There are dozens of myths out there about dividend investing and how it works. If an investor does not fully grasp how to invest in dividend companies, it’s hard to know what to believe about dividend stocks. Below, we debunk 10 common myths about dividend stocks.

1. Stock prices adjust downward when dividends are paid

To avoid attracting investors who are solely aiming to capture the dividend the day before it goes ex-dividend, many stock prices will drop the day of the ex-dividend date – not the pay date, as many investors assume.

In many cases, a company’s dividend payment is so small that it’s not noticed that the price has declined slightly on the ex-dividend date. These declines will often blend in with regular market fluctuations. However, with larger companies that pay a bigger dividend, it is sometimes more noticeable that the stock price has fallen, causing some investors to believe that the company’s dividend payment is the reason for the decline.

Again, the stock price is adjusted with dividends, but not the actual pay date. The stock price is actually affected by dividends only on the ex-dividend date.

2. Record date determines shareholder eligibility

Many investors are confused by the record date and the ex-dividend date, causing some to believe that the record date is the date that they must own the stock in order to receive the dividend.

This is not the cause; an investor must own a stock prior to the ex-dividend date in order to receive the dividend. Since the ex-dividend date typically comes two business days before the record date, it is important for investors to understand that the ex-dividend date is the date with actual importance.

3. Dividend stocks are always safe

All investments carry some risk – even dividend stocks.

Dividend stocks can be considered conservative investments, and in some cases they expose investors to less risk than regular stocks. Investors like dividend stocks because the dividend can prevent them from losing too much money if the stock price dips; however, that is not always the case. In fact, there are many dividend traps out there, which can expose investors to risk.

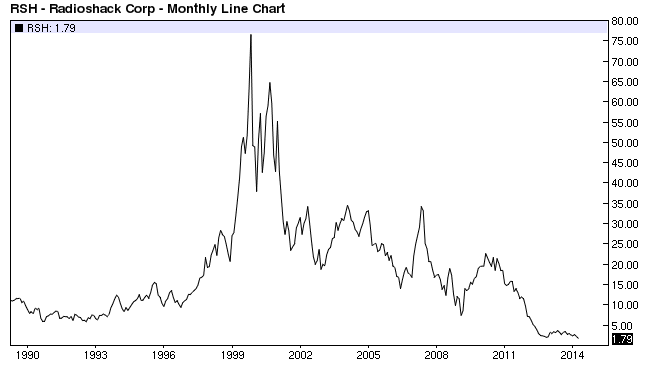

There have been a few dividend disasters throughout the years, Until 2012, RadioShack (RSH) paid a regular dividend, until its share price collapsed and it could no longer sustain its dividend. For additional information on dividend disasters, check out 5 Big-Name Dividend Stocks That Collapsed.

Generally speaking, dividend stocks are considered to be safer stocks than non-dividend plays, but it is always important to properly research investments before purchasing them.

4. Companies that pay dividends limit growth

Many investors believe that companies that pay a dividend are paying dividends because they have stopped growing. The myth that dividend-paying companies are the companies that have stabilized and have stopped growing is simply not true.

Dividends are paid in order to attract and reward shareholders. Companies want to attract more shareholders, as well as keep existing investors so that they are able to grow even more as a company.

Growth is not slowed down by dividends; growth is limited mainly by the company’s market size, competition, and innovation.

5. Big one-time dividends are great

As attractive as a big one-time dividend payment or Special Dividend may appear, buying one of these stocks just prior to the ex-dividend date will only result in a negatively adjusted stock price. For example, if a company is offering a $10 special dividend, the stock price will decline $10 on the ex-dividend date.

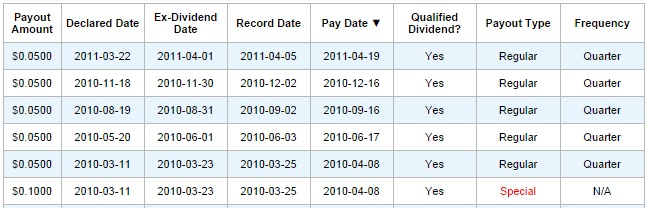

Here at Dividend.com, we prefer large, regular dividend payouts. Regular dividends show a commitment to stockholders over the long term, unlike special dividends, which are simply one-off events.

