didn’t take long for U.S. President Donald Trump to reignite one of the most enduring trade disputes in North America. By slapping hefty import duties on Canadian softwood lumber, the president has made it clear that no trade deal will be exempt from his scrutiny. This sobering reality has put investors on high alert as they evaluate the spillover into other sectors of the Canadian economy.

In April, the U.S. Department of Commerce announced preliminary countervailing duties against five Canadian producers ranging between 3% and 24%. Canada’s softwood lumber industry, which is the world’s biggest exporter of the commodity, is bracing for a second wave of tariffs that could put further pressure on the nation’s export-driven economy. This time, the U.S. government is expected to announce anti-dumping duties with an average rate of 10%.

Analysts say Washington is playing hardball in order to bring Canada back to the negotiating table before the two countries resume trade talks in August. Those meetings will focus on renegotiating the North American Free Trade Agreement (NAFTA), which has governed trade between Canada, the U.S. and Mexico since 1994. Click here to learn about the history of the dispute and explore how the U.S. is using lumber as a bargaining chip in NAFTA renegotiations.

The new trade spat is expected to push lumber prices sharply higher in the near term. Given that Canada will not be able to file for arbitration until 2018 at the earliest, investors are bracing for a multi-year trade dispute. Investors with exposure to the lumber industry must, therefore, plan ahead in order to safeguard against uncertainty.

Below are four potential stocks investors should consider in navigating the lumber dispute.

Click here to read about how investors can play the Canada-U.S. Lumber Dispute.

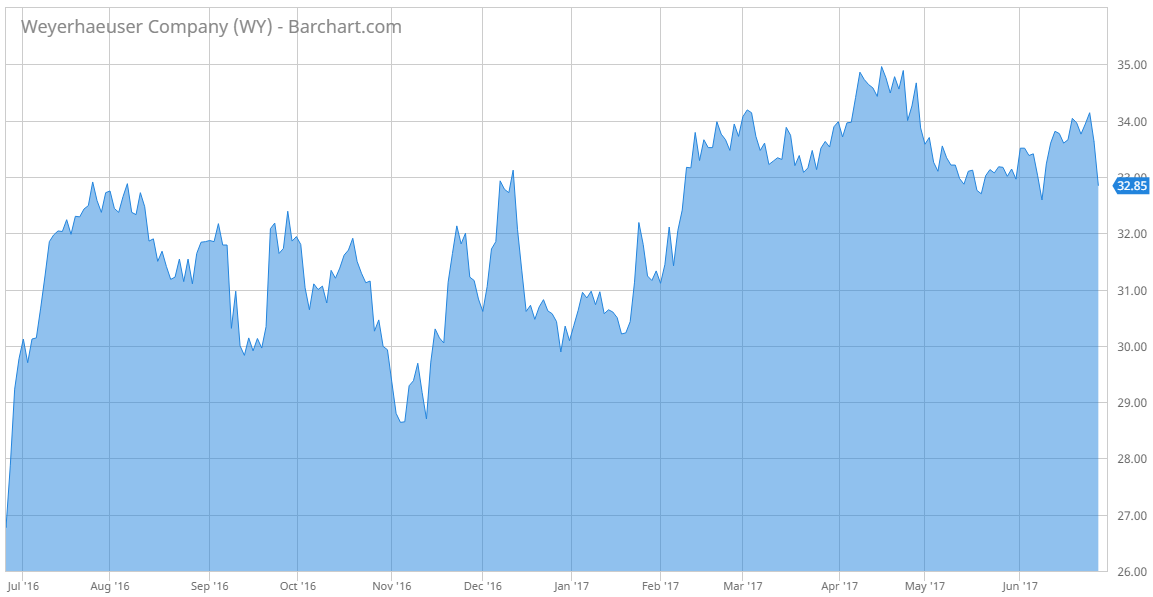

Weyerhaeuser Co {% dividend WY %}

As one of the world’s largest private owners of timberlands, Weyerhaeuser provides a hedge against industry volatility given its exposure to both U.S. and Canadian markets. In 2016, Weyerhaeuser operated 16 mills in the U.S., which produced a total of 3,640 million Bf. That’s higher than any other U.S. producer.

