Many retirees want to maximize income and minimize risk. Unfortunately, these goals are often antithetical to each other. A high-yield bond fund typically holds higher risk bonds because they must pay a higher interest rate to compensate for risk.

But what if you could have the best of both worlds?

Innovator ETFs’ Premium Income Barrier ETFs aim to offer both high income and a protective barrier against losses using a combination of S&P 500 options and U.S. Treasuries.

How Does It Work?

Buffer ETFs have become one of the fastest-growing corners of the ETF market with over 160 funds drawing in over $27 billion in assets since 2018. Using options, these funds have exposure to an underlying index and purchase put options to create a downside buffer.

Like conventional buffer ETFs, Premium Income Barrier ETFs buy and sell S&P 500 put options to provide downside protection. But instead of unlimited upside potential, they focus on generating a high level of income from option premiums and Treasuries.

The strategy typically involves selling a 1% put spread to create a “barrier” along with an additional put for 1:1 exposure below the barrier. Then, the fund invests the principal and option premiums into short-term Treasuries, resulting in a dual source of income.

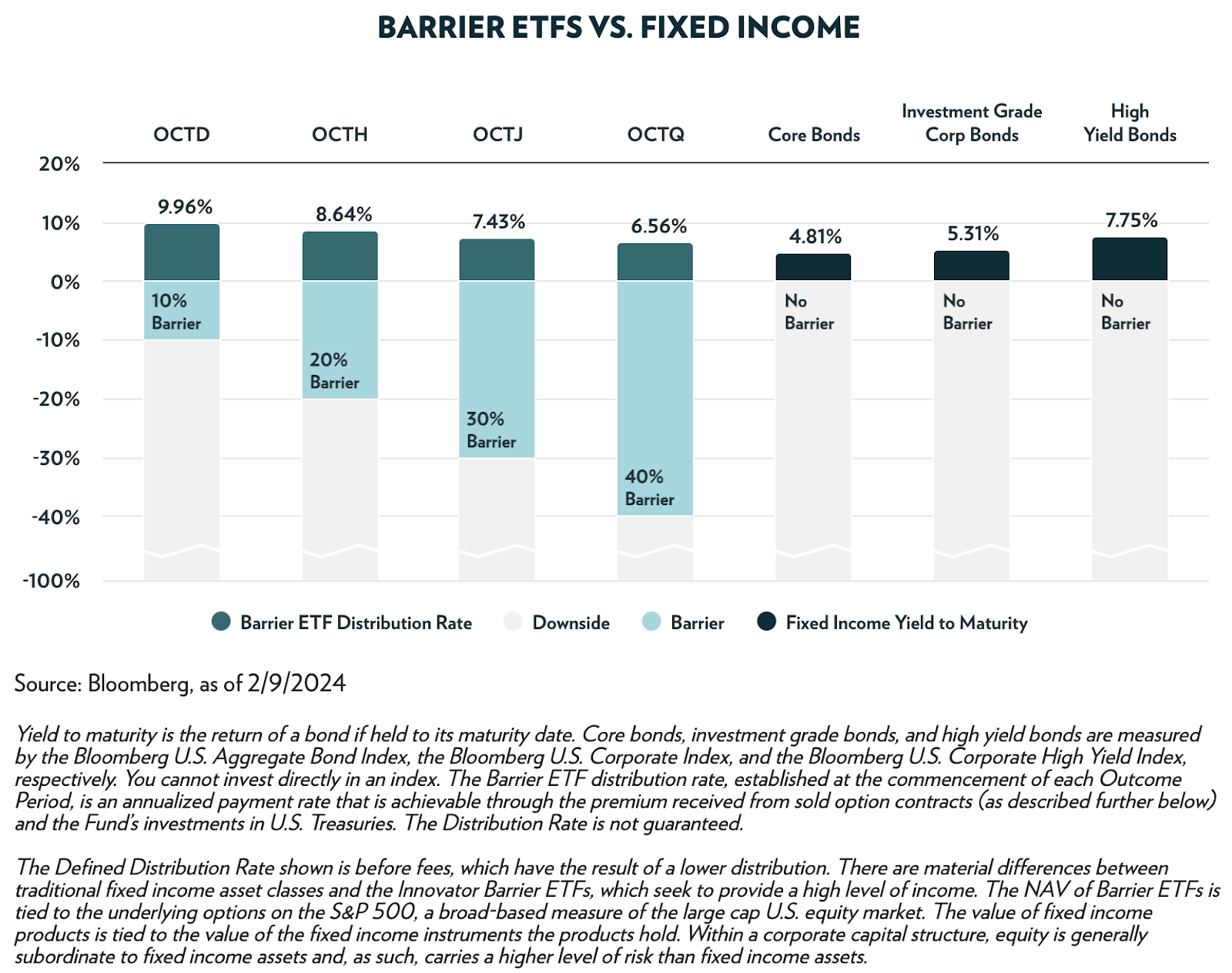

Premium Income Barrier ETFs could be an attractive alternative to conventional fixed-income allocations. With 6%-10% distribution rates and 10%-40% downside protection, you could generate more income with less risk than some core or investment-grade bond funds, as shown above.

Striking the Right Balance

Innovator ETFs offer quarterly funds (January, April, July and October) with four different barrier levels to suit individual risk tolerance levels – 10%, 20%, 30% and 40%. And, of course, greater levels of downside protection offer less yield.

But, as with buffer ETFs, it’s critical to remember that the outcomes may only be realized by investors that continuously hold shares from the beginning of the outcome period until its conclusion. If you buy after a drop in price, you will have less downside protection.

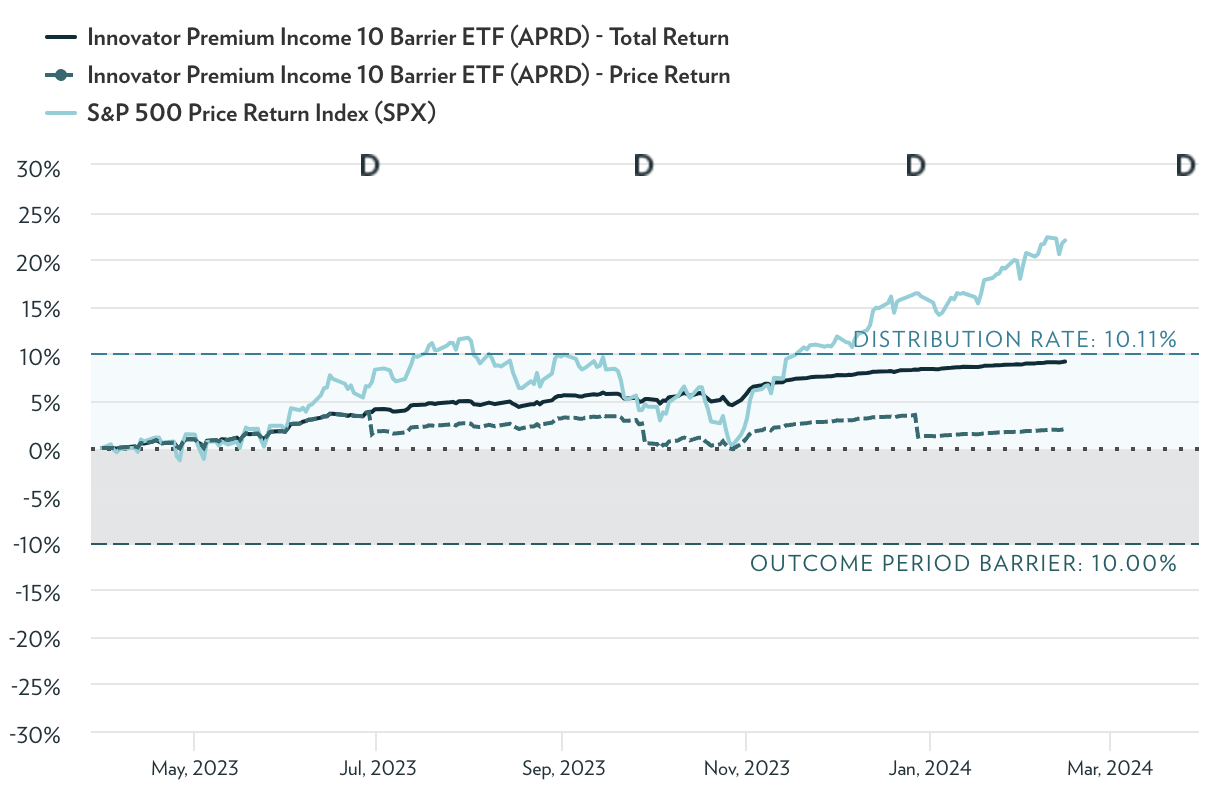

You should also remember that these securities limit potential upside. Unlike barrier ETFs, they’re designed to be a fixed-income alternative. In the example below, you can see that holding the S&P 500 would have resulted in a far better return!

