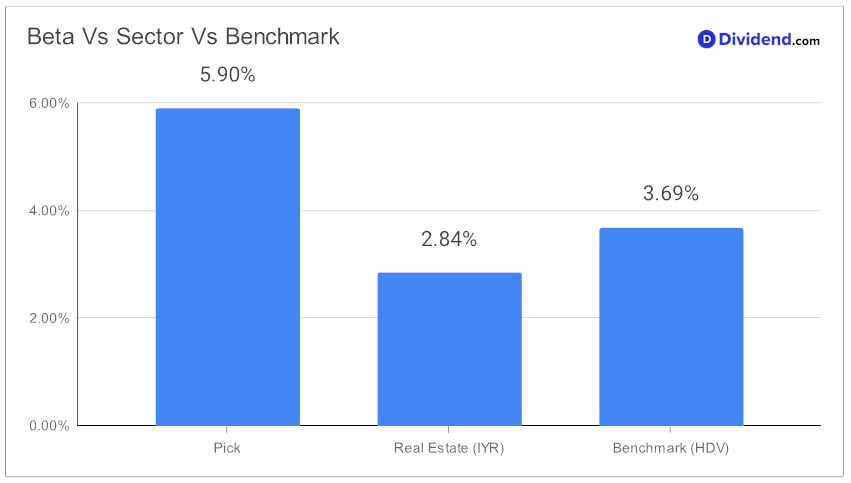

In the landscape of monthly dividend investments, a notable mid-cap equity Real Estate Investment Trust (eREIT) stands out for its impressive forward dividend yield of 5.90%, positioning it in the top echelon of high-yield stocks. This yield not only surpasses the eREIT industry average of 5.7% but also signals a beacon for yield-seeking investors, urging caution against the allure of dividend traps. Over the past three years, the compound annual growth rate (CAGR) of its dividends per share has skyrocketed to 188%, a figure that proudly ranks within the top 20% of all dividend-issuing stocks, marking an extraordinary testament to its financial resilience and commitment to shareholder returns.

Investors on the hunt for monthly dividends have an upcoming opportunity to capitalize on this eREIT’s next payout, with a qualified dividend of $0.080 per share going ex-dividend tomorrow. This event underscores the eREIT’s consistency in rewarding its investors and serves as a critical juncture for those seeking to optimize their portfolios for yield attractiveness, dividend safety, and balanced risk-return potentials.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 24 Feb, 2024. In 2023, the REIT showcased operational prowess and strategic expansion despite slight variances in earnings before interest, taxes, depreciation, and amortization (EBITDA). It fortified its portfolio through the acquisition of six hotels, aiming at markets with potent economic growth. Financially astute, the company raised more than $200 million via an at-the-market program and rewarded shareholders with nearly $240 million in dividends. A key industry trend was the increase in revenue per available Room (RevPAR), driven by average daily rate improvements. Despite a minor quarterly EBITDA dip, annual figures rose, displaying adept operational management amidst market shifts.

Finally, with a solid balance sheet and cautious optimism for 2024, the firm anticipates growth in net income and RevPAR, underpinned by strategic resilience and a commitment to shareholder value, positioning it for future success.

The following in-depth analysis will peel back the layers of its dividend performance, offering a granular view of what makes this eREIT a cornerstone for discerning monthly dividend investors.