There have been several big-name companies that have offered shareholders a special dividend including Costco (COST ), Microsoft (MSFT ) and Las Vegas Sands (LVS ). For more information on special dividends, check out 8 Examples of Special Dividends.

6. Dividends are always taxed the same

Some investors are under the impression that all dividend stocks are taxed equally, but this is not always the case. Taxes on dividends can vary depending on the type of account the investor has and the investor’s tax bracket.

Investors can determine a dividend tax rate based on whether the stock is “qualified” or not. Investments including Real Estate Investment Trusts and Master Limited Partnerships are not qualified dividend payers.

While most qualified dividend are taxed at 15%, non-qualified dividends can be a hefty tax burden for investors. The chart below summarizes the tax rates by ordinary income tax rate.

| Ordinary Tax Rate | Qualified Dividends | Non-Qualified Dividends |

|---|---|---|

| 10% | 0% | 10% |

| 15% | 0% | 15% |

| 25% | 15% | 25% |

| 28% | 15% | 28% |

| 33% | 15% | 33% |

| 35% | 18.8% | 35% |

| 39.6% | 20% | 43.4% |

7. The highest yielding stocks are the best

Although high yield dividend stocks appear to be very profitable investments, the end result for many investors is just the opposite. Ultra high yield dividend stocks are considered the most risky investments in the dividend world.

As mentioned in Myth #3, dividend stocks are pretty conservative for the most part; however, super high yield stocks (for example, 10% yields or higher) carry substantial risk.

8. Dividends are guaranteed

Although most legitimate companies are committed to paying regular and dependable dividends to their shareholders, there is no guarantee that dividends will be paid to shareholders just because the company reported that they would pay a dividend.

Companies have no obligation to pay dividends to shareholders. In fact, companies have the right to cancel, alter or delay dividends at any time without reasoning.

For example, one year before suspending its dividend completely, Books-a-Million offered its shareholders a 10 cent special dividend – showing strength. In 2011, the company paid its last dividend.

9. Investors should buy the cheapest dividend names

In many cases, buying bargain bin stocks is not a smart move. Stocks are usually cheap for a reason. Although there are some cases where cheap stocks surge and result in their investors seeing substantial gains, in most cases, a cheap stock will remain a cheap stock.

An example would be having the option of buying AT&T (T ), which shows healthy increases, and a healthy dividend, or a stock like General Motors (GM ), which cut its dividends until it fell into bankruptcy in 2009. GM was a “cheap” stock at one point, while AT&T was not. It’s easy to see which one turned out better.

If an investor is looking to buy dividend stocks with the intention of having a low-risk investment, cheap stocks are not the way to go. Healthy dividend stocks are a much safer choice.

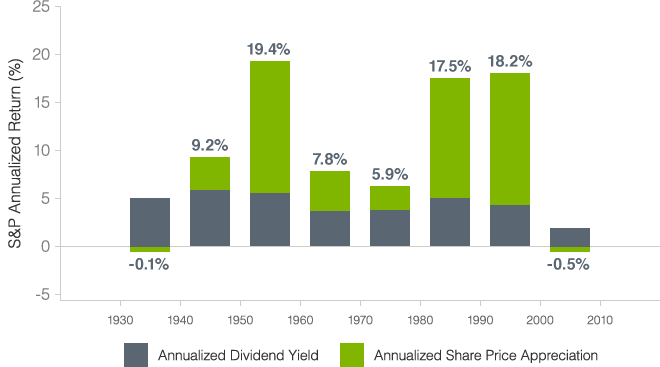

10. Dividends are boring

Many investors are under the impression that dividend stocks are boring investments. Although these stocks are not intended to be constantly traded, dividend stocks are often the most profitable investments, and what’s boring about making money?

Dividend stocks are not all low-growth, flat stocks that are simply used for investors to collect a payment. These stocks are still investments that could rise and drop at any time, and they require investors to pay close attention to the markets.

The Bottom Line

Dividend investing can be a great way to grow your portfolio in a more conservative way. Investors should realize that although solid dividend paying companies are considered the “safe stocks”, there are always risks that come with any type of investment.