The bond market has been on a rollercoaster over the past few years. With inflation hitting a high of 9% in mid-2022, the 10-year Treasury yield rose to nearly 5% by late 2023 and the iShares Core US Aggregate Bond ETF (AGG) plummeted from a high of $120 to a low of $90 in just a couple years – a remarkable 25% drop.

During the first quarter of 2024, inflation seemed to have stabilized at around 3% and bond prices are no longer in freefall. The Federal Reserve also appears ready to allow interest rates to fall later this year, if inflation remains in check.

In this article, we’ll look at what this means for bonds throughout the remainder of the year, as we lay out a base case for 2024 and how to position your portfolio.

Slowing Economic Growth

Most economists predicted a recession last year, but economic growth clocked in at a robust 3% pace. However, there’s little doubt that higher interest rates are increasing the cost of capital for businesses and will eventually take a toll on economic growth.

The consensus is that economic growth will slow to a 1-2% pace in 2024, which is sufficient to keep the economy out of a recession – although, that’s a thin margin of error. Instead, many economists believe we could see “rolling recessions,” where subsets of the economy get hit with problems at different times.

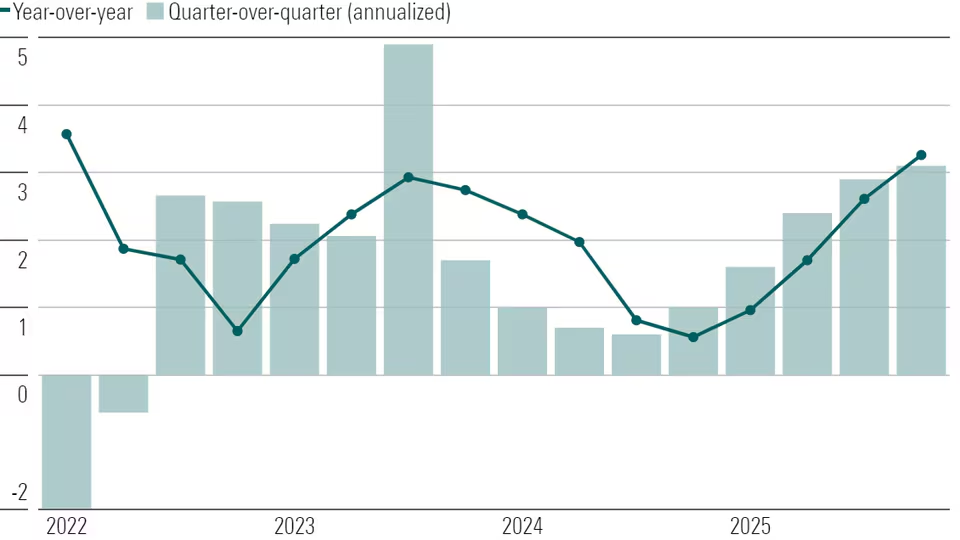

Morningstar anticipates a dip in 2024 GDP followed by a rebound in 2025. Source: Morningstar

There are also several broader unknowns:

Inflation – The Federal Reserve remains cautious in calling inflation a solved problem. If inflation rises again, the central bank may have to either push out its scheduled interest rate cuts or increase rates to combat it – and that could hurt economic growth by further increasing the cost of capital.

Geopolitical Risk – Wars in the Middle East and Eastern Europe, both large oil-producing regions, could lead to energy shocks. And, of course, broader conflict could more broadly increase risk premiums.

Loan Books – Rising interest rates could lead to more defaults, which could reduce profits in the banking sector. Moreover, defaults of commercial real estate could spill over into the broader economy.

