The house always wins. While the saying predominantly focuses on casinos in Las Vegas and Atlantic City, it could also apply to Wall Street. It’s no secret that Wall Street makes a bundle off of investors, which includes both the bad guys ripping off investors with high fees and the good guys who truly have investors’ best interests at heart.

Luckily for investors, T. Rowe Price (TROW ) is one of the ‘good’ ones.

It also happens to be one very good stock to own. Continued asset growth and investor satisfaction have powered the firm’s profits and dividend for years. And while low-cost indexing remains a threat to its future, TROW has the ability to fight off that threat and thrive in the future. For investors, the asset manager remains a top contender for dividend portfolios.

Find out which stock was recently added to the Best Dividend Stocks list due to Trump’s victory.

A History of Active Management

Founded in 1937, T. Rowe Price has made a name for itself as a growth shop and active management firm. It offers mutual funds, advisory services and separately managed accounts for individuals, institutional investors, retirement plans and financial intermediaries.

As a sector, the firms that manage money on behalf of investors are one of the least capital intensive businesses on Wall Street. The only real expense is its people, plus a bit of technology and market expenses. As a result, margins for asset managers like T. Rowe Price are huge.

The true benefit is that those margins exist no matter what. Whether your mutual fund or exchange-traded fund (ETF) outperforms the market or sinks like a stone, you still pay fees to the portfolio manager quarter after quarter, year after year. That’s a steady stream of cash flow hitting the asset manager’s books at all times.

The biggest players in the industry – in terms of assets under management – make the most money as their fees for managing assets are larger. Fortunately for TROW, it happens to be one of the biggest managers on the planet. Its focus on the retirement plan, 401(k) and IRA industry has allowed it to garner more than $776 billion in assets under management. This puts it near the top of all asset managers on Wall Street.

The reason for that huge amount of assets? TROW is a great manager.

Ask many market pundits who the father of “growth” investing is, and the answer will most likely be Thomas Rowe Price. Price created the concept of searching for stocks that were earning more – or had the potential to earn more – than market/sector averages. The firm that still bears his name shares that passion and its fund managers actually perform and outperform their benchmarks – unlike some active asset managers. Lower-than-average expense ratios, high active shares and a team of fund managers who have guided their respective funds for decades have helped TROW beat the competition and get its hands on more retirement plans.

Find out other investor resources that you need to know as an investor about TROW here.

Still Plenty of Growth

And…TROW is still growing.

Despite the growth in ETF and index fund adoption, T. Rowe Price’s focus on retirement plans has continued to be a boon for the fund manager. Over the last five years, more than $65 billion in new investor money has moved into its highly successful suite of target-date retirement funds. That’s about 23% of its total assets. Meanwhile, around two-thirds of its total assets under management are in retirement and annuity accounts. Workers are pretty much stuck with the retirement plan their employers use for the duration of their jobs. This ensures a constant and steady stream of asset growth to power fees. During the first half of 2016, assets under management increased $13.5 billion – thanks in part to contributions to retirement accounts.

TROW has another ace up its sleeve to find growth and, ultimately, higher fee revenue: private placements. As a growth shop, T. Rowe Price’s managers have been very successful at finding the “next big thing,” before it became the “next big thing.” It has made plenty of private placement investments, i.e. before IPOs. These include buying stakes in Whole Foods (WFM), Starbucks (SBUX ), Facebook (FB ) and Twitter (TWTR ) before they became public companies. Its competitive edge and ability have several of its tech-focused funds crushing their competition, and seeing an increasing gathering of assets.

And let’s not forget that T. Rowe could easily launch its own line of ETFs. It has the size and scope to do so with ease.

Putting Numbers to TROW’s Growth

Rising assets under management and continued growth along its retirement businesses lines mean one thing – plenty of fees and a long dividend history.

T. Rowe Price is a member of the exclusive Dividend Aristocrats, which means it has increased its dividend for at least 25 years. In TROW’s case, it has managed to do so for 30. What’s more is that TROW continues to pay out special dividends, in addition to its regular rising payout.

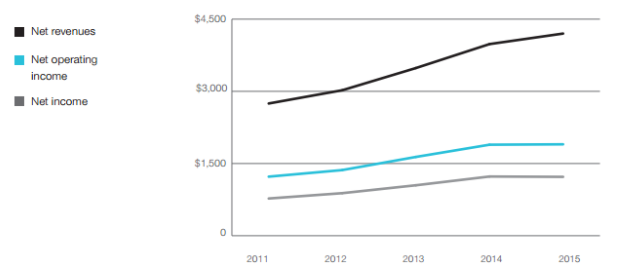

Driving that has been the steady dividend growth in its revenues and fee-cash flows, as is evident from the chart below from its latest annual report. Currently, the dividend only needs approximately 1/3 of fee-cash flows to be covered.

TROW is a Dividend Aristocrat. You can find other Dividend Aristocrats on Dividend.com’s 25-year Dividend Increasing Stocks tool.

With zero debt on its balance sheet and a continued rise in assets under management – thanks to its great skill at navigating growth and rising retirement portfolio – the stock should be able to keep on increasing its payout. Analysts expect TROW to grow its earnings by 8% annually over the next five years.

The Bottom Line

The firm’s that are managing the assets usually make the most money. For T. Rowe Price investors, it translates into plenty of earnings and a large 3.2% growing dividend. Its continued focus on retirement assets and growth stocks has made it a leader in the investment management space. And that leadership position is wonderful for its future dividend growth.

Follow Dividend.com’s Upgrade/Downgrade section for the latest rating changes to dividend stocks.