Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Last fortnight was all about the earnings announcements. Apple, first in the list, has reported better-than-expected results thanks to rising services sales. Second in the list is ExxonMobil, which reported another blockbuster quarter. Third is Energy Transfer, an oil and gas pipeline operator that upwardly revised its earnings guidance for 2023. Last in the list is IBM, which reported declining revenues but expanding margins.

Don’t forget to read our previous edition of trends here.

Apple Reports Strong Results

Apple (AAPL) has taken the first position in the list with an advance in viewership of 67%. The iPhone maker reported better-than-expected results for the second quarter. Revenue came in at nearly $95 billion compared with $93 billion expected by analysts. The strong results were largely thanks to record revenue in the services division.

At the same time, the company seems to be shifting its focus from China as a key growth market to India, with CEO Tim Cook saying the country is seeing a growing cohort of the society coming into the middle class, something that makes them potential Apple customers.

On the back of strong results, Apple announced a new $90 billion share buyback. This has prompted a rally in the stock, which is now trading within a whisker of its all-time high.

Although Apple’s dividend yields a small 0.5%, its stock performance has been stellar. The company acted as a safe haven in a tech space that has been hit by capital flight. The stock recently received another boost, after legendary investor Warren Buffett said Apple was one of his best portfolio companies.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

ExxonMobil Reports Strong Results

ExxonMobil (XOM) is second in the list with an increase in traffic of 45%. Exxon reported another strong quarter, with revenues slightly declining year-over-year but net income doubling to more than $11 billion. Exxon Mobil has been returning most of its free cash to shareholders via dividends and stock buybacks. It last announced a $50 billion share repurchase program at the end of last year after strong earnings.

Exxon’s strong results come despite lower oil prices of late. The earnings this quarter were driven by higher oil production in Canada and the coming online of new refining facilities. Going forward, it would be harder for Exxon to improve earnings. Demand is unlikely to tick higher given the deteriorating global economic environment, although geopolitical tensions could lead to supply shocks.

Exxon’s dividend yields 3.3%, and the company’s stock trades at a record high. However, the path forward is filled with uncertainties.

Source: Barchart.com

Energy Transfer Increases Guidance for Full Year

Energy Transfer (ET) is third in the list with an increase in traffic of 44%, not far from Exxon Mobil. As with most energy companies, Energy Transfer has also reported a good set of results in the second quarter, with distributable cash flow to partners coming in at more than $2 billion, slightly lower than the same period last year, when energy prices were higher.

Energy Transfer upwardly revised its guidance, saying it now expects adjusted EBITDA for the full year to be in a range of $13.05 billion and $13.45 billion compared with $12.9 billion to $13.3 billion previously. The increased guidance was largely due to the acquisition of Lotus Midstream Operations and higher expected demand.

Energy Transfer stock continues to trade below pre-pandemic levels, despite improving results on the back of higher demand for energy. The company’s depressed stock means the dividend yields a strong 10%.

Source: Barchart.com

IBM Issues Mixed Results

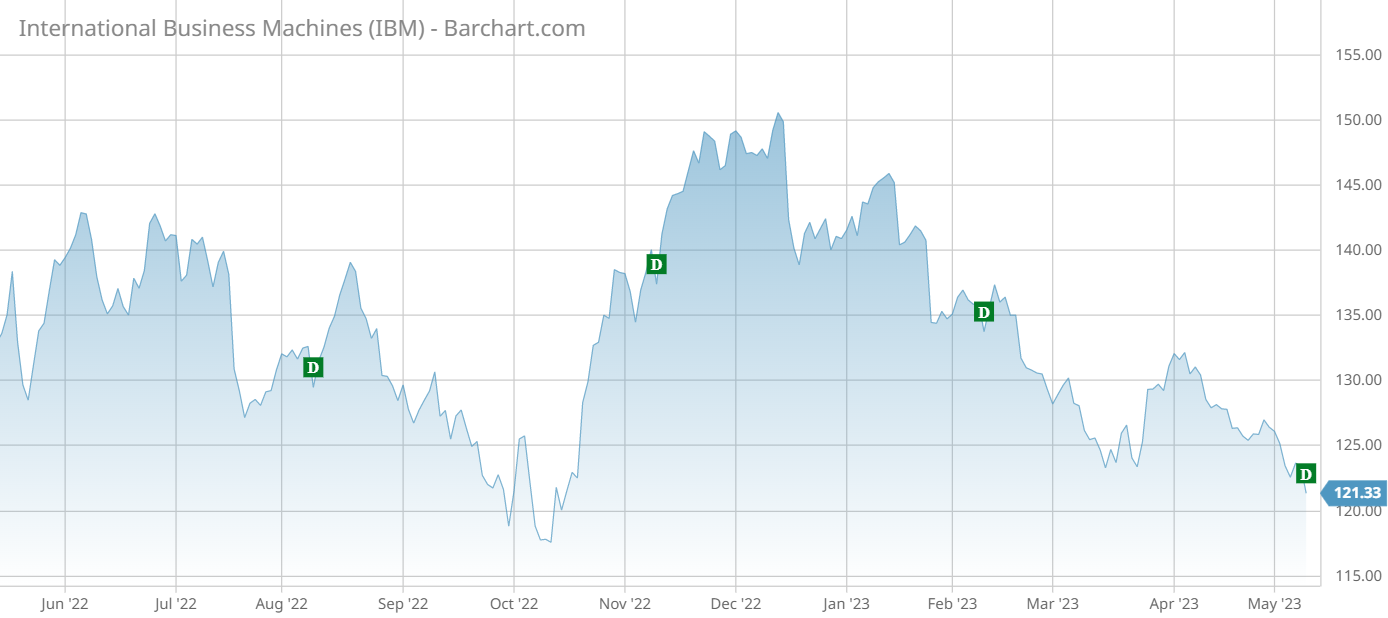

IBM (IBM) is last in the list, seeing its viewership rise 24%. IBM has reported mixed results for the second quarter, with revenues declining by around $100 million to $14.25 billion and earnings per share jumping from $1.26 to $1.36.

Earnings per share have improved thanks to lower costs with research and development. The company is undergoing an efficiency improvement program. IBM said that it put hiring on pause as it expects a number of positions to be replaced by artificial intelligence (A.I.). Around 7,800 jobs can be saved in the next year at the company, which already laid off 3,900 employees in late January.

IBM pays an annual dividend of $6.64 per share, resulting in a yield of 5.4%. The company’s stock, however, is down more than 8% so far this year, and it largely traded sideways over the past five years.

Source: Barchart.com

The Bottom Line

Apple stock hovers near record highs as the company reported strong results. Exxon has seen its profits double in the second quarter, even as revenues declined. Energy Transfer increased its guidance for the full year thanks to an acquisition and higher expected demand. Finally, IBM earnings per share increased on lower overall costs.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.