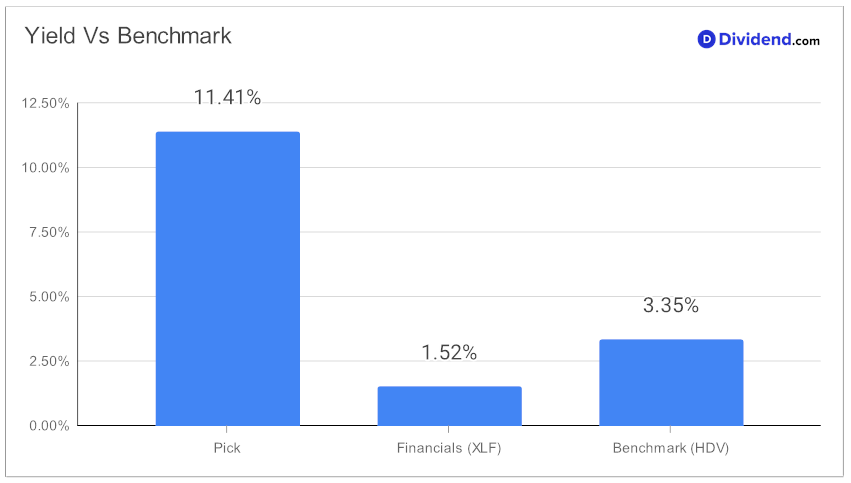

For investors seeking robust returns through dividends, it is essential to highlight a small-cap Business Development Company (BDC) that has recently reaffirmed its position in a respected High Dividend Stocks model portfolio. With a forward dividend yield of 11.41%, this entity stands out not only for its yield that ranks in the top 20% of high dividend stocks but also for its consistency in dividend growth. Over the past three years, the company has managed a dividend compound annual growth rate (CAGR) of 10%, positioning it well within the top 40% of all dividend-issuing stocks.

The next payout from this BDC is anticipated to be around $0.550 per share, scheduled on or near May 3. This move aligns with the portfolio’s strategy to optimize for both yield attractiveness and dividend safety, while carefully considering the potential returns and associated risks.

While arriving at the recommendation we also factored in the 1Q24 earnings call discussion by the company management held on 02 Feb, 2024. The specialty lending corporation experienced a quarter of strong investment activity but faced challenges with increased non-accruals and a decline in net investment income (NII) and net asset value (NAV) per share. The firm’s portfolio, heavily weighted towards senior secured and first lien loans, reflected a strategic adjustment towards lower-risk investments.

Management discussed the impact of high interest rates on the industry and maintained a cautious outlook due to ongoing market volatility. They reaffirmed their commitment to shareholder returns, maintaining a stable quarterly dividend, and emphasized their robust liquidity position to navigate future market conditions effectively. This strategy aims to sustain and potentially enhance shareholder value amidst economic complexities.

The forthcoming in-depth analysis will delve deeper into how this BDC sustains such high yields and navigates the competitive landscape of the BDC industry, providing a crucial look for high dividend investors into whether this stock could be a strategic addition to their portfolios.