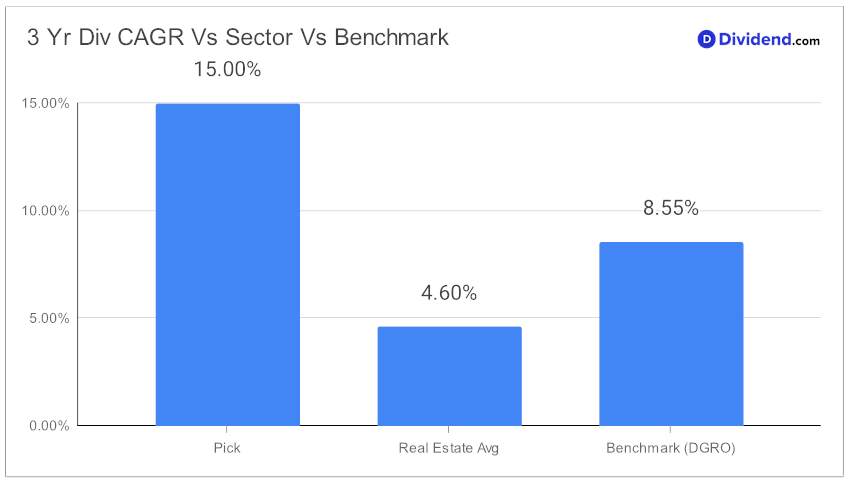

In the dynamic landscape of dividend growth investing, one standout has cemented its position within a prestigious model portfolio. Recognized for its impressive 11-year track record of consistent dividend increases—a feat placing it in the upper echelon of dividend stocks—this large-cap eREIT not only promises future growth but delivers it. With a 15% compound annual growth rate in dividends over the past three years, it ranks among the top 20% of dividend payers, showcasing its robust financial health and commitment to shareholder returns.

The excitement builds as the next payout announcement promises a generous 10.3% increase, translating to a significant $0.960 per share, scheduled to go ex-dividend in the near future. This increase is not just a number; it’s a testament to the eREIT’s strong performance and a signal to investors about its potential for sustained growth and stability.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 17, 2024. The industrial REIT reported a successful year, achieving an 11% earnings growth. Despite challenging market conditions, the firm effectively deployed over $7 billion in new investments and raised nearly $2 billion of strategic capital. With a strategic focus on portfolio expansion and energy investments, the company achieved significant rent growth, particularly in strong markets like Southern California.

Looking ahead, it forecasts market rent growth averaging between 4% and 6% over the next three years, driven by a declining trend in development starts and an improvement in customer sentiment. The company remains optimistic about its future, anticipating continued operational excellence and strategic growth.

Investors looking for a blend of safety, growth, and yield will find this analysis compelling. The selection process, rigorously optimizing for return potential, dividend safety, and to a lesser extent, risk and yield attractiveness, underscores the methodical approach behind this recommendation. Dive deeper into our in-depth analysis to uncover this eREIT.