Have you ever wondered about alternatives to dividend investing? For income investors, there are many different investment options out there, but one of the choices getting a lot of press recently is investing in peer-to-peer or P2P lending.

Income investors might wonder whether P2P lending makes more sense than dividend investing – it’s a reasonable question to ask – and one that many investors do not know how to answer. Together, we’ll take a look at both options. This article will walk you through everything you need to know to make an informed decision.

What is a P2P Loan?

P2P lending essentially is just one person loaning money to another via an internet website. The largest and most popular P2P lending platforms are Lending Club and Prosper. Both are major websites that have facilitated billions of dollars in loans between people. In each case, the lending process works similarly.

How do P2P Loans Work?

The process for peer-to-peer lending is as follows.

First, a consumer looking for a loan goes to the website of Prosper or Lending Club, and fills out an online loan application. The website uses quantitative credit metrics to determine if the borrower is a reasonable risk, and if so, they offer the prospective loan to a large group of registered individuals who are lenders on the website.

The lenders can then choose if they would like to be part of a loan syndicate by lending the borrower a small amount of money, such as $25. Typically, a large number of lenders get together to make each loan. Lending only a small amount of money enables the lenders to spread out their investment across many different borrowers and hopefully limit their risk.

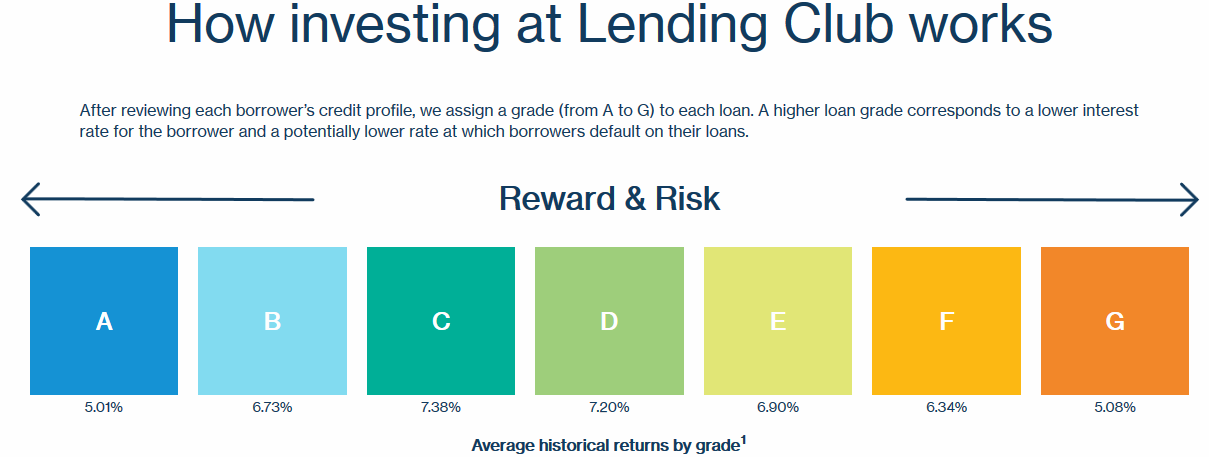

While individual loan results differ, the average return historically on most loans has ranged from 5-7%. In a few select cases with riskier loans, the returns have sometimes been as high as 13% as the graphic below shows.

P2P lending has boomed in popularity in recent years, largely because it is relatively easy for lenders to get involved with, and because the returns on P2P lending have had minimal correlation to the broader stock market.

Adding P2P lending to your investments is simple and straightforward – all you have to do is go to Prosper or Lending Club’s website and sign up, then answer a few simple questions and fund your account. Indeed, both websites have tried to appeal to more and more lenders in recent years by adding new features such as prebuilt bundles of loans that investors can easily invest in, rather than having to pick their loans one at a time. These innovations have helped bring many institutions into the fold as lenders with Prosper and Lending Club.

For more investment concepts, visit our Dividend Investing Ideas Center.

Risks in P2P Loans Compared to Dividend Investing

While it is easy for investors to add P2P lending to their portfolio, these investments are definitely not without risk. In fact, while Lending Club and Prosper are happy to have you as a lender and will even let you invest your 401(k)s with them, it makes sense to step back and understand the risks first.

First, P2P lending is short term in nature. Most loans are 36 months, while a few are 60 months. As a result, the loans do not offer the same kind of long-term investing income that dividend stocks do. Instead, investors will have to keep rolling over their investment into new loans.

Second, because of the tax treatment of loans, all income received will be taxed at ordinary income rates, while dividends can be taxed at reduced rates in many cases (depending on how long an investment in firm has been held).

Third, while dividends can feature rising payouts over time if companies become more successful, P2P loans are only made at fixed and unchanging rates. As a result, your income cannot grow in the same way that it can with dividends.

Fourth, while a diversified portfolio of loans to individuals may seem safe, it’s not as attractive as one might expect. In fact, a borrower’s ability to repay loans is likely to be related to the overall economy, and so if a recession occurs, many loans may default all at once. In contrast, companies are more creditworthy than individuals typically, and they may offer greater consistency in dividend payouts compared to P2P loan interest.

Finally, it’s important to remember that P2P lending is still a very new area. As a result, returns on these types of loans are influx and may change over time. The figure above illustrates this – Lending Club grades the riskiness of its loans with “A” loans being safest and “G” loans being riskiest. In most areas of the investing world, riskier investments have higher returns – but in Lending Club’s case, the returns on G loans are 5.08% historically compared to 7.20% for safer D loans. This demonstrates that the industry as a whole is still working through the challenges of determining the correct interest rates to charge various buyers.

Find out all the companies that have increased their dividends for more than 25 consecutive years, in our 25 year dividend increasing stocks.

You might also want to check out a list of our Best Dividend Stocks that is more geared to your long-term financial needs. You can have complete access to this list by going premium for free.

The Bottom Line

On the whole, there are two important points for investors to remember. First and most importantly, each investor needs to make up their own mind about what kind of investment risk is right for them. For some investors, P2P lending makes sense. For others it does not. Second, P2P lending is easy to do, but it is also risky. P2P lending involves risks related to reinvestment, tax rates, limited growth in investment income, and potentially flawed interest rates. Prospective investors in the space should be careful before jumping in.

Stay up to date with next week’s major corporate changes regarding dividends in our News section on Dividend.com.