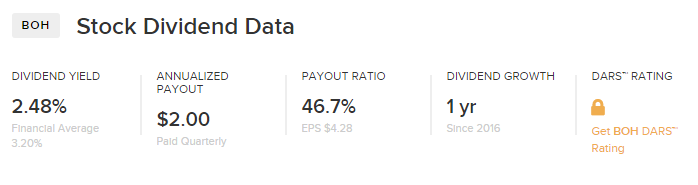

Learning how to evaluate a stock’s dividend characteristics is an important part of income investing. At Dividend.com, we provide investors with five essential dividend-specific formulas for evaluating a stock’s performance. At the top of each ticker page, we provide a snapshot of essential stock dividend data, including dividend yield, annualized payout, payout ratio, dividend growth and our proprietary Dividend Advantage Rating System (DARS) barometer.

In this article, we explain the importance of the dividend growth formula.

A Brief Introduction to Dividend Growth

Dividend growth refers to the annualized rate at which a security’s dividend changes over a specific period. Dividend growth is expressed as the percentage change from one period to the next. To calculate a security’s dividend growth rate, you first need to obtain its dividend history. This can be found by typing in the security’s ticker symbol on Dividend.com.

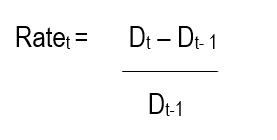

Once you have the security’s dividend history, you can easily calculate the dividend growth rate using the following formula:

In the above formula, Rate in time period t is equal to dividend in time period t minus dividend in time period t – 1 divided by the dividend in time period t – 1.

Using this formula, investors can determine the year-over-year change in a security’s dividend. Income investors usually look for securities with steady dividend growth. Some of the most prominent dividend payers, such as Johnson & Johnson (JNJ ), Procter & Gamble (PG ) and Coca-Cola Co. (KO), have experienced continuous dividend growth for decades.

Companies with a longer history of dividend growth are generally considered to be more investor-friendly. These securities are also considered to be more serious about rewarding shareholders, making them attractive options for income investors. To learn more about what dividend growth is, read this article.

In our DARS rating system, we measure dividend growth using the P/E ratio. If the stock is valued at par with the overall market then our model anticipates the company will keep growing its dividend. You can screen stocks that have a 5-star rating for dividend uptrend (P/E) ratio in our Dividend Screener.

In our Dividend University section, you can find further analysis on the basics of dividend investing.

Find out the 40 essential things every dividend investor should know apart from dividend growth rates.

Why Some Securities Show No Dividend Growth

Having established the importance of dividend growth, it is equally important to consider reasons why securities go through periods of dividend stagnation. Adverse economic conditions often force companies to stop increasing dividends. This is especially the case in the current economic climate, which is marked by weak global growth, political uncertainty and a strong U.S. dollar. All these factors have weighed on corporate profitability.

Target payout ratios and mergers & acquisitions can also force companies to hold their dividend payment. However, these companies can maintain a dividend-friendly approach in many ways. Signs of shareholder-friendly management include having a clear dividend policy, requiring executives to own shares in the business and putting the needs of shareholders above corporate management. Paying limited stock options to executives and insisting on limited related-party transactions are also good signs you are dealing with a dividend-friendly company.

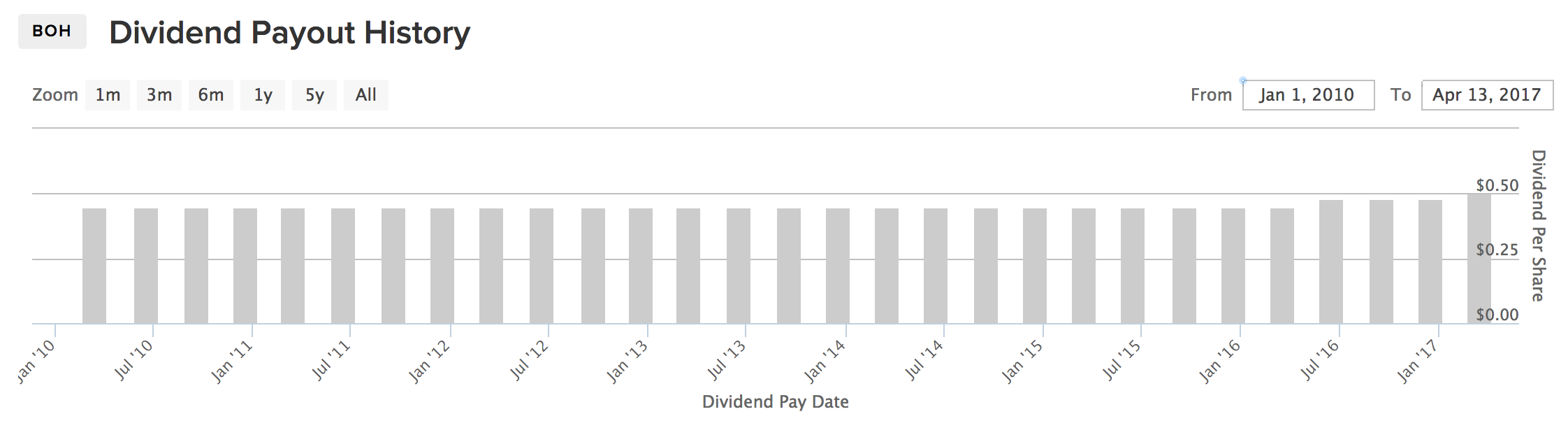

Bank of Hawaii (BOH ) is an example of a security whose annualized payout remained unchanged for several years after the financial crisis, despite boasting a long dividend-paying history. Between 2010 and 2015, BOH had a quarterly dividend payout of 45 cents. It wasn’t until the second quarter of 2016 that the annualized dividend payout rose. After holding steady for the next two quarters, the company’s dividend rose to a new record high of 50 cents in the first quarter of 2017.

Below is a snapshot of BOH’s dividend payout history.

In the current economic climate, investors may get accustomed to seeing “no payout increase last year” in the Stock Dividend Data section. While dividend growth is an important metric for investors when evaluating the health of a company, it is not the only criteria. Investors can go further down the ticker page to see the company’s dividend history before making a portfolio decision.

Securities may sometimes show no payout ratios. To find out why, click here.

The Bottom Line

Investors should investigate a security’s entire dividend data to determine how valuable it is from an income investing perspective. It may be that the company is dividend-friendly despite not increasing its payout; on the other hand, it may not be shareholder-friendly at all and hence not increase its dividend.

Dividend.com has two tools: The 25-Year Dividend Increasing tool and the 10-Year Dividend Increasing tool. These tools find those companies that have consecutively grown their dividends for 25 years and 10 years.

Both these tools also mention the number of years of dividend growth shown by the companies, the latest dividend yields and the latest ex-dividend dates.

You can download both these lists into a spreadsheet as you do your analysis.

More than 100,000 investors have subscribed to Dividend.com Premium. As a premium member, we send out a daily dividend newsletter that briefs you on the latest happenings in the dividend world. More than 100,000 investors have subscribed to it. Go premium for free by starting a free 14-day trial here.