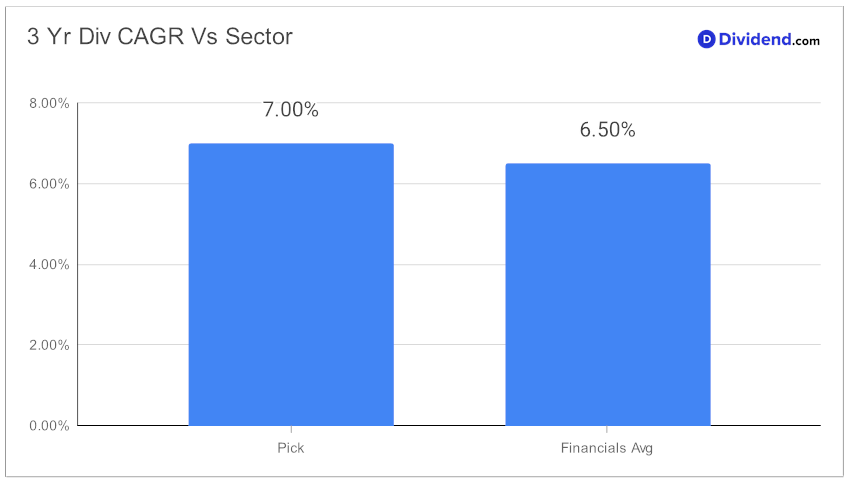

In the realm of dividend investing, where stability meets growth, there exists a noteworthy large-cap asset management stock that exemplifies the balance between dependable income and promising returns. This entity, with its 15-year track record of consistent dividend increases—a feat placing it in the upper echelon of dividend stocks—continues to capture the attention of balanced dividend investors. Not only does its history reflect a commitment to shareholder returns, but the anticipation of future dividend increases further cements its standing. The stock has also managed to grow its dividend by a compound annual growth rate (CAGR) of 7% over the last three years, slightly better than the sector average.

The forthcoming payout, estimated at $5.100 per share on or around May 24, is a testament to the stock’s robust financial health and its management’s confidence in continued prosperity. This payout is part of a broader investment strategy that prioritizes a harmonious blend of yield, dividend safety, potential returns, and risk, specifically within the financial sector. Such a meticulous approach ensures that investments are not just safe but are poised for growth amidst market fluctuations.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 16 Jan, 2024. The asset manager announced substantial growth and strategic developments, notably through the significant acquisition of an infrastructure investment firm, marking a pivotal expansion into the infrastructure sector with over $150 billion in client assets. Despite challenging market dynamics, the company showcased resilience with more than $250 billion in net inflows, a 7% increase in quarterly revenue, and an 8% rise in earnings per share (EPS), attributed to diversified investment strategies and robust performance in the ETF space.

The firm’s strategic roadmap for the future emphasized enhancing global presence and expanding offerings in ETFs, international markets, and private investments, underpinned by a growth-first philosophy in acquisitions and a focus on operational excellence and client service. The leadership conveyed an optimistic outlook, poised for continued growth and innovation in responding to market demands and opportunities in asset management.

For those intrigued by the prospects of enhancing their portfolio with a blend of stability and growth, a detailed analysis follows. It delves into the intricacies of this asset management giant’s financials, strategic dividends, and its place within the broader market landscape, providing a comprehensive overview for the discerning investor.