The natural resource industry can be a challenging space for passive investments. For instance, the United States Oil ETF (USO) tracks front-month oil futures contracts, which can diverge quite significantly from spot market prices. So, some investors find themselves deep in the red even when crude oil prices are higher.

Moreover, while they provide valuable diversification from equities, many investors struggle to build and maintain a diverse portfolio of commodities. Each natural resource has different economic factors influencing its price and it’s time-consuming to keep up with the latest geopolitical events and market trends.

Fortunately, a new wave of active ETFs makes it easier to build a diversified group of commodities into your portfolio.

Why Actively Managed Funds?

Most investors are familiar with the benefits of investing in commodities. They offer a near-zero long-term correlation with stocks and bonds and can even outperform returns during geopolitical instability. Both of these attributes are critical in today’s market where equity valuations are stretched and geopolitical conflicts are on the rise.

But why choose active funds?

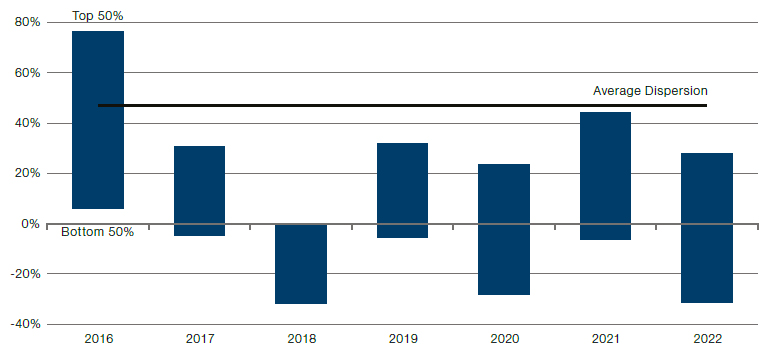

The natural resources industry has a wide dispersion of returns, unlike conventional equity markets. The average dispersion (measured by the average performance of the top 50% versus the bottom 50%) is close to 50%. This is one of the widest across asset classes and creates meaningful opportunities for active investors, according to the Man Institute 1.

Source: Man Institute

While passive funds average out these dispersions via diversification, active managers can identify pockets of opportunity to generate significant alpha. But, despite these potential advantages, there haven’t been many actively managed ETFs available until recently.

NRES: Xtrackers RREEF Global Natural Resources ETF

The Xtrackers RREEF Global Natural Resources ETF (NRES) seeks total return from both capital appreciation and current income by investing in a broad basket of commodities.

Currently, the fund holds a portfolio of 60 equities with exposure to Materials (60.76%), Energy (33.45%), and Consumer Staples (3.51%). The largest holdings include names like Total SA (4.87%), Nutrien Ltd. (4.57%), and Cenovus Energy Inc. (4.52%), which managers choose based on extensive research rather than market capitalization.

The fund managers start with a top-down research process to determine allocation weights across market segments and regions. Then, they analyze individual securities based on their relative valuation and fundamental performance. In addition, the managers may purchase derivatives, and actively trade or lend securities to boost performance.

The fund charges a 0.45% management fee and pays out quarterly distributions to shareholders. And currently, the 30-day SEC yield stands at 3.47%.

MGNR: American Beacon GLG Natural Resources ETF

The American Beacon GLG Natural Resources ETF (MGNR) is another resource-focused active ETF that launched earlier this year. The fund invests in 30 to 60 companies in the natural resources sector with a focus on combining a commodities viewpoint with sub-industry selection and top-down and bottom-up analysis.

Currently, the fund holds a portfolio of 44 companies, including companies like Capstone Copper Corp. (4.72%), Permian Resources Corp. (4.63%), Teck Resources Ltd. (4.27%), and Targa Resources Corp. (4.03%). Like NRES, the fund holds companies across several subsets of the commodities and energy spaces to create a diversified portfolio.

The fund managers start by looking at cyclical and secular inflections and trends and then identify different parts of the value chain that are well-positioned at various points of the cycle. Finally, they combine stock picking with top-down commodity viewpoints to identify idiosyncratic and company-specific exposures and catalysts.

The fund charges a 0.75% expense ratio and does not currently offer a yield.

Alternative Natural Resource ETFs

These ETFs are sorted by their YTD total return, which ranges from -1.4% to 6.7%. Their AUM is between $8M and $3.4B and they have expenses between 0.35% and 0.59%. They are currently yielding between 2.7% and 5.8%.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| iShares North American Natural Resources ETF | IGE | ETF | No | $601M | 6.7% | 2.9% | 0.41% |

| Amplify Natural Resources Dividend Income ETF | NDIV | ETF | No | $8.64M | 2.8% | 5.8% | 0.59% |

| SPDR S&P North American Natural Resources ETF | NANR | ETF | No | $483M | 2.6% | 2.7% | 0.35% |

| SPDR® S&P® Global Natural Resources ETF | GNR | ETF | No | $3.39B | -1.4% | 3.5% | 0.40% |

The Bottom Line

Natural resources provide a haven in today’s environment by diversifying away from equities and bonds while offering some degree of protection from geopolitical conflict. While there are many passively managed ETFs out there, the high dispersion of returns in the industry makes it ripe for active manager expertise.

Fortunately, NRES and MGNR are two newly launched active ETFs filling the void.

1 Man Institute (February 2024). Extracting the Best from Natural Resources