[Updated on September 28, 2017 by David Dierking]

Dividend aristocrats – companies that have paid and raised their dividends for at least 25 straight years – are favorites among income seekers due to their reliability and, often times, above-average yields. Some aristocrats have been paying dividends for over six decades. Below is a list of the highest-yielding dividend aristocrats.

Find out all the companies that have increased their dividends for more than 25 consecutive years on our 25-year dividend-increasing stocks page, and for more than 10 consecutive years, on our 10-year dividend-increasing stocks page.

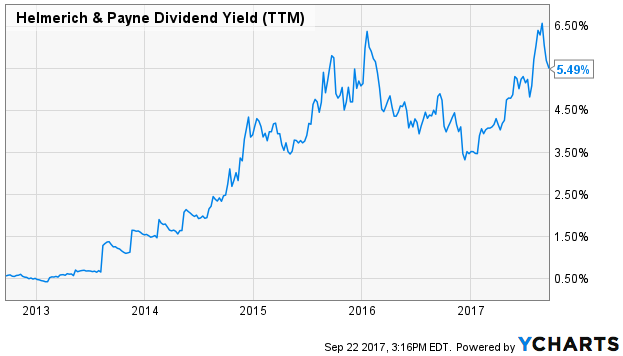

20. Helmerich Payne {% dividend HP %}

Oil driller Helmerich & Payne holds the title of highest yielder among the dividend aristocrats. The nearly 100-year-old company has lifted its quarterly dividend from just $0.15 in 2013 to $0.70 in 2017.

19. AT&T (T )

Dividend investors love telecom giant AT&T thanks to its yield, which is often above 5%. Dividend growth is more modest with this very mature company as investors have enjoyed a steady one-penny-per-share quarterly dividend increase in each of the past nine years.

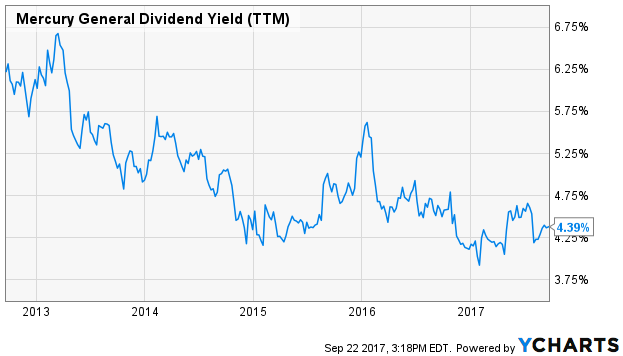

18. Mercury General (MCY )

Mercury Financial is an insurance holding company that has been raising its dividend for more than three decades. Dividend growth has been modest, however, as it’s lifted its quarterly payment by just a fraction of a penny per share annually over the past five years.

Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Dividend Stocks by Yield page.

17. Target (TGT )

Tough times in the retail sector have pushed Target’s dividend well north of 4%, but the dividend hikes keep coming. The company is about to hit 50 consecutive years of dividend growth and has grown its payment by an average 18% annually over the past decade.

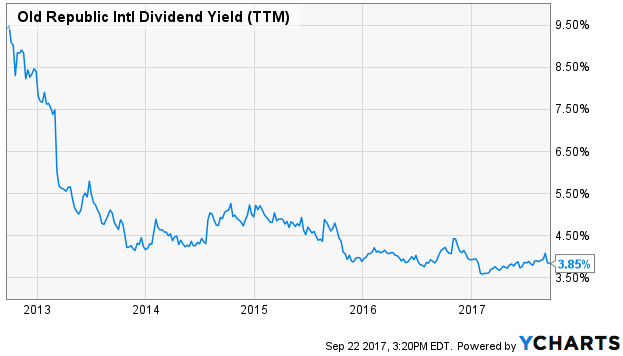

16. Old Republic International (ORI )

Old Republic International is a title insurance company whose dividend streak is at 35 years. Its dividend typically rises by about 1-2% per year and is supported by a payout ratio just over 50%.

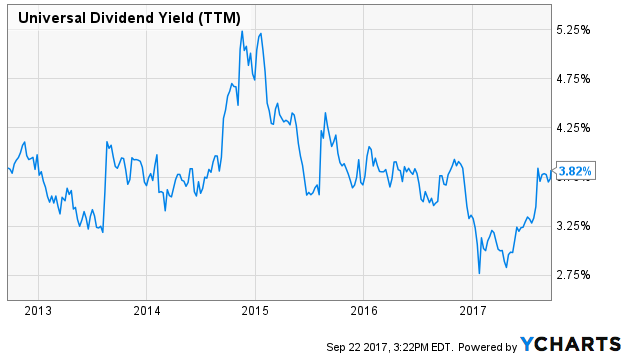

15. Universal Corp (UVV )

Tobacco companies such as Universal Corp tend to be cash-intensive businesses, which allow them to reward shareholders with big dividends. Universal has been raising its annual dividend by a penny per share every year like clockwork for more than a decade.

