Welcome to our latest installment of dividend growth investing insights. We are excited to introduce an outstanding player in the Asset Management arena that has made its way into our Best Dividend Growth Stocks model portfolio.

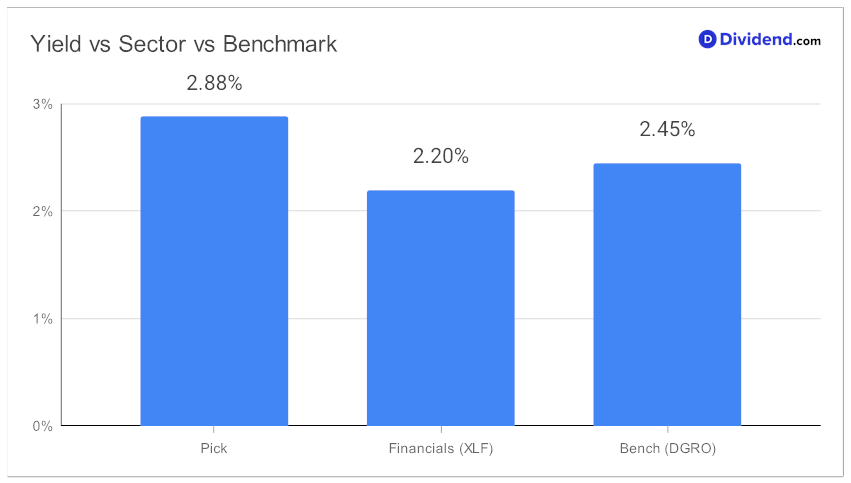

This highly coveted stock boasts a stellar 14-year dividend increase track record, ranking it in the upper echelon – the top 10% of dividend stocks. Its impressive 3-year dividend Compound Annual Growth Rate (CAGR) of 11% places it firmly within the top 40% of all dividend stocks, hinting at the possibility of robust future growth. At the same time, with a 2.88% forward yield, our pick manages to beat its benchmark and sector.

Mark your calendars, as a generous estimated payout of $5.00 per share is anticipated on or around July 13.

Our rigorous recommendation process ensures we prioritize Return Potential through dividend growth, Dividend Safety, with considerations for Returns Risk and Yield Attractiveness. Stay tuned for an in-depth analysis of this mystery stock, leveraging these metrics for your investing advantage.