How did two exactly opposite sectors of the economy-luxury stores and discount stores-outperform the broader market at the same time while income inequality grew in America?

The answer: the rich got richer and the poor remained as they were. This development has turned traditional macroeconomic theory on its head.

Income Inequality: the 99% vs. the 1%

In the United States, the growing economic gap is staggering. The top 1% holds more overall wealth than the bottom 90% combined and has captured more than half of all income growth since 1993.

To put things even more into perspective, here are six shocking facts regarding income inequality:

- Income captured by the richest 10% of the U.S. population jumped from 30% in 1980 to 48% in 2012.

- Wall Street bonuses are twice the earnings of all minimum wage workers in the country.

- The top 1% of America owns 50% of all investment assets.

- The top 1% also owns 35% of the country’s wealth.

- Only 2.5% of the country’s wealth is owned by the poorest half of the population.

- 16 million children in the U.S. (22% of children), live in families with incomes below the federal poverty level of $23,550 per year for a family of four.

For more information, check out this video that sums up America’s income inequality situation: Wealth Inequality in America.

When the 1% Buy

The traditional macroeconomic analysis used to dictate that luxury stocks outperform in the late bull phase, when consumers have lots of disposable income to spend. In the late bull phase every stock gives you a return, but if outperformance is what you are looking for, then luxury stocks have that aspect covered. During recessionary periods or downtrends, individuals don’t have as much disposable income and hence stick with discount store stocks because they are the ones to outperform during that phase.

But looking at the statistics of how income is being redistributed from the poor to the rich makes one re-think this traditional strategy of buying luxury stocks in the early part of the late bull phase. The 1% have been increasing their coffers irrespective of business cycles and they need a source to spend their money. Here’s where the Ralph Lauren’s, the Tiffany’s, and the PVH’s of the world enter.

Income distribution has never been as skewed in America as it has been for the past 80 years. This is one of the major factors that has led to luxury stocks no longer being treated as cyclical. The other reason has been the emergence of China.

According to the book The Bling Dynasty, by Erwan Rambourg, in 2015 the Chinese represent 20% of global luxury consumers and 35% of sales. Further, the country is expected to give an 11% average growth per annum by the year 2025, when it will account for 50% of global sales.

Luxury Stores

Ralph Lauren (RL )

Company Background:

RL focuses on the design, marketing and distribution of men’s, women’s, and children’s apparel and fragrances, as well as home furnishings.

The company has three major segments:

Wholesale: RL’s wholesale segment represented 47% of the company’s fiscal 2014 net revenues, namely sales made to major department stores and speciality stores across the world.

Retail: The retail segment represented 51% of the company’s fiscal 2014 revenues. These were sales made directly to consumers through retail stores across the world.

Licensing: Some of the product licensing partners for the U.S. market are L’Oreal, Peerless, HanesBrands, and Luxottica Group.

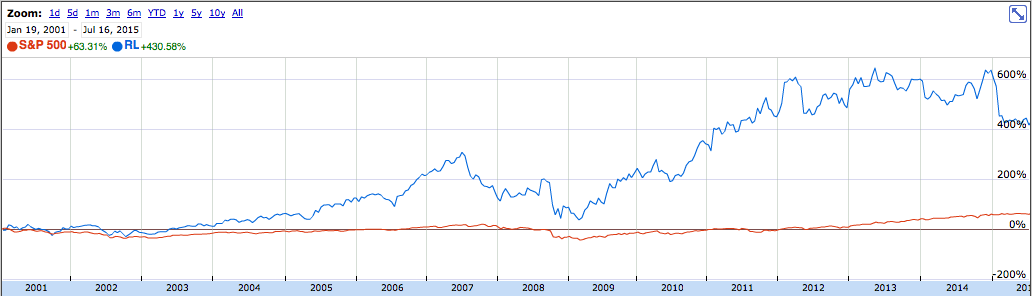

Below is Ralph Lauren’s chart in comparison to the S&P 500.

Traditional play: Overall from the 2001 to 2007 bull phase the company did outperform the S&P 500, but the stock skyrocketed only at the end of the bull phase.

New Macroeconomic Play: Since the 2008 recession, the stock has broken higher highs right from the beginning of the bull phase and is no longer seen as a cyclical stock by the market.

Check out this analysis of RL’s financials. From March 2012 to March 2015, revenues grew 11% overall and profits grew 3%.

Tiffany & Co. (TIF )

Company Background

The company principally sells jewelry, timepieces, leather goods, crystal, fragrances, and other luxury products. It also has e-commerce enabled websites.

Traditional play: Overall from the 2001 to 2007 bull phase, the stock was in-line with the S&P.

New Macroeconomic Play: After the recession it was no longer a cyclical play. The stock gave an approximately 175% return.

Check out this analysis of TIF’s financials. Revenues have grown 16% from 2012 to 2015, while profits have grown 10%.

PVH Corp. (PVH )

Company Background

PVH Corp. is an apparel company that owns some of the top brands such as Calvin Klein, Tommy Hilfiger, Van Heusen, and Arrow. It’s licensed brands include Speedo, Kenneth Cole, Michael Kors, and Ted Baker to name a few.

Traditional play: PVH followed the same cyclical pattern from 2001 to 2007, when it outperformed in the end.

New Macroeconomic Play: The company was non-cyclical after the 2008 recession, with its stock giving a 150% return by mid-2015.