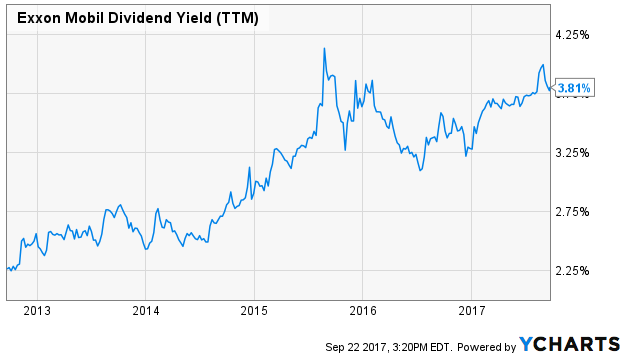

14. ExxonMobil (XOM )

Oil giant ExxonMobil started raising its dividend back in 1983 when it was still just Exxon. Dividend growth has slowed in recent years but its almost 4% yield makes it one of the highest-yielding Dow components.

Check out our Best Dividend Stocks page by going Premium for free.

13. Chevron (CVX )

Chevron is another high-yielding Dow component from the energy sector. Despite its current 31-year streak, dividend growth has slowed to a snail’s pace of less than 1% annually over the past three years.

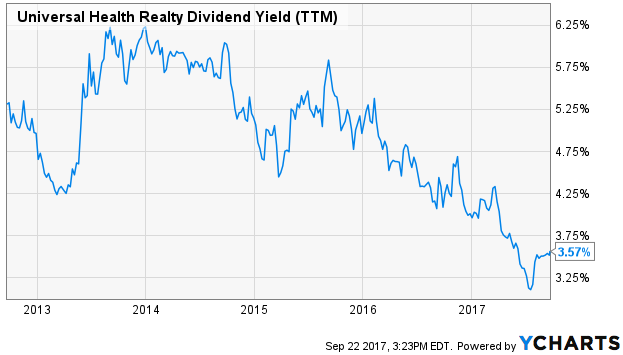

12. Universal Health Realty Income Trust (UHT )

The Universal Health Realty Income Trust is a, REIT that focuses on healthcare facilities such as hospitals and rehab facilities. It has been delivering dividend growth for over three decades, but historically has only lifted its dividend by $0.005 at a time.

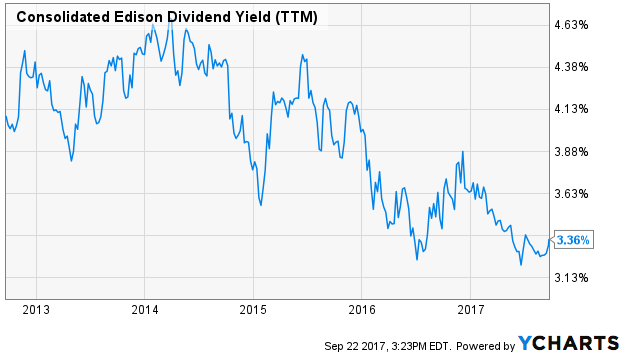

11. Consolidated Edison (ED )

Consolidated Edison is one of the nation’s oldest utilities having originally launched in 1823. The cash-rich electric and gas utility has been growing its dividend for more than four decades, and typically announces a 2-3% increase early every year.

Check out Top High-Yield Monthly Dividend Stocks.

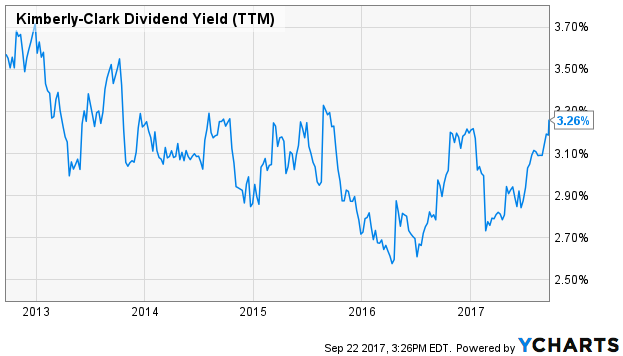

10. Kimberly-Clark (KMB )

Household products manufacturer Kimberly-Clark (KMB ) has been in business since 1872 and now generates more than $20 billion in sales annually. With a payout ratio of just 62%, the company is well-positioned to continue its 44-year dividend growth streak into the foreseeable future.

