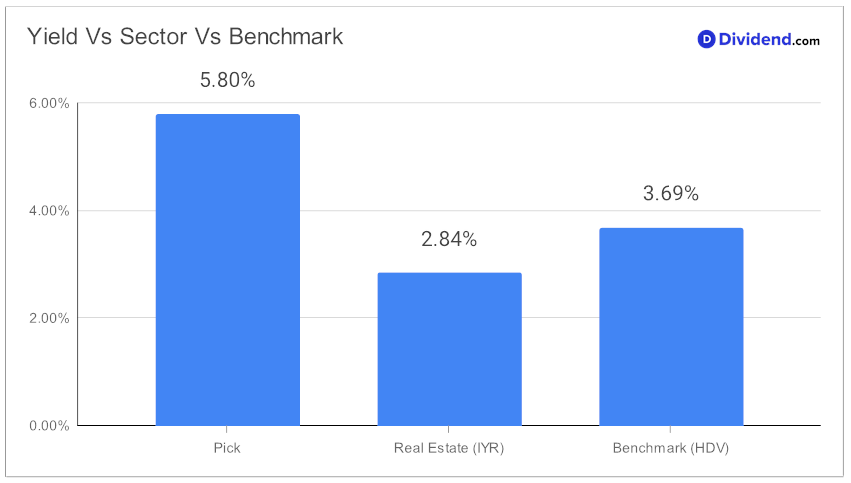

In the realm of monthly dividend investing, one standout entity is capturing the attention of those seeking both stability and generous returns. Boasting a forward dividend yield of 5.80%, this entity not only surpasses the industry average of 5.6% but also ranks in the top echelon of high-yield dividend stocks. However, investors are cautioned to navigate the high-yield waters carefully, mindful of potential dividend traps that lurk beneath enticing yields.

This well-covered large-cap eREIT stands out not just for its yield but also for its remarkable consistency in rewarding investors. With a 31-year track record of dividend increases—a feat placing it in the upper tier of dividend-paying stocks—it signifies not only past reliability but also the anticipation of future growth. The upcoming payout remains steady at $0.257 per share, with a payout date slated for March 15, following its ex-dividend date on February 29.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 21, 2024. The REIT closed 2023 with remarkable investment growth and strategic global expansion, surpassing $9.5 billion in transactions. Its diversification strategy yielded a notable average cash yield, highlighted by significant deals and ventures into new industries, including data centers, and strategic mergers, emphasizing its strong market position.

Financially, the company showcased robust performance with an optimistic growth outlook, underpinned by strategic capital management and risk mitigation efforts. Its disciplined investment focus and financial planning, including managing interest rate risks and optimizing debt, indicate a well-prepared approach for future market conditions.

The selection process for inclusion in the Best Monthly Dividend Stocks model portfolio isn’t taken lightly. Focusing primarily on Yield Attractiveness and Dividend Safety, with a balanced consideration for Returns Potential and Risk, this stock emerges as a prime candidate for monthly dividend investors. The detailed analysis that follows dives deeper into its performance, offering insights into why it holds a coveted spot in the model portfolio.