When a big-ticket celebrity investor like Warren Buffet makes a move, the world takes notice. This is what happened in the last few months. Even when he buys something reasonable, people start to debate over the timing of the trade or why some alternatives were not picked by him. In the recent months, a lot of attention was given to why Buffett was buying Phillips 66 (PSX ). Given that Phillips 66’s stock price has been all over the place in the last few months, it makes this an even more interesting choice. The natural questions to ask are: is this connected to broad economic factors concerning oil prices (and we all know it has to be) and what is he really trying to do? We will try to answer some of these questions in this article.

What Does Phillips 66 Do?

Phillips 66 defines its business into these major segments: Midstream, Chemicals, Refining, and Marketing & Specialties (M&S). Midstream segment engages in the processing of natural gas. Chemicals segment manufactures and markets petrochemicals and plastics. Refining segment, as the name suggests, purchases crude oil, refines and markets petroleum products in the US and abroad. Marketing & Specialties, the last segment, purchases and markets/resells refined products (e.g. gasolines, distillates and aviation fuels) in the US and abroad. In summary, the company processes, transports, stores and markets fuels and related products globally.

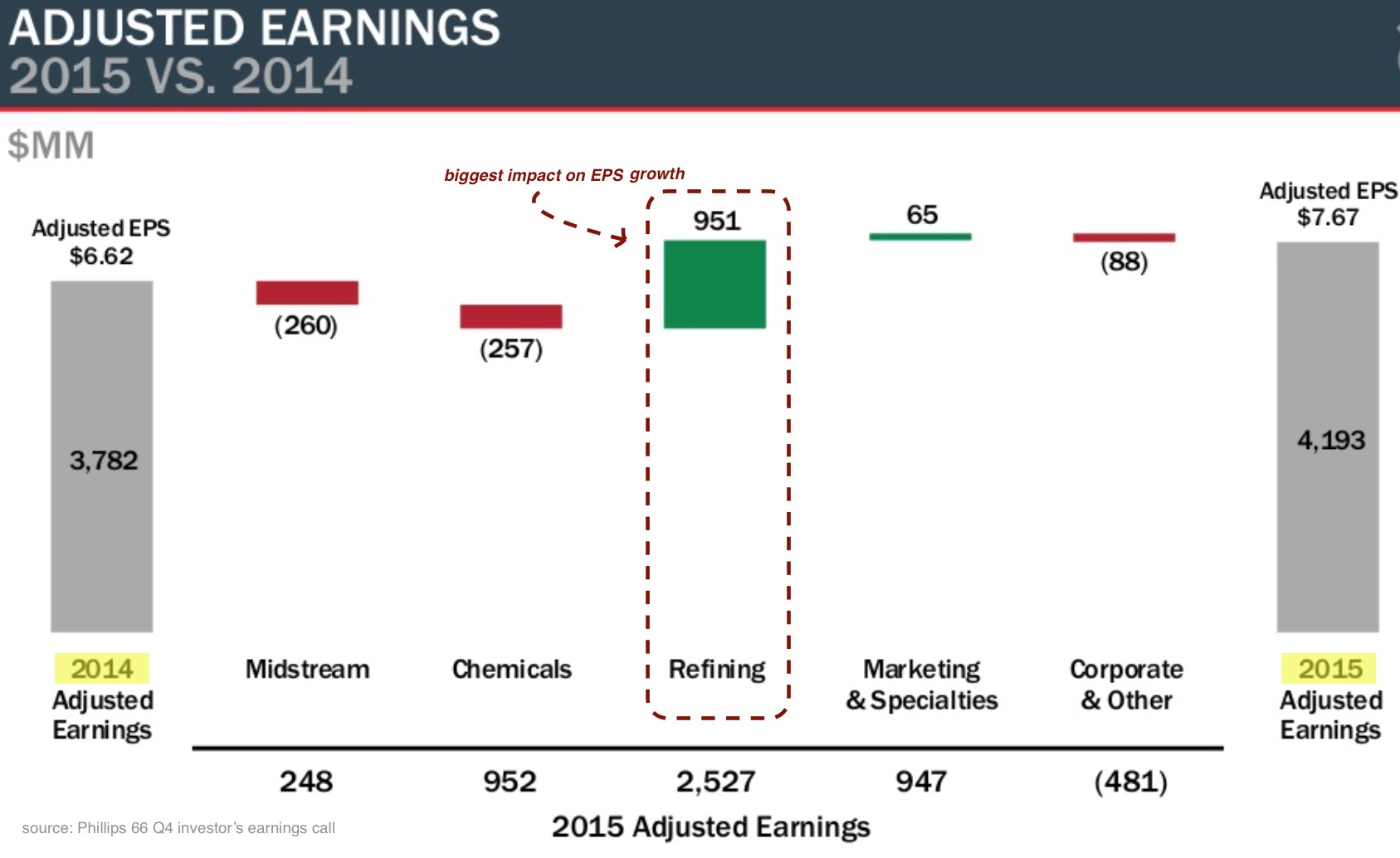

One quick look at the earnings breakdown by each segment paints a very simple picture about each segment. Refining, not surprisingly, has had the biggest impact towards EPS growth in 2015.

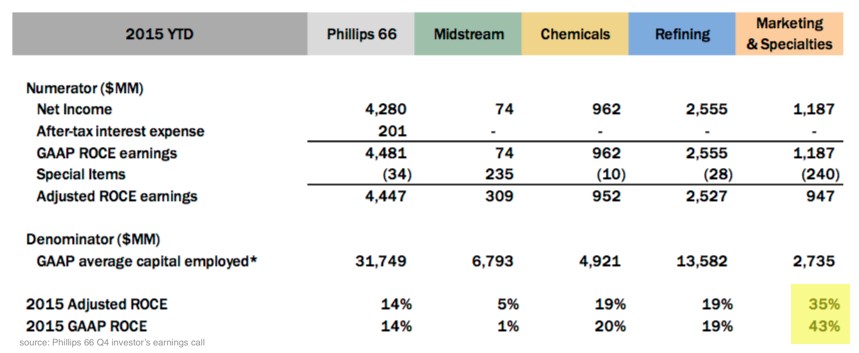

Even though business is still heavily dependent on its refining segment, the M & S segment produces good net income and the best return on capital because of its low capital requirement. It is, thus, a crucial contributing segment for the business, as shown in the chart below.

Lately (in the last 3 months), there has been a correction in stock price. That can be largely attributed to the lifting of the 40-year-old ban on crude oil exports. While the ban was in play, refiners had an advantage by exporting finished products and gaining from the price difference between crude and its derivative products (e.g. gasoline and diesel). The lifting of the ban will make a dent in refinery earnings, hence, the stock reaction in its stock price. This, however, is not going to break Phillips 66 because the margins between crude and refined products are strong (especially because of low crude oil prices).

How Important Is the Phillips 66 Investment for Buffett?

