We all could use more income these days, especially with interest rates at historically low levels. For many investors, the hunt for yield has taken them toward some exotic and risky fare. New strategies, security types, funds, and insurance products have grown in popularity since the Federal Reserve began its zero interest rate policies (ZIRPs) during the Great Recession. But one simple, risk-less technique is being ignored by many investors. We’re talking about using options.

We’re referring specifically to selling covered calls on your portfolio of dividend stocks.

While many investors shun options due to their complexity, using covered calls to supplement your income is quite simple and the effects can be pretty dramatic to your bottom line. Moreover, the risk for these option techniques is minimal as well versus other forms of income generation.

In the end, selling covered calls could be what retirees or near retirees need to boost their income profiles.

To learn more about different portfolio management techniques, check out our Portfolio Management channel.

Covered Call Basics

When most people think about options, they envision a complex portfolio strategy full of ‘Condors,’ ‘Iron Butterflies,’ and ‘Christmas Trees.’ This is the stuff that day traders and Wall Street pros play with all day that allow them to leverage positions or what have you. The reality is that options—like all derivatives—started out as insurance for a portfolio. It’s here that regular investors can use options to potentially generate more income from their stock holdings.

For this, we’re looking at covered calls or a buy-write strategy.

At its very basic, a buy-write is an investment approach where the investor buys a stock or a basket of stocks tied to an index and writes call options that cover the stock position. A call option gives its holder the right to buy a stock from the option seller at a certain price by a certain date. By writing the call, an investor caps the upside potential of the underlying stock; if it goes past the strike price, the option buyer will get to buy the shares away. In exchange for writing the option, the investor generates income from the fee the option buyer pays. In the meantime, the option writer still owns the stock, collects dividends, etc.

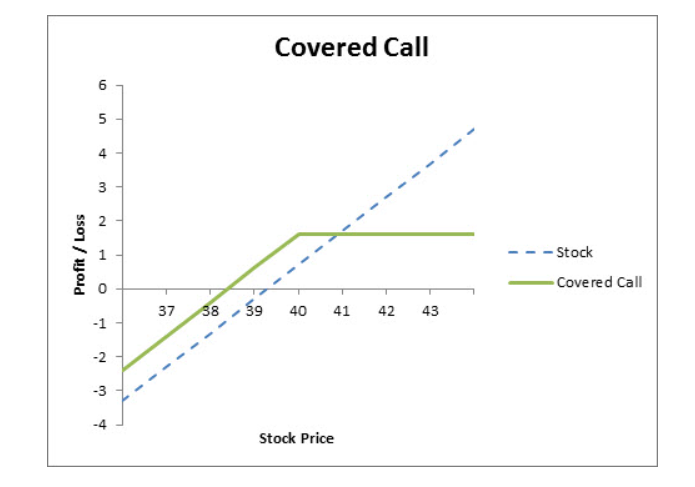

The following chart from Fidelity is a good example of what this looks like in practice.

Source: Fidelity.com

It looks something like this in a real-world example.

Sally owns shares of dividend stalwart Walmart (WMT), which is currently trading at $140 per share. She decides to write (sell) call options on the stock with a strike price of $150. Jim decides to buy the option from Sally and pays her a fee to do so. Sally gets to keep this fee no matter what happens next. If WMT shares never cross that $150 line, the option expires worthless and Sally can keep the shares and go about her day. If Walmart stock suddenly rises to $175, Jim can now exercise his option and buy the shares from Sally for just $150. While Sally doesn’t make the full capital gain, she still makes a profit of $10 per share ($150 minus $140) plus the fee for writing the option.

As you can see, the risks are muted for Sally, the covered call writer.

Tax Issues

Just like everything in the investing world, Uncle Sam wants his share when it comes to options as well. Profits and losses obtained from covered calls are considered short-term capital gains as are the option premiums. This holds true no matter how long the option was. That’s something to consider when exploring the use of options.

Investors also need to be wary of some tax implications when they write call options and sell shares used in writing those options. This gets into tax straddle rules designed to prevent an investor from deducting losses before offsetting gains have been recognized.

However, there are ways to potentially limit the effects of taxes on covered call writing. Tax-loss harvesting can help reduce the amount owed on short-term gains, while using an IRA to write options completely eliminates the taxable gains associated with the strategy. Meanwhile, holding your covered call positions for the long haul can help eliminate many of the tax straddle rule headaches.

Check out our Mutual Funds Screener to find the right kind of fund to suit your investment needs.

Putting Covered Calls Into Practice

While writing call options on your entire portfolio doesn’t make much sense, writing options on a portion or a few stocks can be a great way to boost the income of your portfolio. It especially makes sense on stodgy and slow-moving dividend payers. The reality of a stock like Coca-Cola (KO) or Walmart going parabolic is pretty slim. To that end, investors may be able to write options that have a good chance to expire worthless. Even still, having a stock getting called away isn’t the end of the world and still produces some gains for option writers in most cases.

A great way to implement the strategy could be to write options on half a position in a single stock. That way, if the stock gets called away, you still own a chunk of shares. For example, if you owned 2,000 shares of WMT, writing options on 1,000 of those shares could add just enough income while keeping the bulk of your holdings.

Another option for options could be letting someone else do the work. The Invesco S&P 500 BuyWrite ETF (PBP) holds a long position in the S&P 500 and sells covered calls on that position. Now, the effect isn’t exactly the same as selling individual covered calls on stocks you own, but it’s an option for investors just looking to get their feet wet when exploring options.

The Bottom Line

Most investors ignore options due to their perceived complexity. However, in their basic form, they can provide an extra layer of income to a portfolio. Writing covered calls on dividend stocks you already own could result in extra needed income with little risk.

Be sure to check out MutualFunds.com’s News section for more information and investing tips.