For retirement investors seeking stable and growing returns, one mega-cap consumer products stock stands out as a beacon of reliability in the often turbulent financial markets. This stock not only boasts an impressive 60+ year streak of dividend increases—a track record that places it in the elite top 10% of dividend-paying stocks—but also holds potential for a sustained growth in payouts.

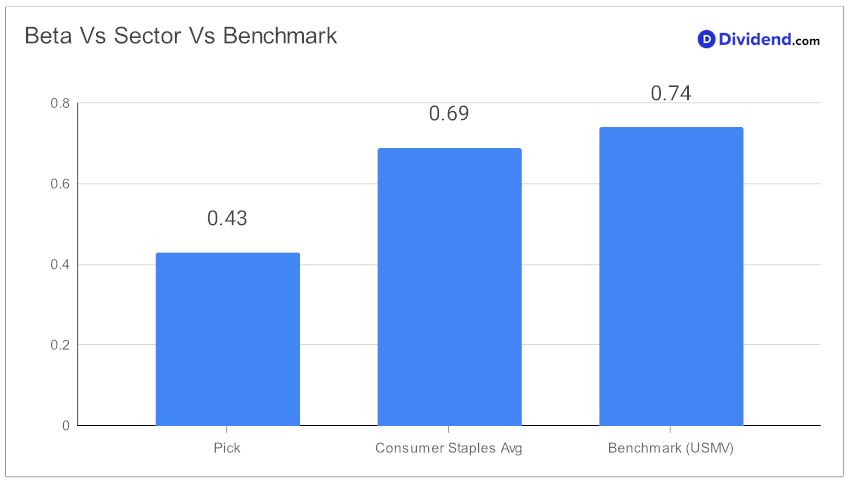

The resilience of this stock is further underscored by its low beta of 0.43, indicating that its monthly returns are generally less influenced by broader equity market fluctuations. This characteristic can offer a valuable diversification benefit to your retirement portfolio. Comparatively, it has outperformed with a 12% return year-to-date, surpassing both the S&P 500’s 9% and the consumer products industry’s 5%.

Investors can look forward to the next dividend payout estimated at $1.007 per share, scheduled for distribution around July 11. This steady and predictable income stream is optimized to balance dividend safety and risk of returns, making it an attractive choice for those focused on sustaining their lifestyle through retirement.

While arriving at the recommendation we also factored in the 3Q24 earnings call discussion by the company management held on 22 Apr, 2024. The household and personal product company reported strong performance in the first three quarters of fiscal 2024, with a 3% increase in organic sales and consistent volume. Despite facing challenges in markets like Greater China and currency volatility, particularly with the Argentine peso, the company managed to deliver solid earnings.

Management raised the fiscal year’s core earnings per share outlook from 8-9% to 10-11% and maintained its organic sales growth forecast at 4-5%. The company has continued its commitment to shareholder returns, highlighting a significant cash return through dividends, which saw a 7% increase, and share repurchases, totaling $3.3 billion this quarter.

For a deeper dive into how this stock aligns with a strategy focused on dividend safety and potential returns, stay tuned for our comprehensive analysis. This will provide further insights into why it remains a top pick in our Best Dividend Protection Stocks model portfolio.