The Seattle-based company boosted its revenue by 20.5% in its most recent quarter. After a volatile fourth quarter, Weyerhaeuser’s stock price has rebounded sharply to trade at all-time highs. Its dividend yield of 3.68% is more than twice as high as the average for the industrial goods sector. To top it off, its annualized payout of $1.24 has grown each year since 2012.

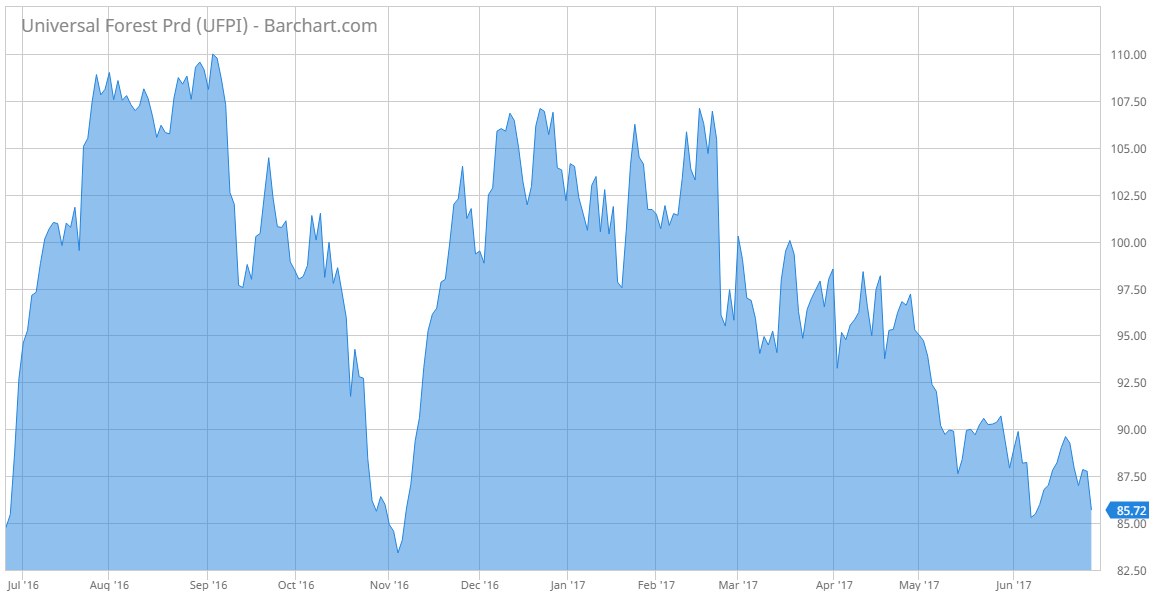

Universal Forest Products {% dividend UFPI %}

U.S. wood and wood-alternative manufacturer Universal Forest Products is another potential dividend play for investors looking to diversify in the lumber industry. Although the stock is well off its 52-week high, the business recently reported record first-quarter earnings and sales. The Grand Rapids-based company is well diversified, with three main lines of products serving the retail, construction and industrial sectors.

UFPI pays out $0.90 and has a dividend yield of 1.03%. It has registered dividend growth in each of the last four years.

