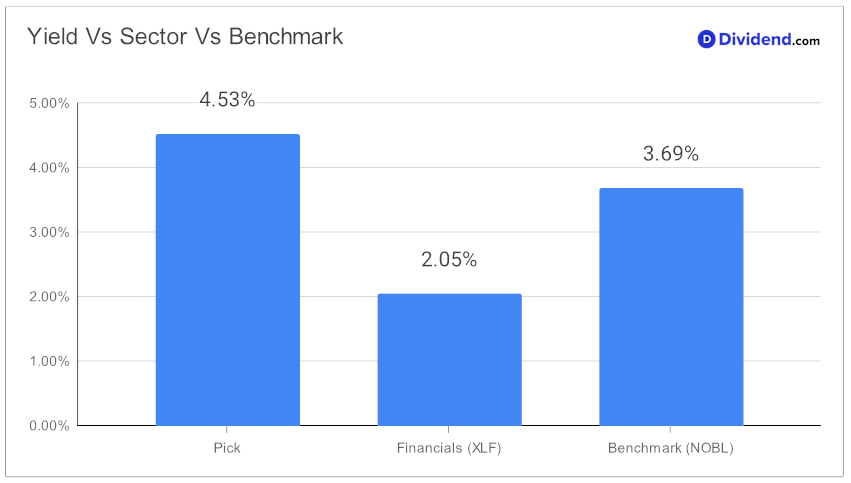

In the ever-evolving landscape of dividend investing, a standout large-cap banking stock has recently made its mark by being added to a prestigious model portfolio renowned for showcasing the best dividend stocks. With a forward dividend yield of 4.53%, this inclusion not only outperforms the banking industry average of 3.8% but also ranks in the impressive top 40% of dividend-yielding stocks. This is particularly noteworthy for balanced dividend investors seeking both stability and attractive returns.

What sets this stock apart is its commendable 13-year track record of dividend increases—a testament to its robust financial health and commitment to shareholder returns, positioning it in the elite top 10% of dividend stocks. With expectations set for future increases, investors have much to look forward to. The next anticipated payout is an estimated $0.490 per share on or around June 13, reflecting the stock’s consistent and reliable dividend distribution strategy.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 18 Jan, 2024. The regional banking specialist reported significant financial growth, marked by an adjusted earnings per share (EPS) that highlighted revenue boosts from its fee-based businesses, counteracting net interest income (NII) pressures and a slight dip in loan demand. The company demonstrated strategic acumen in managing deposit pricing and credit risks, signaling a cautious yet optimistic approach to financial management. A notable industry trend was the normalization of credit conditions, alongside strategic efforts to enhance NII and liquidity positions.

Looking ahead, the company anticipates stable to slight improvements in NII for 2024, buoyed by strategic mergers and investments aimed at growth and expansion. This underscored a strong capital position, promising for future capital accretion and shareholder returns, reflecting the company’s resilience and strategic foresight amid challenges faced by the financials sector.

This stock selection is the result of a meticulous recommendation process, balancing yield attractiveness, dividend safety, returns potential, and returns risk. The inclusion in the model portfolio is not just a nod to its present achievements but a forward-looking indication of its sustained value to investors. For those intrigued by the prospects of this distinguished banking stock, an in-depth analysis follows, offering a deeper dive into its financial health, strategic positioning, and what it means for your investment portfolio.