When choosing one of these options, you should carefully consider your income requirements and the remaining downside protection. On the Innovator ETFs website, you can see the current price along with the upper and lower limits for each ticker.

Innovator Premium Income Barrier Funds with 10% Barrier

Here are the April, July and October series funds with 10% starting barrier. Note the outcomes that the Funds seek to provide may only be realized if you are holding shares on the first day of the Outcome Period and continue to hold them on the last day of the Outcome Period, approximately one year.

Return numbers are current returns since the start of the outcome period.

SPX refers to the S&P 500 Price Return Index.

| Name | Ticker | Defined Distribution Rate | Starting Barrier | Fund Return | SPX Return | Outcome Period | Expense |

|---|---|---|---|---|---|---|---|

| Premium Income 10 Barrier ETF - April | APRD | 10.11% | 10% | 2.11% | 23.12% | 4/1/2023 - 3/31/2024 | 0.79% |

| Premium Income 10 Barrier ETF - July | JULD | 9.20% | 10% | 2.43% | 13.68% | 7/1/2023 - 6/30/2024 | 0.79% |

| Premium Income 10 Barrier ETF - October | OCTD | 9.96% | 10% | 3.57% | 17.95% | 10/1/2023 - 9/30/2024 | 0.79% |

Alternatives to Consider

Premium Income Barrier ETFs blend the safety net of buffer ETFs with the income of high-yield bonds or buy-write ETFs. But there are alternatives to consider.

Buy-Write ETFs

Buy-write ETFs use covered calls to generate income from a long stock portfolio, which doubles as a way to provide a downside buffer. Since they rely exclusively on writing call options, they may offer more upside potential than Premium Income Barrier ETFs, although they have more downside exposure too.

These ETFs are sorted by their 1-year total return, which ranges from -9% to 18%. They have AUM between $650M and $30B and expenses between 0.35% and 0.66%. They are currently yielding between 4.8% and 12.1%.

| Name | Ticker | Type | Actively Managed? | AUM | 1-year Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| Global X NASDAQ 100 Covered Call ETF | QYLD | ETF | No | $7.68B | 18.3% | 12% | 0.6% |

| JPMorgan Equity Premium Income ETF | JEPI | ETF | Yes | $29.2B | 10.3% | 6.5% | 0.35% |

| Global X S&P 500 Covered Call ETF | XYLD | ETF | No | $2.85B | 8.4% | 9.4% | 0.6% |

| Amplify CWP Enhanced Dividend Income ETF | DIVO | ETF | Yes | $2.88B | 7.5% | 4.8% | 0.55% |

| Global X Russell 2000 Covered Call ETF | RYLD | ETF | No | $1.5B | -5% | 12.1% | 0.66% |

| iShares 20+ Year Treasury Bond BuyWrite Strategy ETF | TLTW | ETF | No | $654M | -9% | 9.8% | 0.35% |

Risk Managed Income ETFs

Like buy-write ETFs, risk-managed ETFs use options to provide income and downside protection. Using call options, they help manage risk using a strategy that’s very similar to Premium Income Barrier ETFs. However, they provide ongoing protection rather than defining a set of monthly or quarterly funds.

These ETFs are sorted by their 1-year total return, which ranges from -3% to 27%. They have AUM between $10M and $400M and expenses between 0.60% and 0.68%. They are currently yielding between 7.9% and 12.1%.

| Name | Ticker | Type | Actively Managed? | AUM | 1-year Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| Nationwide Nasdaq-100 Risk-Managed Income ETF | NUSI | ETF | No | $399M | 26.9% | 7.9% | 0.68% |

| Global X NASDAQ 100 Risk Managed Income ETF | QRMI | ETF | No | $10.9M | 8.6% | 12.1% | 0.6% |

| Global X S&P 500 Risk Managed Income ETF | XRMI | ETF | No | $27.5M | 3.1% | 11.8% | 0.6% |

The Bottom Line

Innovator ETFs’ Premium Income Barrier ETFs offer a unique combination of income and downside protection. As a result, they may be a suitable drop-in replacement for core or investment-grade bond allocations. But, of course, there are some key risks and caveats to remember.