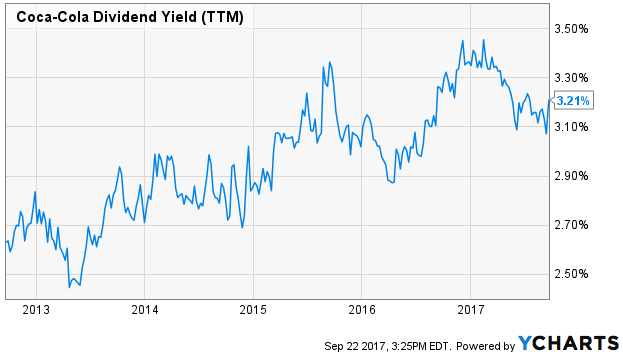

9. Coca-Cola (KO )

Warren Buffett favorite Coca-Cola has been a top dividend growth investor pick thanks to its strong yield, financial strength and streak of annual dividend raises that has spanned more than half a century. Coca-Cola has averaged dividend hikes of more than 8% per year over the past decade.

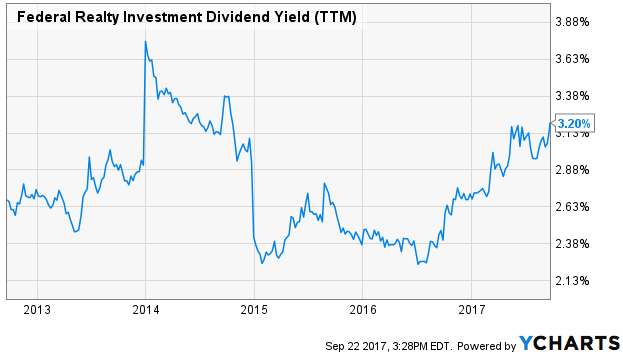

8. Federated Realty Investment Trust (FRT )

The Federated Realty Investment Trust is the longest-running dividend grower among REITs with a streak of 49 years and counting. REITs are required to distribute at least 90% of earnings to shareholders in the form of dividends, making them popular among income seekers.

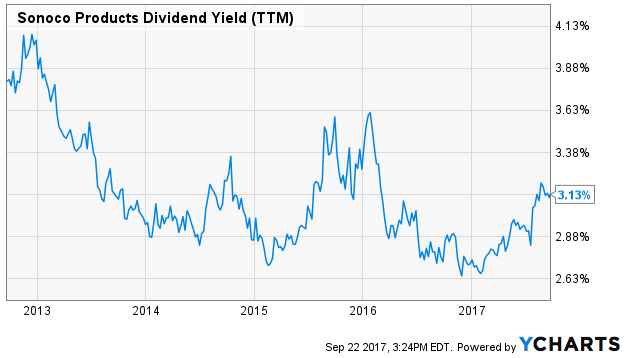

7. Sonoco Products (SON )

Sonoco Products is a packaging products supplier that has been in business since 1899. It started its dividend raises in 1981 and has averaged about a 5% increase per year recently.

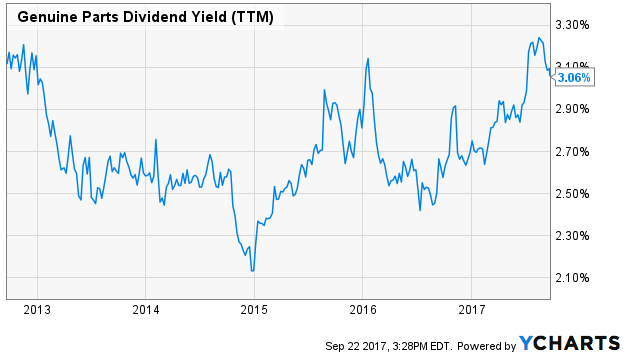

6. Genuine Parts (GPC )

Genuine Parts is the owner of the popular NAPA Auto Parts brand. It is one of the very few companies with a 60-year streak of annual dividend growth. Over the past 10 years, the company has raised its dividend by a healthy 7% annually.

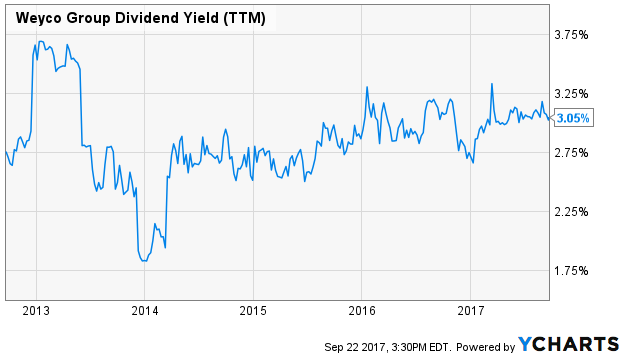

5. Weyco Group (WEYS )

Weyco Group, the company that designs and manufactures footwear, typically announces its annual dividend raise around the middle of the year. The company has raised its quarterly dividend by a penny per share every year since 2011.

