Alliance Resource Partners Ltd {% dividend ARLP %} - Downgraded

ARLP is being removed from the “Best Dividend Stocks List” as its relative strength is being lowered from 3.5 to 3.

Low natural gas prices have incentivized utilities to switch from coal to natural gas. For ARLP to go up again, almost surely, natural gas prices need to go up too. ARLP always had operational advantages—mines are close to the end user, which reduced transportation costs, and the company has priced and committed more than 90% of its deliveries. It maintains a reasonably strong balance sheet with a manageable 1.27 times total debt to trailing 12 months EBITDA ratio, indicating an ability to continue to pay dividends.

Although the share price depreciation has likely been overdone and unwarranted, we were wrong on this upgrade. The market forces overwhelmed the stock price and ultimately, our original thesis is broken. There are better places to place new money, and adhering to our DARS system, we need to reduce the relative strength— in fact, we should have done this earlier. While we are never making “buy/sell” calls, we don’t feel this is the best place for new money.

Aqua America {% dividend WTR %} - A Pensioner’s Stock- Upgraded

Aqua America, Inc., a Pennsylvania corporation, is the holding company for regulated utilities providing water or wastewater services to what we estimate to be almost 3-million people in Pennsylvania, Ohio, Texas, Illinois, North Carolina, New Jersey, Indiana, and Virginia.

Aqua by numbers

- Provide drinking water to 2.75 million people

- Own and operate 1,447 public water systems

- 187 wastewater treatment plants that provide wastewater service to 250,000 people

DARS Analysis

DARS, as we mention on our website, is a rating system, and not a portfolio management system. Each stock is weighted on 5 factors that are mentioned below.

Relative Strength

Aqua America has displayed tremendous strength in today’s volatile conditions. The stock has absolutely not budged from its $28-$30 range as the market had trillions wiped off at the start of 2016. The stock’s one-year performance is 10.83% (excluding dividends). In these times of volatility, it would make sense to seek quality with reduced volatility—Aqua America fits the bill sporting a beta of 0.42. The stock hasn’t followed the market when it has careened downwards but has followed the market when it went up.

The broad markets did not get off to a good start in 2016, with the S&P down [XX%], its worst 10-day start to a year, ever. Aqua America serves as a good defensive play in this case. Why? Because they sell one commodity: water, which no one can live without.

Overall Yield Attractiveness & Dividend Reliability

They have paid common dividends consecutively for 70 years. Over the past 5 years, their average payout ratio has been 51%. They had their 24th dividend increase recently in the past 23 years and the 16th consecutive year that they have increased their dividend in excess of 5 percent. They have also had 15 consecutive years of earnings growth.

The dividend looks extremely reliable given the fact the market values the stock at 23.5 TTM PE. We don’t anticipate a large share price appreciation, given the ceiling the valuation provides, but inversely, we don’t anticipate a large share price depreciation, given the solid and reliable dividend yield. The need of the hour is to have a stock with low volatility, low correlation with the market and yet fulfills all the requirements of a dividend investor: a good payout, and potential future earnings and dividend growth. The stock currently yields 2.40%.

Dividend Uptrend

Judging by their commitment to keep distributing approximately 50% of their earnings as dividends, it gives us confidence to recommend Aqua as we see the strong uptrend continue. Dividends are above average, and growing as per Benchmark/Peers/Broader Market/Analyst Expectations.

A detailed analysis of why we see a dividend uptrend, and from where the earnings growth would come from is as follows.

Aqua America - Acquiring Their Way to Growth

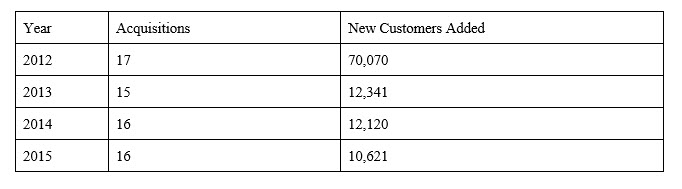

Aqua America has been active in acquisitions, which have been driving customer acquisitions as is evident from the chart below.

Acquiring non-regulated business

Aqua America has been focusing on the expansion of its non-regulated business to become their #1 primary source of customer growth. This is where they especially believe that there is an opportunity in the 4,500 wastewater utilities spread out across the United States.

Acquiring regulated business

Aqua America’s regulated growth strategy is focused on using its expertise and financial strength to acquire both municipal and private water systems. The company has completed more than 300 acquisitions of utility systems in the last 15 years.

Water-Fragmented Business

- Approximately 53,000 water systems and more than 16,000 wastewater systems exist in the country

- Even though roughly half of the drinking water systems are privately owned, they serve only about 15 percent of the population

- Approximately 20 percent of the wastewater systems are privately owned, but they serve only about 3 percent of the population.

- More stringent regulations from federal and state environmental regulators, the capital needed to meet such standards on the part of many system owners, and the monetizing of public assets to support the financial condition of municipalities are among the factors that might drive consolidation.

- The U.S. Environmental Protection Agency (EPA) has estimated that an investment of $335 billion for water infrastructure and $298 billion for wastewater infrastructure is needed for required improvements in the next 20 years.

Meeting Federal Standards

Many of the small players are in violation of the EPA rules. Aqua acquires them and fixes the problem. Tap water is 1/100th of the price of bottled water. Once Aqua acquires smaller players, and treats the aesthetics of the water that these small players were previously providing, it convinces people to switch back to tap water from bottled.

