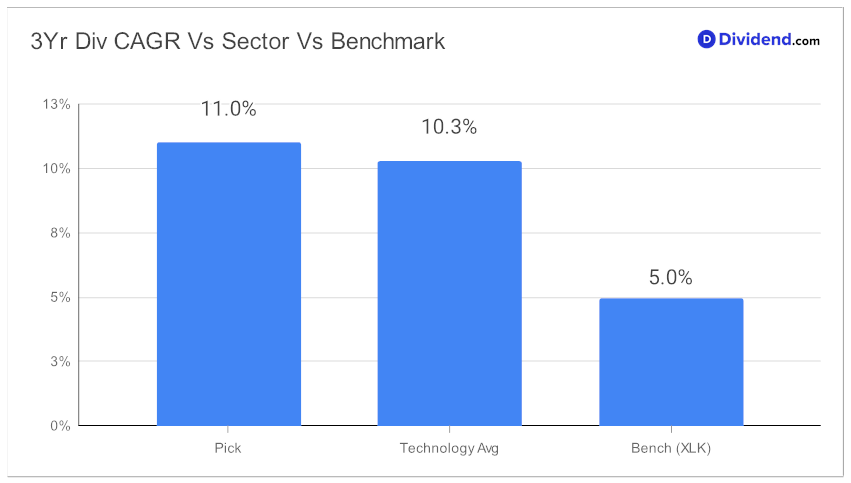

For dividend investors who appreciate a blend of robust yield, safety, and growth potential, this Tech Services giant is a noteworthy choice. The stock has an incredible 48-year track record of consistent dividend increases, putting it in the top 10% of all dividend stocks. Moreover, it’s projected to continue this upward trajectory in the future. When it comes to dividend growth rate, its three-year Compound Annual Growth Rate (CAGR) for dividends per share stands at 11%, ranking in the top 40% of dividend stocks.

Year-to-date, the stock has returned 2%, which may seem underwhelming compared to the S&P 500’s 17% and the 13% returned by the Tech Services industry. However, it’s crucial to look at this holding for its long-term value, especially in the tech-oriented dividend space. For instance, the stock’s economic moat is built on its scale, network effects, technological capabilities, regulatory expertise and long-standing client relationships. This is likely to help the stock get through a variety of different economic cycles with minimal impact.

Investors can look forward to the next dividend payout, which remains a qualified $1.250 per share. This dividend went ex-dividend on September 7, with an expected pay date of October 1. While the payout hasn’t changed, it’s important to view it as part of a long-term strategy optimized for an equal blend of yield, dividend safety, returns potential, and risk within the Technology sector.

We also take into account the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on July 26, 2023.

For a deeper dive into the stock’s performance, prospects, and how it fits into a balanced dividend investment strategy, continue on to the full analysis that follows.