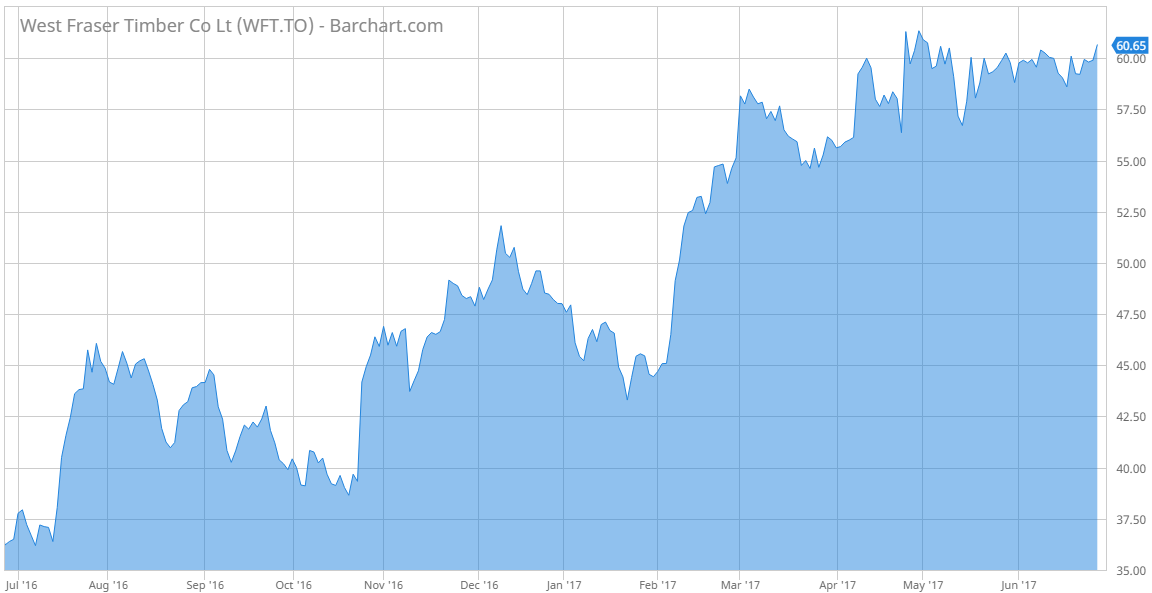

West Fraser Timber Co Ltd. (WFT)

British Columbia-based West Fraser Timber Co has emerged as the biggest sawn wood producer in North America at 8,460,000 m3/year. With operations on both sides of the border, West Fraser is Canada’s biggest softwood lumber producer and the third-largest in the United States. In 2016, its Canadian operation produced 3,796 million Bf of softwood lumber. Output at its U.S. operations reached 2,139 Bf.

The company yields 0.47% and has a market cap of $4.7 billion. Its share price has performed exceptionally well over the past 12 months, returning more than 66% over that period.

West Fraser, listed on the Toronto Stock Exchange (TSE), just went ex-dividend. To search the ex-dividend dates of all your favorite U.S.-listed stocks, utilize our Ex-Dividend Date Search tool.

