In today’s rapidly evolving market, finding stable returns combined with dividend reliability can be a challenge. Yet, there are still gems in the market that not only offer attractive yields but also exhibit a robust track record of dividend growth, critical for balanced dividend investors. One such opportunity lies within the integrated utilities sector, which offers a compelling 4.43% forward dividend yield—just slightly above the industry average of 4.4%. What makes this stock particularly appealing is its 14-year history of consistent dividend increases, a testament to its financial resilience and commitment to shareholder returns.

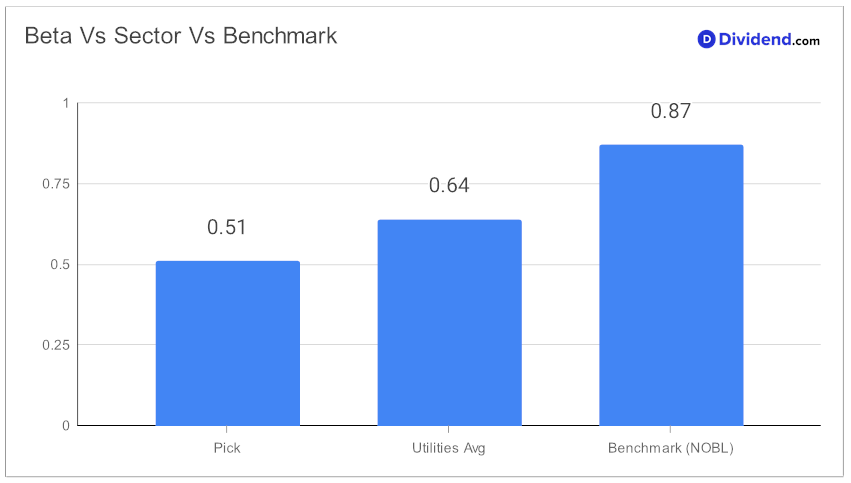

Moreover, with a beta of 0.51, this stock promises less correlation with broader equity market movements, providing a diversifying effect in an investment portfolio.

The next payout is expected soon, with an estimated dividend of $0.880 per share on or around April 25, highlighting its ongoing reward to investors.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 28 Feb, 2024. The company, a major player in the electric utility space, reported consistent performance in 2023, successfully meeting earnings expectations despite challenges such as adverse weather and rising interest costs. Management highlighted operational efficiencies and strategic asset management, including the successful sale of unregulated renewables. Regulatory developments and a more than $9 billion investment in regulated renewable resources underscored a proactive response to industry trends toward sustainable energy.

Looking ahead, the company projects a 6% to 7% growth in earnings per share, with earnings guidance for 2024 set at $5.53 to $5.73 per share, affirming its commitment to delivering value to shareholders.

This analysis is just the beginning. Dive deeper into how the unique blend of yield attractiveness, dividend safety, returns potential, and risk are meticulously balanced in our comprehensive stock analysis, ensuring you make the most informed investment decisions in your quest for dividend stability and growth.