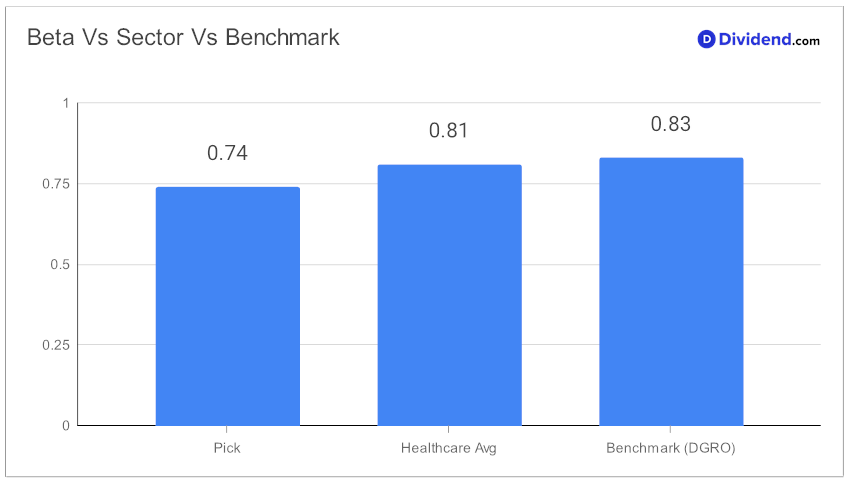

In the realm of dividend growth investing, a standout has been identified, a well-covered mega-cap Medical Device focused stock, setting a high bar for consistency and reliability. This company not only boasts an impressive 50+ year track record of dividend increases, placing it within the top echelon of dividend stocks, but it also shows promising signs for future hikes. Its resilience is further underscored by a 0.74 beta, highlighting its unique stance of minimal correlation with broader equity market fluctuations, offering a diversification boon to equity portfolios.

Year-to-date, the stock has demonstrated solid performance, delivering a 10% return, which aligns with its industry average and notably outpaces the broader market index. Additionally, since making it to this portfolio back in March 2023, the stock has managed to stay ahead of the benchmark for a significant amount of time.

In terms of immediate shareholder rewards, investors can look forward to an upcoming payout of $0.550 per share, maintaining its commitment without change, and going ex-dividend on April 12.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 24, 2024. The healthcare company, with a diverse portfolio including medical devices, diagnostics, nutritional products, and pharmaceuticals, reported strong sales and earnings growth in 2023, surpassing forecasts. Despite initial challenges from the COVID-19 pandemic, strategic investments in research and development during peak demand for COVID testing have now begun yielding new growth opportunities.

For 2024, the company projects 8% to 10% sales growth with adjusted earnings per share (EPS) expected between $4.50 and $4.70. This outlook reflects optimism for continued robust performance despite ongoing challenges from foreign exchange rates.

This selection, grounded in a rigorous recommendation process that prioritizes returns potential through dividend growth, safety, and to a lesser extent, risk and yield attractiveness, paves the way for the in-depth analysis that follows.