Earnings Growth

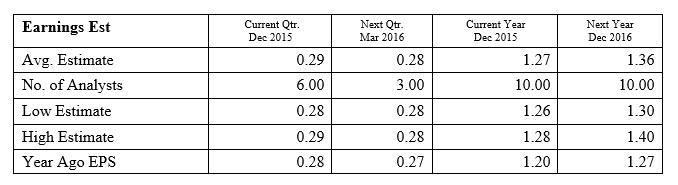

These are the Analysts estimates for Aqua America for 2016.

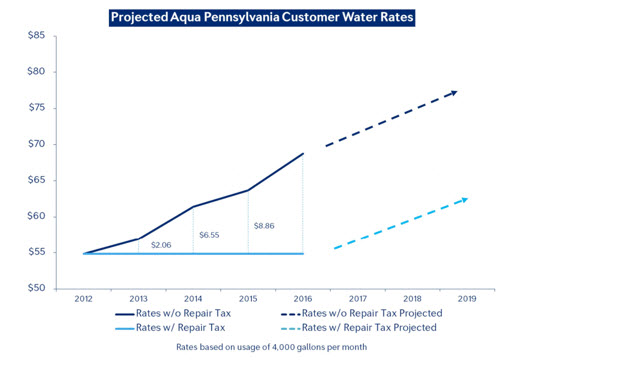

If we break down their earnings, we can see that their estimated growth comes from Pennsylvania, which is their #1 contributor to revenue—and the rates are expected to go up in the future.

Source: 2016 Analyst Day Investor Presentation, Aqua America

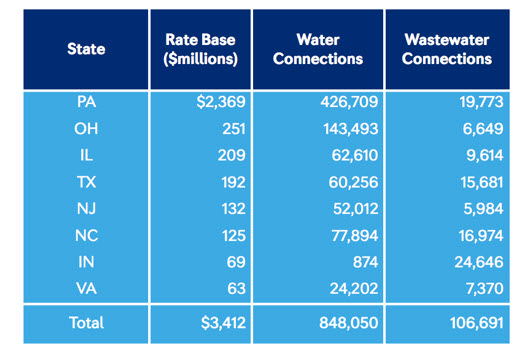

A large portion of their revenue also comes from Pennsylvania, where they have the maximum number of water connections.

Source: 2016 Analyst Day Investor Presentation, Aqua America

These are the projected Aqua Customer water rates from 2016 to 2019, as mentioned by the company, which point to a growth in the state that gives them the most revenue.

Source: Investor Relations, Aqua America Fact Sheet

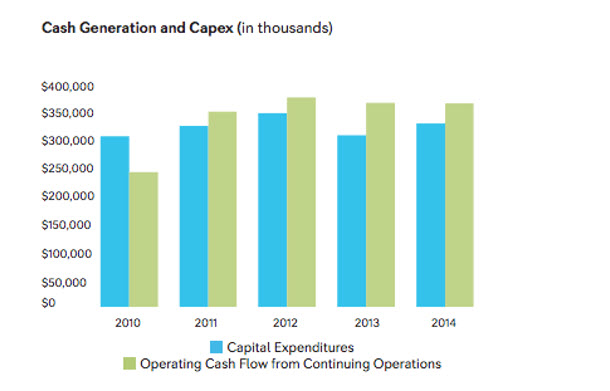

Since 2011, they finally have more cash than CAPEX, which leaves room for a dividend growth. This is expected from Aqua America, given their track record.

Are Water Conservation and Droughts a Problem?

The two major risks that Aqua could face are the habit of “Water Conservation” and severe droughts. How do they plan to address both of these issues?

Droughts

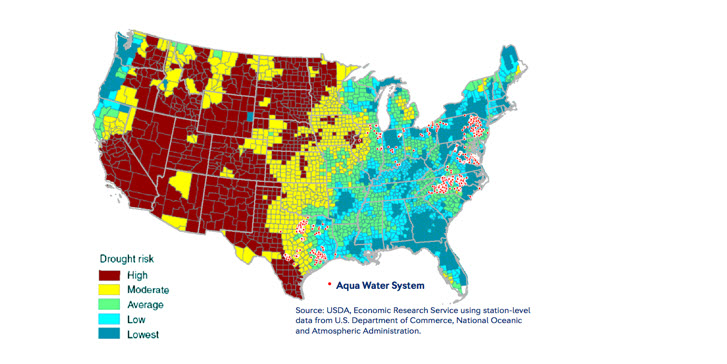

Aqua has strategically exited from 19 states, and are now down to 9 states in the past 20 years. They currently do not operate in severe drought-prone states according to a presentation given by the company to analysts, with the exception of Texas (see image below). The positive side to this risk is they only have 60,256 water connections and 15,881 waste water connections, which translates into 4th on the list of states that give them the highest revenue, as noted in one of the charts above. Drought means that Aqua has to source water from trucks, which results in increased expenditures for the company. To keep revenue intact, Aqua then has to pass on the increase to its customers.

Source: 2016 Analyst Day Investor Presentation, Aqua America

Water Conservation as a Habit

As more and more people become aware of the fact that they need to conserve water, there is a risk that people could bring down their water bills through conservation. Every year, less and less water is being consumed—but that doesn’t affect Aqua, according to Nicholas DeBenedictis, who is on the Board of Directors of Aqua America. He says that every year when they go for rate filing, they are re-bracketed into a higher rate, due to the infrastructure spending that they do to transport clean tap water.

The Bottom Line

Aqua America ranks highly on the 5 parameters we use to rate dividend stocks. In the current market volatility, the stock hasn’t fallen down, which prompts an increase in “relative strength” for the stock from 3 to 3.5, This pushes its overall DARS rating to 3.5, which is a “recommended”, according to our rating system and means it has garnered a spot on our Best Dividend Stocks List.