Check out PVH’s financial statements. Revenue has grown 40%, while profits have grown 60% from 2012 to 2015

When the 99% Buy

Discount Stores

The logic behind playing discount stores is that they produce cheap goods (economically) and appeal to an entirely different class of consumers. Individuals switch from luxury products to cheap products in times of recession, and then switch out from cheap products to luxury ones in a bull market.

But this bull market is very different.

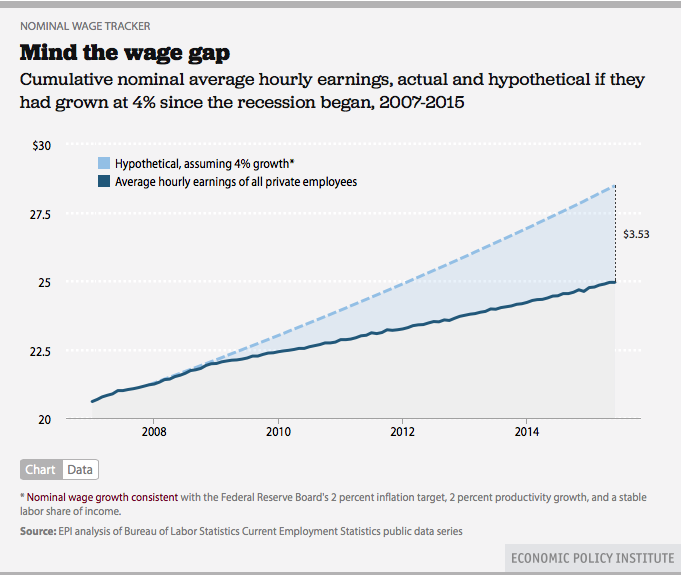

The Phillips curve says that unemployment and inflation have an inverse relationship. Inflation is low in recessions when unemployment is high and inflation is high in peaks when unemployment is low. America’s low unemployment rate in the 5%-6% range in this bull phase looks rosy from the outside, but when you delve deeper, and look at the nominal wage growth rate, you’ll find it is much lower than expected. The growth target on nominal wages was 3.5%-4%. However current YOY growth is just 2%.

Low unemployment means employers have to work harder to get new employees and existing employees can threaten to leave as there are plenty of jobs and hence, demand a higher salary.

Source: http://www.epi.org/nominal-wage-tracker/

The wage growth rate, or lack thereof, has led to declining standards of living for many Americans. Hourly wages have not increased in-line with productivity. Cumulative productivity from 1948 to 2013 has increased more than 240%, but cumulative hourly compensation increased only 108% during those same years. Where did the surplus productivity go? It went to the top 1%: the business owners. Since wage growth never picked up as expected, consumers continued shopping at discount stores.

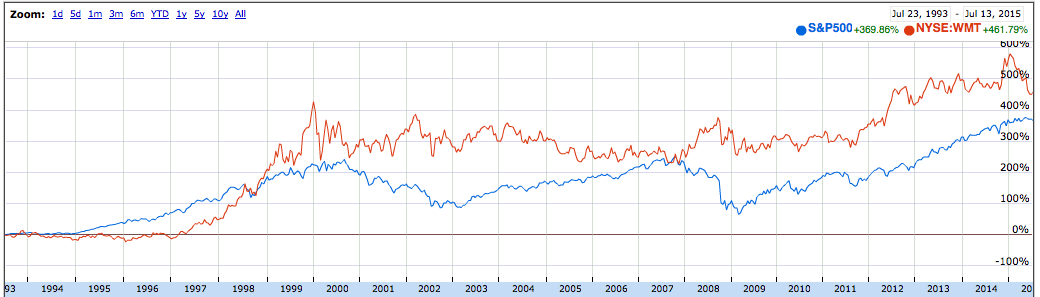

The following charts of Wal-mart, Dollar Tree and The TJX Companies show how those companies outperformed the broader market.

Wal-Mart (WMT )

Wal-Mart Stores, Inc. is engaged in the operation of retail, wholesale and other units in various formats around the world. The company offers an assortment of merchandise and services at everyday low prices.

Read WMT’s financial statements. From 2012 to 2015, revenues grew 8%, while profits grew 4%.

Dollar Tree (DLTR)

Dollar Tree, Inc. (Dollar Tree) is an operator of discount variety stores, offering merchandise at the fixed price of $1. The company offers a selection of everyday basic products and also supplements these items with seasonal, closeout and promotional merchandise.

Read an analysis of its financial statements. From 2012 to 2015, revenues grew 30% and profits grew 22%.

The TJX Companies (TJX )

The TJX Companies, Inc. (TJX) is an off-price apparel and home fashions retailer in the United States and worldwide. TJX has over 3,300 stores that offer a rapidly changing assortment of fashionable, brand name and designer merchandise at prices generally 20% to 60% below department and specialty store regular prices on comparable merchandise.

Check out an analysis of the company’s financial statements. From 2012 to 2015, revenues grew 25% and profits grew 48%.

The Bottom Line

Discount stores and luxury stores both look bullish unless there are structural changes that take place in hourly wage rates, wage growth rates, income distribution from the rich to the poor and unemployment rate, just to name a few factors.

And remember what the economist Joseph Stiglitz once said: “Inequality is the cause and consequence of the failure of the political system, and it contributes to the instability of our economic system, which in turn contributes to increased inequality — a vicious downward spiral.”

Image courtesy of Praisaeng at FreeDigitalPhotos.net

Source for charts- Google Finance