In the realm of dividend growth investing, there’s an undeniable titan continuing to maintain its rank in our Best Dividend Growth Stocks model portfolio. This colossal entity, a well-covered large-cap asset management company, carries a commendable 14-year dividend increase track record, placing it within the top 10% of dividend stocks.

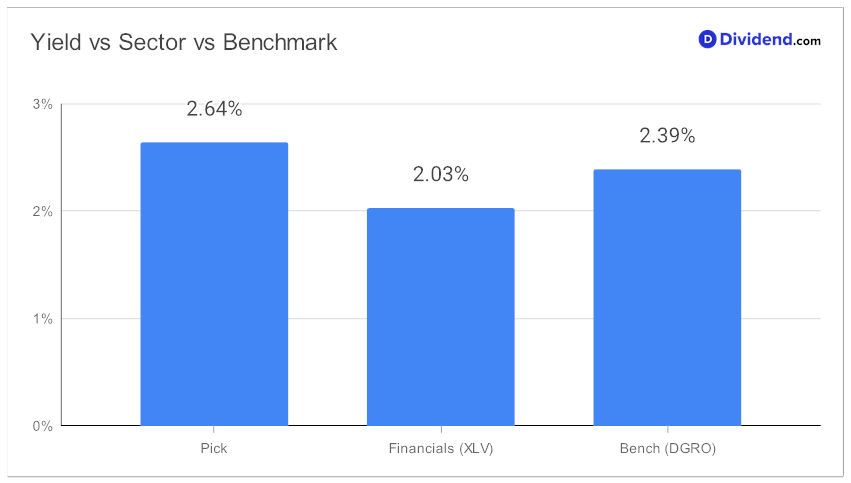

Its impressive 3-year dividend per share compound annual growth rate (CAGR) of 11% also situates it in the top 40% of all dividend stocks. Additionally, the stock yields 2.64%, higher than the financial sector average and this portfolio’s benchmark.

Despite facing a challenging market environment with year-to-date returns of 6% against the S&P 500’s 20% and Asset Management Industry’s 13%, this behemoth continues to defy odds.

On the payout front, look forward to an unchanged qualified $5.000 per share, declared last week and going ex-div on September 7.

While coming up with our final recommendation, we’ve factored in the stock’s 2Q 2023 earnings results announced on July 15, 2023.

We optimize for Returns Potential via dividend growth, Dividend Safety, Returns Risk, and Yield Attractiveness to bring you this recommendation. Stay tuned for an in-depth stock analysis.