Most people associate the term ‘hedge fund’ with exclusivity and spectacular gains. After all, Renaissance Technologies famously returned 66% a year before fees between 1988 and 2018; it was so successful that it’s mostly run for employees now. And Citadel’s Wellington fund has returned 19.6% on average since 1990, beating the S&P 500’s 10.7% returns.

A new crop of actively managed ETFs promises to bring hedge fund strategies to everyday investors. While ETFs have more restrictions than hedge funds, a dizzying array of derivatives help fund managers recreate many popular hedge fund strategies.

In this article, we’ll look at whether these new ‘hedge fund ETFs’ offer the same appeal as conventional hedge funds or whether they’re simply piggybacking off the name.

What Are Hedge Fund ETFs?

More than 30 actively managed ETFs employ hedge fund-like strategies, ranging from simply covered calls to merger arbitrage. Like conventional hedge funds, some ETF managers focus on a single strategy while others take a multi-strategy approach. In total, these funds have amassed $6 billion in assets with a 0.8% average expense ratio.

Popular Hedge Fund Strategy-Based ETFs

These ETFs are sorted by their YTD total returns, which range from -1.6% to 36.2%. They have AUM between $136M and $33B and expenses between 0.50% and 0.85%. They are currently yielding between 0% and 12.1%.

| Name | Ticker | Type | Actively Managed? | AUM | YTD Total Ret (%) | Yield | Expense |

|---|---|---|---|---|---|---|---|

| Simplify Interest Rate Hedge ETF | PFIX | ETF | Yes | $136M | 36.2% | 2.71% | 0.50% |

| iMGP DBi Managed Futures Strategy ETF | DBMF | ETF | Yes | $767M | 14.3% | 10.2% | 0.85% |

| JPMorgan Equity Premium Income ETF | JEPI | ETF | Yes | $32.8B | 3.0% | 6.5% | 0.35% |

| SPDR SSGA Multi-Asset Real Return ETF | RLY | ETF | Yes | $542M | 3.0% | 7.8% | 0.50% |

| Global X Russell 2000 Covered Call ETF | RYLD | ETF | No | $1.42B | 1.5% | 12.1% | 0.63% |

| Alpha Architect Tail Risk ETF | CAOS | ETF | Yes | $178M | 0.8% | 0% | 0.76% |

| RPAR Risk Parity ETF | RPAR | ETF | Yes | $627M | -1.1% | 4.2% | 0.52% |

| IQ Merger Arbitrage ETF | MNA | ETF | No | $298M | -1.6% | 1.2% | 0.77% |

These funds employ several strategies, including:

- Covered Calls – Writing a call option against a long stock position helps generate extra income in exchange for limiting upside.

- Managed Futures – Managed futures funds employ long and short positions in derivatives, including futures contracts and forward contracts, across equities, fixed income, currencies, and commodities, just like many hedge funds.

- Risk Parity – Risk parity involves allocating capital to equities, commodities, and bonds based on their risk contribution rather than expected return or market capitalization, resulting in more optimal diversification.

- Merger Arbitrage – Merger arbitrage is a strategy that involves investing in a merger target while short-selling the acquirer or broad equity indexes as a hedge.

While these are the largest funds, the most successful ETFs this year have been inflation-focused funds. For instance, the Simplify Interest Rate Hedge ETF (PFIX) is up 28.4% since January by investing in interest rate options providing a direct and convex exposure to large upward movements in interest rates and interest rate volatility.

Do Hedge Fund ETFs Beat the Market?

The S&P 500 index is up 6.75% between January 1 and April 15, 2024. By contrast, only nine of 36 hedge fund ETFs posted higher returns over the same timeframe, representing just 25% of the total. Meanwhile, the average one-year return is about 9.97% across the group compared to a blistering 22% for the S&P 500 index.

That said, most hedge fund managers would argue that total returns aren’t a very good benchmark. Instead, they would insist that hedge funds are valuable because they produce the highest risk-adjusted returns over time. And most of their alpha typically comes from avoiding downturns rather than amplifying bull markets.

The problem is that many hedge fund ETFs have only been around a few years, which isn’t long enough to have survived a major downturn. However, many funds have strategies in place to limit a major downturn. For instance, the Alpha Architect Tail Risk ETF (CAOS) aims to earn positive returns during significant market downturns.