Falling Interest Rates

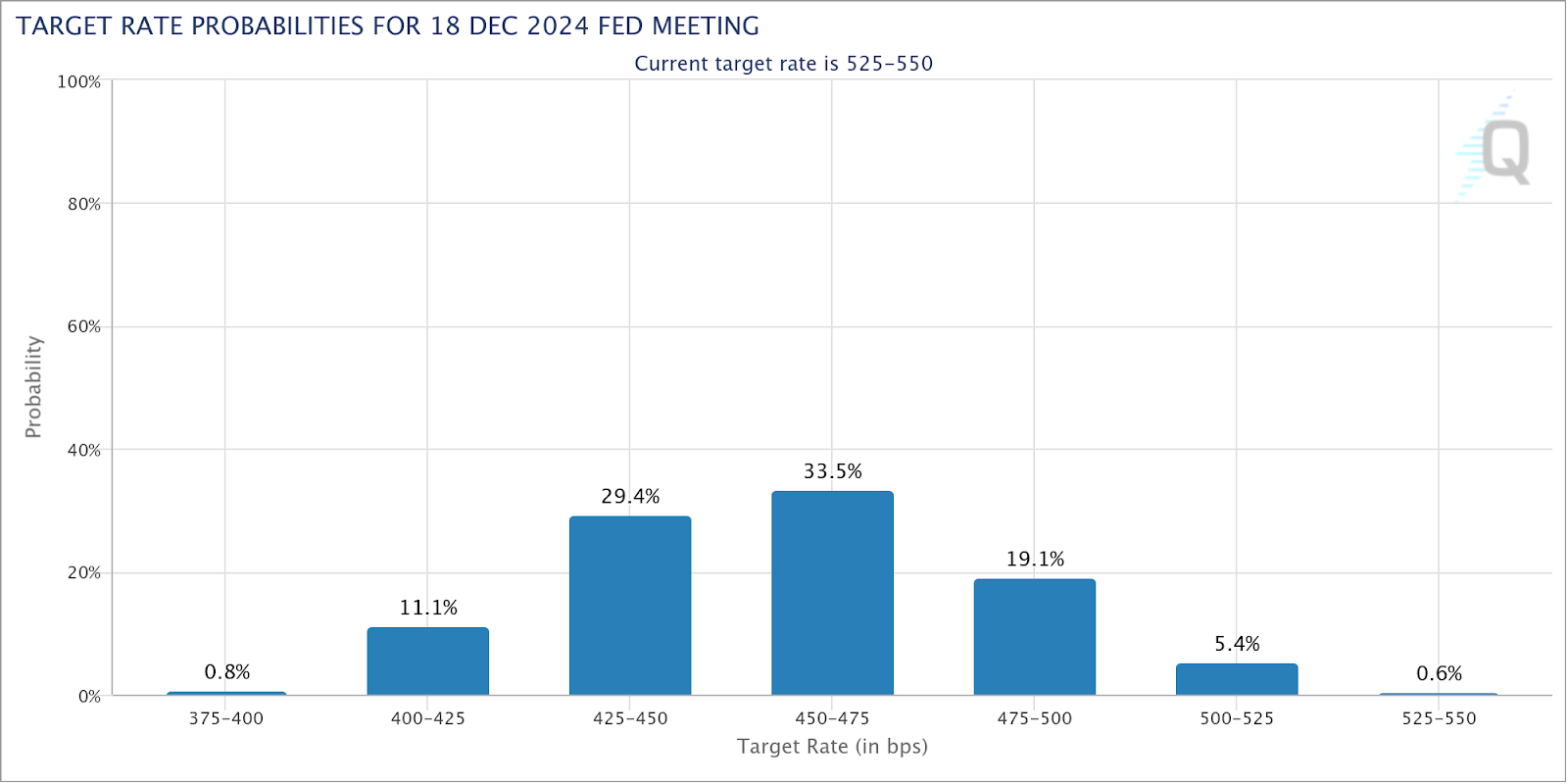

Most economists believe that inflation will decrease by the end of 2024. According to the CME FedWatch tool, the futures market projects a 33% probability that target rates will be in the 450 to 475 basis point range by December (see below). Meanwhile, they see a 29% chance that rates will be even lower, between 425 and 450, and a 19% chance they’re between 475 and 500 basis points.

The futures market sees a distribution of probabilities, reflecting some uncertainty. Source: FedWatch

Most of these interest rate cuts are expected to occur in the latter half of the year. In June, the market sees a 58% likelihood of a rate cut, while July has a 34% chance of a further cut to a 475 to 500 basis point range. While the distribution becomes a little less certain over time, the aggregate likelihood of a rate cut increases as the year progresses.

Strategies for Investors

Investors may want to consider lengthening the duration to lock in the current high interest rates. By doing so, investors can earn a higher interest rate on investment while benefiting from additional price appreciation if bond yields fall. In many ways, today’s market is a goldilocks environment for fixed-income investors.

Corporate bonds could be a little more hit or miss. With a likely economic slowdown on the horizon, investors may want to consider holding higher-quality bonds and ditching the high-risk, high-yield issuers that paid off over the past few years. The spread between Treasuries and corporates also remains less than compelling given these risks.

Preferred stock – the hybrid between stocks and bonds – also looks risky given lingering banking concerns (many preferred stock issuers are banks). While regional banks have recovered, their equity valuations remain near ten-year lows. The only exception may be high-net-worth investors who stand to benefit from the lower tax rates of qualified income from preferred stock.

High-Quality and Longer Duration Corporate Bond ETFs

These ETFs are selected based on their exposure to investment-grade and longer duration corporate bonds. They are sorted by their YTD total return, which ranges from -1.9% to -0.3%. They have expenses between 0.03% and 0.15% and have AUM between $10M and $40B. They are currently yielding between 3.6% and 5.1%.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| Schwab 5-10 Year Corporate Bond ETF | SCHI | ETF | No | $5B | -0.3% | 4.7% | 0.03% |

| Vanguard Intermediate-Term Corporate Bond Index Fund | VCIT | ETF | No | $39.6B | -0.5% | 4.1% | 0.04% |

| SPDR Portfolio Corporate Bond ETF | SPBO | ETF | No | $886M | -0.5% | 5.1% | 0.03% |

| Goldman Sachs Access Investment Grade Corporate Bond ETF | GIGB | ETF | No | $608M | -0.7% | 3.6% | 0.14% |

| iShares Aaa - A Rated Corporate Bond ETF | QLTA | ETF | No | $922M | -1% | 3.9% | 0.15% |

| ProShares S&P 500 Bond ETF | SPXB | ETF | No | $10.7M | -1% | 4.6% | 0.15% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | LQD | ETF | No | $27.9B | -1.2% | 4.3% | 0.14% |

| Vanguard Long-Term Corporate Bond Index Fund | VCLT | ETF | No | $6.44B | -1.8% | 4.4% | 0.04% |

| iShares 10+ Year Investment Grade Corporate Bond ETF | IGLB | ETF | No | $1.86B | -1.9% | 4.9% | 0.04% |

The Bottom Line

The bond market has been a volatile place over the past couple of years, but stabilizing inflation and a soft landing could make for a quieter 2024. Still, investors may want to consider increasing duration and quality moving into the latter half of the year as economic growth starts to slow and the Federal Reserve prepares to cut rates.