Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Hawaiian Electric has taken the first spot in the list, as the company’s stock price collapse led to an increase in the dividend yield to more than 10%. Home Depot is second in the list, as the company’s financial results have been impacted by weakening consumer demand. Third in the list is REIT Medical Properties Trust, which faces issues with tenant pay. The list is closed by wholesale retailer Costco Holdings, which recently declared its regular quarterly dividend.

Don’t forget to read our previous edition of trends here.

Hawaiian Electric Faces Trouble Ahead

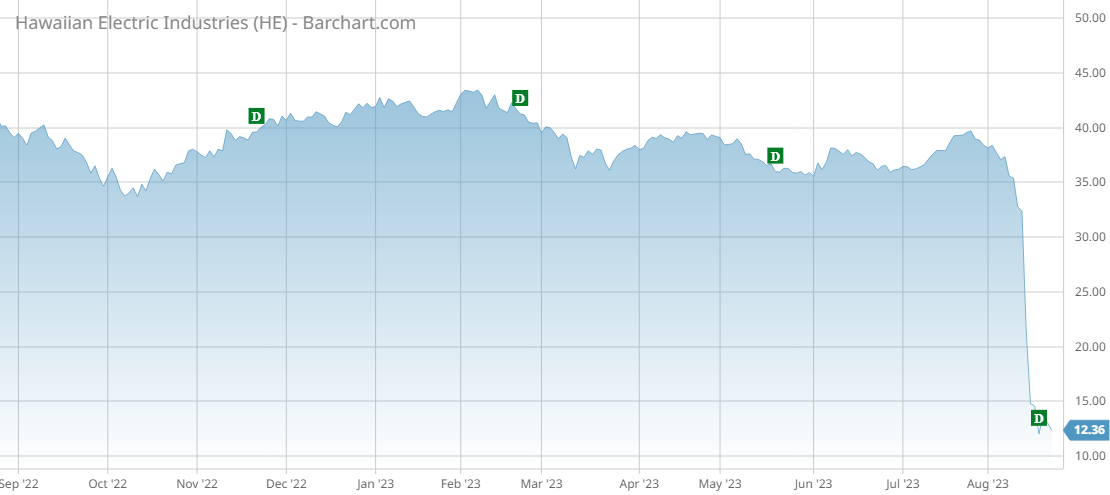

Hawaiian Electric (HE) has taken the first spot in the list this fortnight, seeing an increase in viewership of 3,107%. Hawaiian Electric was in the news after its stock lost 60% on potential bankruptcy concerns. As a result, the dividend now yields an impressive 11%, although there is big uncertainty whether it is sustainable.

Hawaiian Electric is being blamed for contributing to the deadly fires in the historic Maui town of Lahaina, HI, by failing to shut off electricity when high winds risked blowing power lines. The company’s stock was downgraded by ratings agencies Fitch and S&P Global Ratings to junk, as HE carries a big risk of financial liabilities related to the fire.

Hawaiian Electric said it is seeking advice from experts. The situation is similar to that of PG&E, a California utility that was forced to seek bankruptcy and restructure after it estimated the costs related to fire liabilities in California would exceed $30 billion.

While the dividend is high and the stock is depressed, Hawaiian Electric faces a big risk that it will have to seek bankruptcy protection and restructure, wiping out common shareholders in the process.

Source: Barchart.com

Home Depot Results Suffer Due to Weak Consumer Demand

Home Depot (HD) has taken the second position in the list with an increase in traffic of 39%. Home Depot recently declared a second-quarter dividend of $2.09 per share, resulting in a dividend yield of 2.6%. The company has been growing its dividend for 14 consecutive years.

Home Depot has said that in the first half of this year sales declined by 3.1% to $80.2 billion, compared with the same period last year. The post-Covid pandemic boost has faded, with the consumer becoming more cautious about home improvements amid rising interest rates and inflation.

Guidance was also negative. Home Depot said it expects sales to fall between 2% and 5% this year, while earnings per share will decline between 7% and 13%.

Shares in Home Depot have fallen slightly from recent highs. Despite cyclical headwinds, the company remains in a strong position to reward shareholders over the long term with stock price appreciation and dividends.

Source: Barchart.com

Medical Properties Trust Stock Tanks on Worries About Deal With Tenant

Medical Properties Trust (MPW) has placed third in the list with an increase in readership of 37%.

Medical Properties dividend yields an impressive 16.8%, but it is not safe. The REIT’s stock lost about half of its value since news emerged it faces difficulties collecting rent from two of its largest tenants, Steward Healthcare and Prospect Medical Holdings. To resolve the issue, Medical Properties exchanged accrued rent with an equity interest in its Prospect’s managed care business, news that pleased shareholders.

The company still has to receive approval from regulators, and it reassured investors that it’s a matter of time. But investors fear that might not be the case, having bid the stock, which was on its way to recovery, down 30% since early August. The stock is currently trading at lows not seen since 2009.

Source: Barchart.com

Costco Wholesale

Costco Wholesale (COST) has placed last with an advance in viewership of 29%. Costco shares are trading within a whisker of record highs, as sales are continuing to rise despite weakening consumer sentiment. Costco’s focus on value items is certainly a catch with cash-strapped consumers. Memberships are continuing to increase.

For the month of July, Costco said sales jumped 4.5% to $17.60 billion compared with the same period last year. The company is now eyeing expansion in the U.K. It plans to open 14 new stores over the next two years, something that will increase the number of stores in the country to 44.

Costco has been increasing its dividend for 19 consecutive years, and currently the dividend yields 0.75%. It trades at a relatively expensive P/E ratio of 40.

Source: Barchart.com

The Bottom Line

Hawaiian Electric pays a high dividend, but the company faces potential litigation related to the deadly fires in Hawaii. Home Depot is experiencing a drop in sales as consumers delay home improvements. Medical Properties Trust is facing uncertainty as two of its tenants are struggling to pay rent. Finally, Costco Wholesale is seeing growing demand as cash-strapped consumers look for value.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.