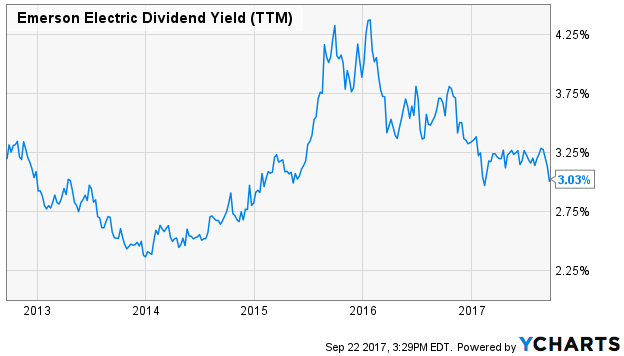

4. Emerson Electric (EMR )

Industrial equipment provider Emerson Electric owns a 60-year long record of raising its dividend. Increases have been just 1% over the past couple years, although raises of 6-7% annually have been common in the past.

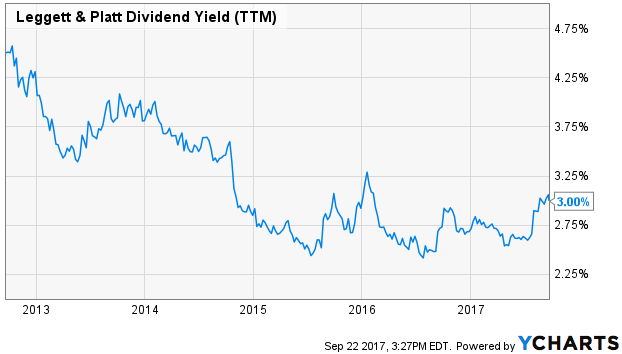

3. Leggett & Platt (LEG )

Furniture manufacturer Leggett & Platt has been a consistent dividend growth stock having lifted its quarterly payment by a steady $0.02 per share, or about 6%, over each of the past several years.

Check out what the investors are currently most interested in by visiting our Most Watched Stocks Page.

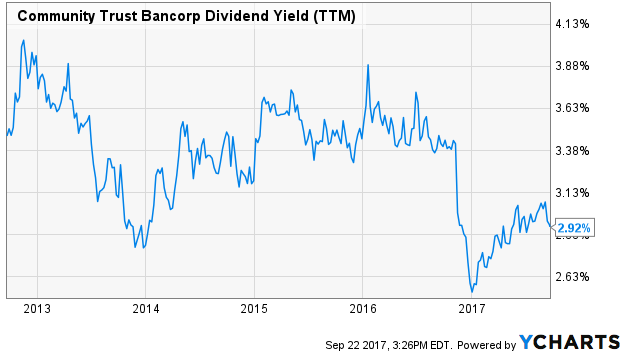

2. Community Trust Bancorp (CTBI )

Community Trust Bancorp is the holding company for Community Trust Bank, which has been operating since 1903. The company’s annual dividend raise has been steady in the 2-3% range, and it has been raising its dividend for 36 years.

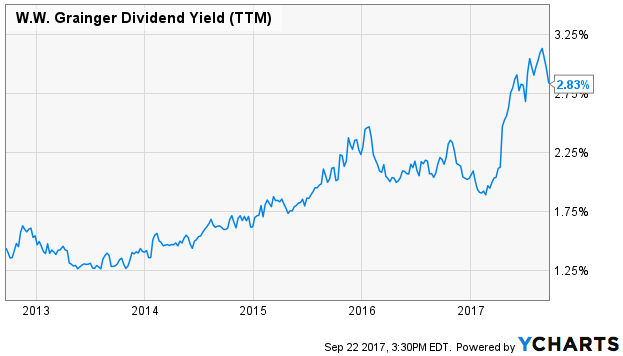

1. W. W. Grainger (GWW )

Industrial supply wholesaler W. W. Grainger has delivered one of the strongest dividend growth rates among the aristocrats. Averaging 16% growth over the past decade with a payout ratio of under 50% suggests the company is poised to extend its 45-year run of dividend growth.

The Bottom Line

Investors looking for steady and predictable income from their portfolios would be well served to start with the dividend aristocrats. Their long-term track records are a result of financial health, strong cash flows and a discipline to continue rewarding shareholders year over year.