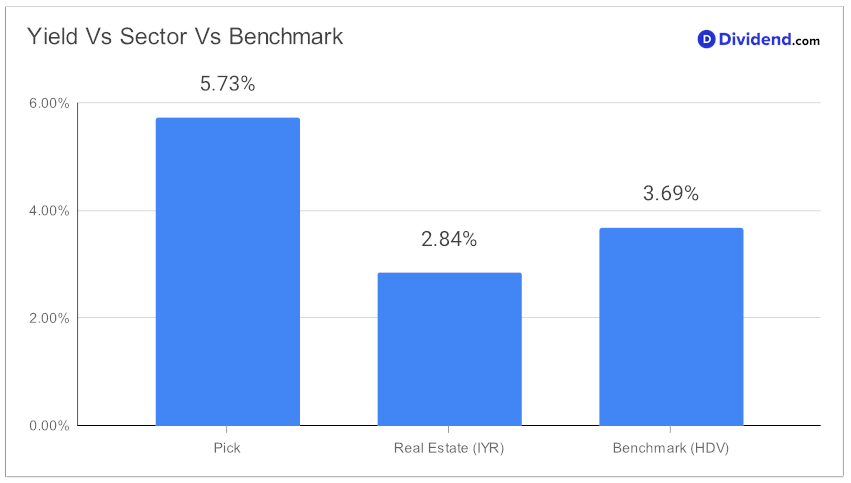

In the realm of high dividend investments, identifying assets that combine yield attractiveness with dividend safety is paramount. A well-regarded large-cap Real Estate Investment Trust (eREIT) has recently been reaffirmed as a key holding within the model portfolio, distinguished for its superior dividend offerings. Boasting a forward dividend yield of 5.73%, this stock not only surpasses the eREIT industry average of 5.7% but also ranks in the top 20% of dividend stocks, marking it as a high yield investment worth consideration. Investors should, however, remain vigilant of potential dividend traps.

The upcoming payout remains steady at an unchanged $0.415 per share, going ex-dividend today, March 20th. This consistency underscores the investment’s reliability and appeal to those seeking stable income streams.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 23 Feb, 2024. The REIT, specializing in gaming and entertainment properties, reported significant growth in 2023, with an 11.8% increase in Adjusted Funds From Operations (AFFO) per share. The company’s strategic investments in both gaming and non-gaming sectors, particularly in Las Vegas, alongside creative property-related credit investments, were pivotal in achieving this growth. Despite facing market challenges, the management highlighted resilience and a disciplined growth strategy, emphasizing long-term partnerships and selective investments.

Looking ahead to 2024, the company anticipates further growth, projecting an AFFO between $2.32 billion and $2.355 billion. This outlook reflects a cautious but optimistic stance amidst uncertain macroeconomic conditions.

The selection process for the portfolio emphasizes not just yield attractiveness and dividend safety but also considers the potential for returns and associated risks, albeit to a lesser extent. For those intrigued by the prospect of enhancing their portfolio with high dividend stocks, an in-depth analysis follows, offering insights into the strategic approach behind this investment’s recommendation.