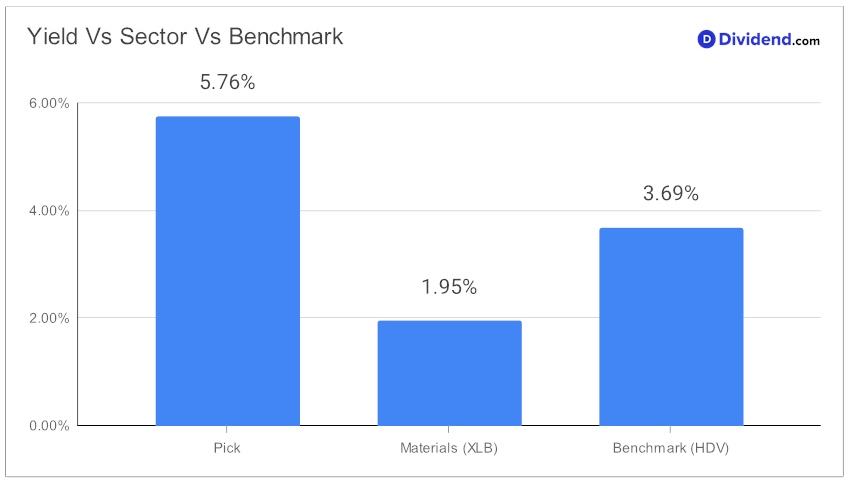

In the dynamic landscape of high-dividend investing, a standout has emerged, capturing the attention of savvy investors seeking robust returns alongside significant dividend reliability. This well-established large-cap entity in the Materials sector distinguishes itself with a forward dividend yield of 5.76%, positioning it in the elite top 20% tier of high-yield stocks. Such an attractive yield, notably above the industry average of 2.1%, underscores its appeal, although it also prompts a cautious evaluation for potential dividend traps.

With a remarkable 60+ year history of consistent dividend increases—a testament to its financial resilience and commitment to shareholder returns—this stock exemplifies a rare blend of yield attractiveness and dividend safety. Its anticipated next payout of an estimated $1.510 per share around May 9 further highlights its position as a compelling choice for investors prioritizing income generation.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 25 Jan, 2024. The global conglomerate known for its diverse product portfolio, including consumer goods, healthcare products, and industrial materials, faced a challenging year with a 3% decline in organic sales, mainly due to consumer retail and electronics sectors. Despite these challenges, the company exceeded earnings and cash flow guidance, achieving significant operational improvements. It successfully reduced net debt and returned substantial amounts to shareholders through dividends.

Looking ahead, the firm projects organic growth to be flat to 2% and anticipates adjusted Earnings Per Share (EPS) between $9.35 and $9.75. This outlook reflects the company’s strategic focus on innovation and efficiency amid a complex macroeconomic environment, aiming for sustainable growth and continued shareholder value.

This analysis leverages a meticulous selection process, prioritizing not just yield attractiveness and dividend safety, but also weighing the potential for future returns against associated risks.

As we delve deeper into an in-depth examination of this promising addition to the Best High Dividend Stocks model portfolio, investors will gain insights into strategic positioning for optimized portfolio performance, drawing on a legacy of dividend excellence and a forward-looking perspective on investment health and growth potential.