On Wall Street, investors continue to digest the latest earnings reports and economic data. Later today, however, many will be paying close attention to Washington, as President Obama delivers his State of the Union address.

Zeroing in on Taxes

Tonight, President Obama is expected to introduce a slew of new tax increases and higher government spending. In addition, many expect the President to reignite the partisan debate about overhauling the tax code. Obama’s plan is reportedly focused on how to best aid the middle class.

Over the weekend, President Obama gave the public a glimpse of his plan, which includes some $320 billion in tax increases over 10 years. These increases will likely be targeted at high-income individuals. A bulk of the tax revenue collected from this increase would then go to funding tax breaks for moderate income workers.

To effectively tax higher income individuals, Obama plans to focus on investment income – raising the top capital-gains tax rates (from the current 23.8% to 28%) and imposing capital gains taxes on inherited assets. To note, there have been no reports thus far regarding plans to change taxes on qualified or unqualified dividends.

Other Issues at Stake

According to the White House website, Obama is also expected to touch on the following topics and issues:

- Affordable high-speed broadband for all Americans

- A new proposal would make two years of community college free for responsible students

- The president’s plan to restore U.S. relations with Cuba

- The president’s push for net neutrality

- Immigration actions and reform

- Reviewing the Affordable Care Act

What to Keep in Mind as Investors

In addition to the proposed tax changes and the issues noted above, investors should keep in mind the overall economic picture while watching the President’s State of the Union.

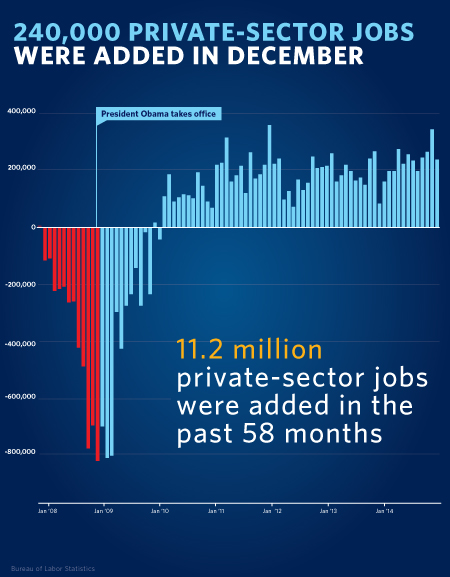

One of the economic issues we’ve been discussing this year is the labor market. Below is an infographic form the White House, which highlights the job market during Obama’s presidency thus far:

While this graph is impressive, given how far the market has come since the Great Recession, it is important to note that the nation is still struggling with wage growth.

Another macroeconomic issue to factor in is our nation’s monetary policy: this year the Fed is expected to adopt a contractionary monetary policy, which includes raising the interest rates for the first time in nearly a decade.

Another sore spot for the economy has been the housing market – which has showed recent signs of price weakness, along with continued multi-year lows in mortgage applications.

The Bottom Line

All of these issues will play a great role in how our economy fares in the coming years and are important to keep in mind while listening to the President’s State of the Union.

Be sure to check us out on Twitter @dividenddotcom.