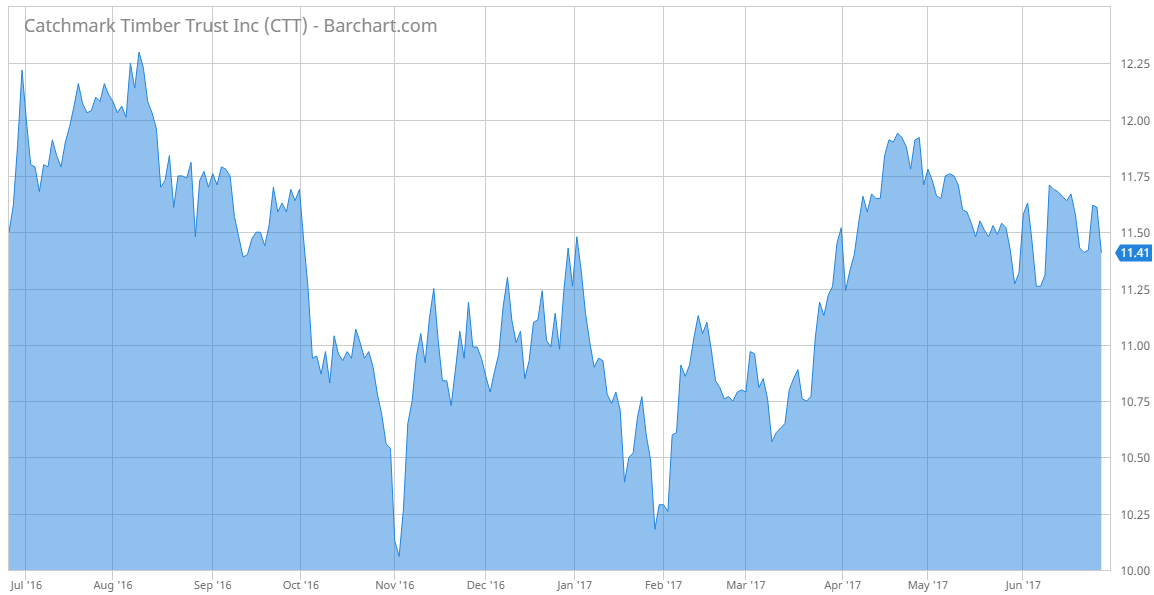

CatchMark Timber Trust Inc. {% dividend CTT %}

Investors looking for diverse exposure to the lumber industry see a lot of potential in CatchMark Timber Trust, a Georgia-based company that invests directly in timberlands. CatchMark’s share price has increased a mere 2% this year, which is well below the broader stock market average. However, the stock may offer a discount given the recent upturn in earnings growth.

With back-to-back years of dividend growth and a yield of 4.65%, the stock is a promising play for investors looking to expand their footprint in the sector. The company’s yield dwarfs the industrial goods average of 1.27%.

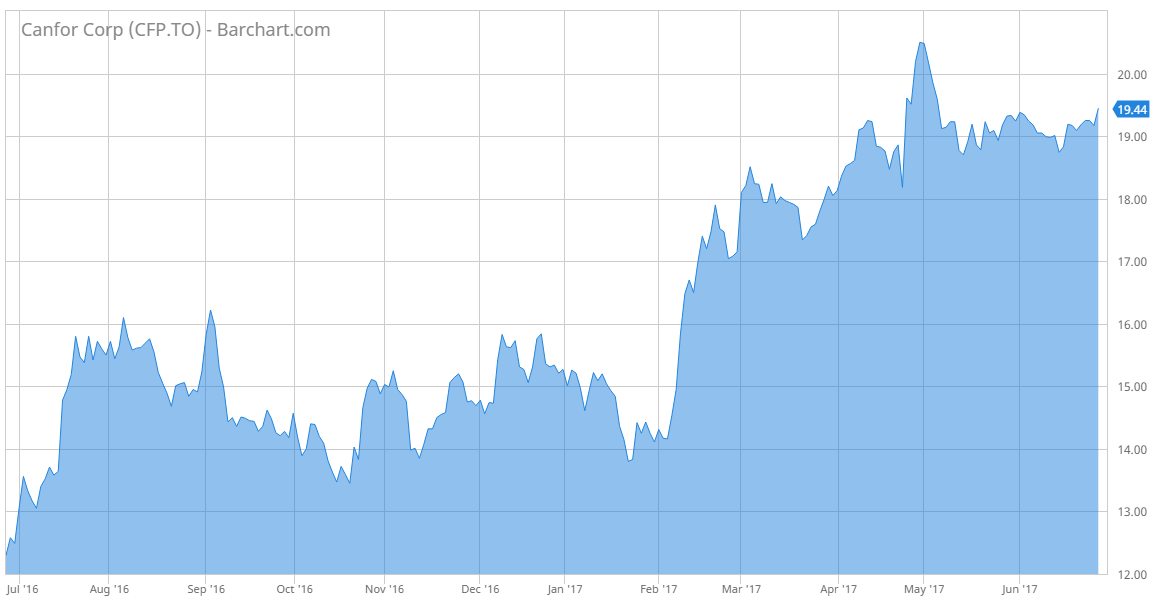

Canfor Corp (CFP)

While not a dividend earner, Canfor Corp is Canada’s second-largest softwood producer. This also makes it the second-biggest producer in North America behind only West Fraser. Canfor’s 2016 output was 3,787 million Bf. The B.C.-based company specializes in lumber, pulp, paper and sustainable-wood products. Despite being subject to high U.S. tariffs, Canfor can benefit given its diversified nature of business.

Canfor’s share price has surged more than 55% over the past 12 months. The company boasts a market capitalization of over $2.5 billion.

Check out the top dividend-paying stocks in the lumber industry here. Also be sure to try Premium for free to get the full scoop on the best dividend stocks on the market.

The Bottom Line

The North American lumber dispute is just getting started. Forward-looking investors can prepare accordingly by finding diversified dividend plays on both sides of the border.

Stay up to date with next week’s major corporate changes regarding dividends in our News section on Dividend.com.