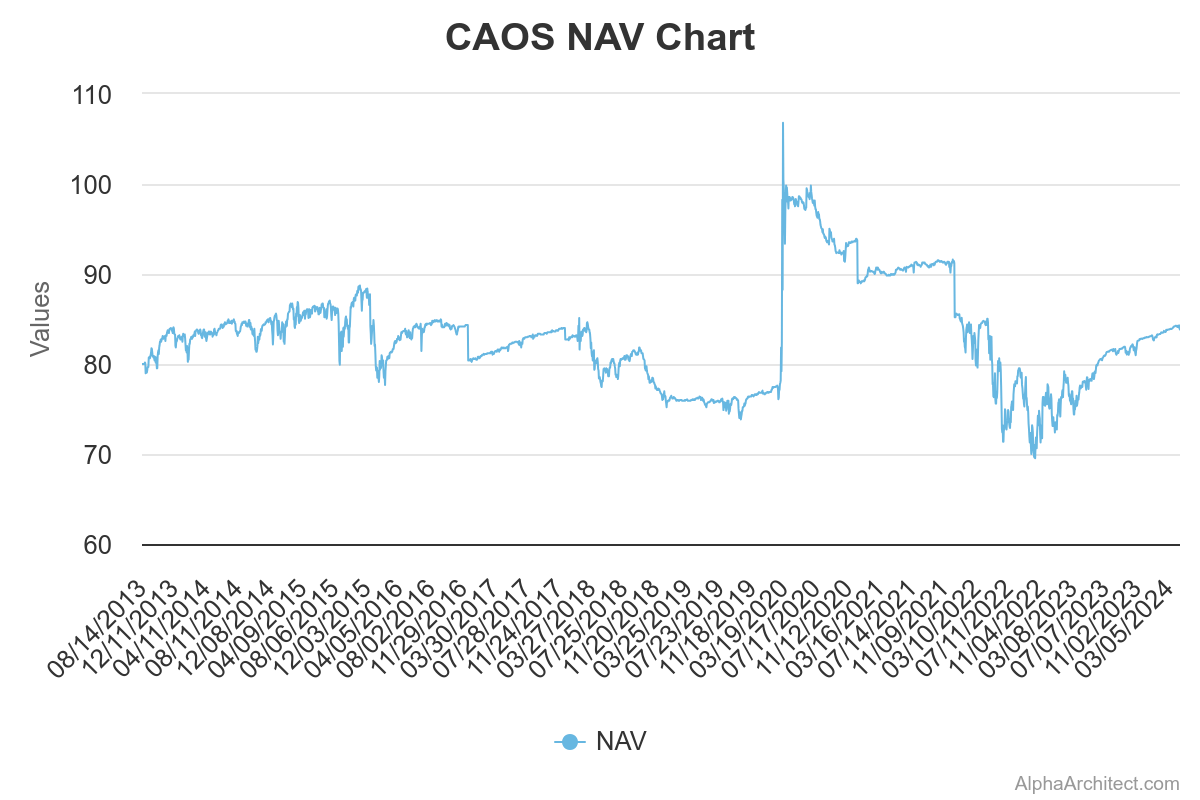

In the chart above showing CAOS’s net asset value over time, the value sharply increased during the COVID-19 pandemic in February-March 2020 despite the S&P 500 falling sharply lower. However, the subsequent decline in net asset value missed out on a significant subsequent gain in the S&P 500 during the COVID-19 recovery.

Should You Invest in Hedge Fund ETFs?

Hedge fund ETFs may not offer the spectacular track records of top hedge funds, but they do provide exposure to many popular hedge fund strategies. These strategies might help reduce risk and improve risk-adjusted returns, but not necessarily total returns, unless you happen to time when certain strategies will outperform.

Hedge fund ETFs may be most suitable for investors prioritizing things other than total return. For instance, if you’re risk averse, you might consider a buffer or tail risk strategy that limits downside risk even if it means less returns during a bull market. Or, if you want regular income, you may consider income-focused strategies.

On the other hand, if you want to beat the market in total return over the long haul, you might want to stick with passively managed funds with lower expenses. Or, you may want to wait for hedge fund ETFs to generate a longer-term track record that proves their ability to navigate market downturns.

The Bottom Line

Active ETFs have become increasingly popular, bringing hedge fund strategies to everyday investors. Unfortunately, these funds don’t have the same lengthy track records as today’s top hedge funds, and most haven’t experienced market downturns where they might generate the most alpha. However, they may still be suitable for some investors.