In a landscape where consistency and stability in investments are as sought after as returns, a prominent large-cap Aerospace & Defense stock stands out not only for its size but also for its remarkable dividend track record. With a history of dividend increases spanning 21 years—placing it in the top 10% of dividend-yielding stocks—this entity shows no signs of slowing down. The anticipated dividend payout of an estimated $3.150 per share on or around April 26 further solidifies its appeal to balanced dividend investors.

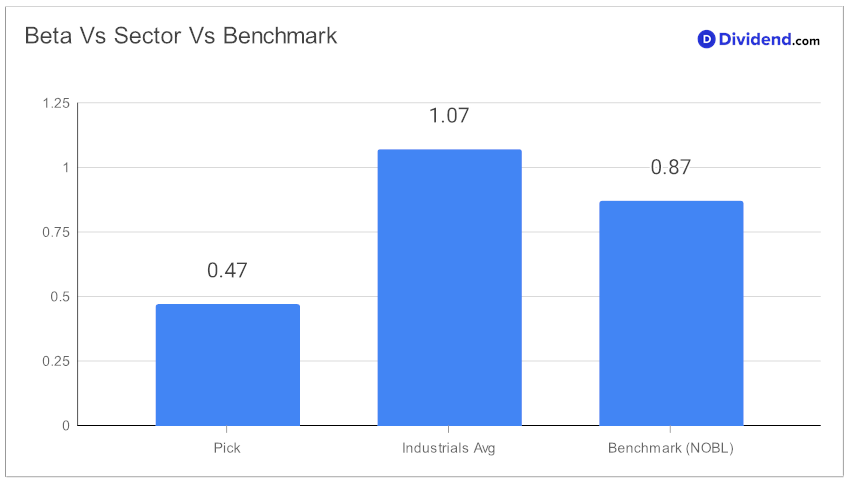

The stock’s low beta of 0.47 highlights its unique position as a diversifier within equity portfolios, suggesting that its monthly returns are less influenced by broader market swings. This characteristic is especially valuable for investors aiming to mitigate risk while seeking steady income streams.

Investors will appreciate the nuanced approach to stock analysis that blends Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. This comprehensive evaluation ensures a balanced perspective that aligns well with the goals of both yield-focused and risk-averse investors.

While arriving at the recommendation we also factored in the 1Q24 earnings call discussion by the company management held on 24 Apr, 2024. The aerospace and defense contractor reported a robust first quarter in 2024, with a 14% increase in revenues, driven by strong alignment with U.S. defense priorities and significant demand for its aerospace technologies. The company’s operations were particularly influenced by the U.S. Department of Defense’s budget, enhancing support for various aircraft and missile defense programs.

Despite some setbacks, such as program cancellations, the company maintained a strong financial outlook, projecting a free cash flow of $6 billion to $6.3 billion for the year. The quarter also saw substantial shareholder returns, with $1 billion in share repurchases and $780 million in dividends, emphasizing a commitment to shareholder value.

For a deeper dive into how this stock fits into a long-term investment strategy, the forthcoming analysis will explore these aspects in greater detail.