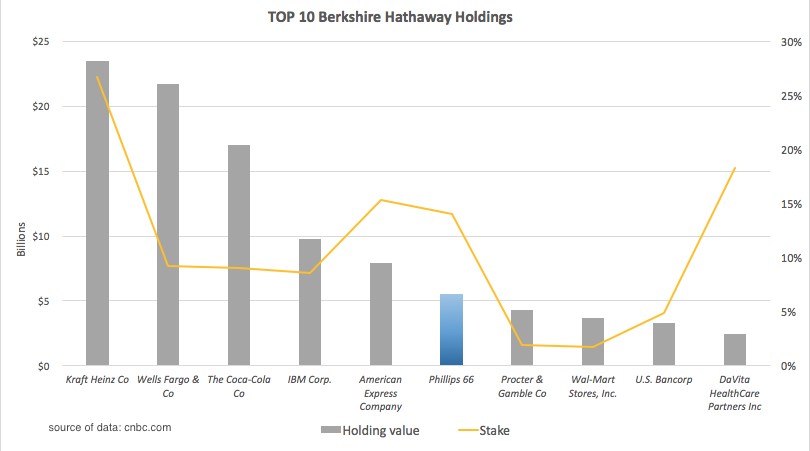

To understand how important this investment is, one needs to look at other constituents of Berkshire’s portfolio. The following chart is drawn from the data from CNBC where they track the real-time value of Berkshire Hathaway’s portfolio. It provides an insight into the top 10 holdings of their portfolio by holding value (ranging from $23 billion in Kraft (KRFT) to $2.5 billion in DaVita (DVA)). The yellow line gives the amount of stake they own in the respective companies as a result of their investment. The $5.5 billion investment in Phillips 66 is the 6th largest position in their portfolio and they currently own more than 14% of the company. Just in mid-Sept 2015, their stake was worth $4.5 billion, so they have bought an additional $1 billion worth of stock in a matter of 5 months (roughly speaking, not adjusting for price changes). That is quite an aggressive investment horizon and shows that they are not only fully committed to the company but also feel that the price/timing is right.

Why Is Buffett Buying Phillips 66?

This question is probably the reason you are reading this article. Buffett has been asked this question several times in the last few months. Most of his argument has been around the company and their management being strong, the nature of their business (that it is more than a refinery) and, in a few cases, he has acknowledged that oil prices have played a role as well. I think the reason they are buying this particular stock can be divided into the following reasons:

1. It is a great company.

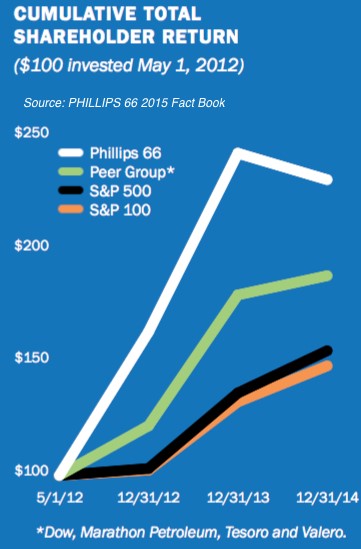

Ever since it was spun off from ConocoPhillips (COP ) in 2012, Phillips 66 has paid excellent dividends every year. It has a dividend yield of almost 3% and a payout ratio of more than 30%. On top of that, the company has had very good stock performance since 2012, returning more than 100%, despite the heavy correction since November last year. The company has more than 72% institutional investor ownership so the stock will probably not be as volatile as some of the other ones that have high retail investor ownership.

2. The time is right.

Oil prices have played a huge role in the decision, despite Buffett downplaying the matter. What is the proof? Buffett dumped all of his $3.7 billion investment in Exxon Mobil (XOM ) (a top 10 member of his portfolio) early last year. He has been piling on Phillips 66 since then. The simple reason for that is falling oil prices affect Exxon’s bottom-line directly. The good thing about refineries is that they are not that adversely affected by falling oil prices (because that is an input of their manufacturing process).

Given that the global economy has struggled with low demand and the ever increasing oil supply glut (with Iran’s lifting of sanctions coming into play soon), the low oil prices are here to stay. Buffett thought it was high-time he entered a business that hedges against the low oil prices.

As far as the stock price valuation is concerned, PSX’s PE ratio is much lower than the industry and sectoral PEs. So, Buffett clearly sees this as a good opportunity to double down on PSX.

3. Buffett is moving into beneficial areas of the energy sector.

Through Phillips 66, Buffett has exposure to refining and associated derivative products coming out of its distillation process. Through the Phillips 66 MLP (PSXP ), Buffett gets exposure to pipelines, midstream assets, processing etc. So, he is moving into storage, processing and transportation businesses, which will be more suited to the new world of low oil and commodity prices in the near future.

The Bottom Line

Buffett’s investment in Phillips 66 was preceded by selling his entire stake in Exxon. This shows a clear shift in strategy to move towards areas of the energy sector that might be least affected by a crude oil price crash (refining, transportation, storage, processing, etc.). In a lot of ways, this is also a validation to the point made by nearly all analysts that low oil prices are probably here to stay. The stock has been under pressure largely because of the crude oil export ban being lifted.