Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Procter & Gamble has taken the first position in the list this week as the company raised its dividend amid strong earnings performance. Second in the list is Cisco Systems, which also performed well despite supply bottlenecks that negatively impacted this year’s operational performance. Pharmaceutical giant AbbVie is third, while Enterprise Products Partners is last.

Don’t forget to read our previous edition of trends here.

Procter & Gamble Hikes Dividend by 3%

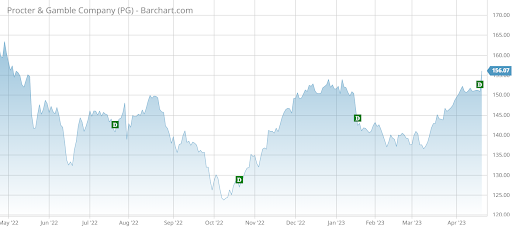

Procter & Gamble (PG) has taken the top spot in the list this week, seeing its viewership advance 46%. Procter & Gamble has trended after the company raised its dividend by 3%. The company now pays a quarterly dividend of 94 cents, representing a yield of 2.4%.

Procter & Gamble has had a strong first quarter, despite deteriorating consumer sentiment. Revenue rose 3.5% to over $20 billion, while net income was up 1.25% to $3.4 billion. While the company has seen sales volumes decline in Europe and the U.S., big price increases have led to overall revenue growth.

The company does have a cushion against a potential recession. Consumers typically cut spending late into a downturn on P&G products like cleaning and personal hygiene. This has been reflected in the company’s stock price performance. P&G shares have risen 21% over the past six months, outperforming the S&P 500 Index by 12 percentage points, Over the past five years, P&G has outperformed the broad index by 60 percentage points.

P&G will disburse its dividend on May 15 to shareholders of record as of April 21.

Cisco Systems Increases Dividend by 1%

Cisco Systems (CSCO) is second in the list with an advance in viewership of 23%. Cisco is another company that has increased its dividend, from a quarterly 38 cents per share to 39 cents, equating to a dividend yield of 3.3%.

Cisco shares have also held up well in the past year, despite the company suffering from supply chain issues. Sales rose just 3.5% in 2022, although net income expanded 11.5%. The company expects to have a much better year in 2023, with sales growth of around 10%. Cisco, which sells communications equipment and software, said demand was strong in the enterprise space and the public sector.

Cisco shares have underperformed since the start of the year, falling 2% compared with an advance of 8.2% for the S&P 500 Index.

Check out our latest Best Dividend Stocks Model Portfolio.

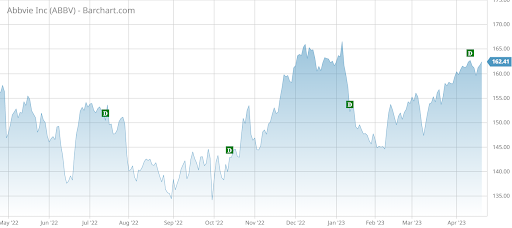

AbbVie Trends As it Faces Patent Cliff

AbbVie (ABBV) has taken the third spot as the pharmaceutical company has seen its viewership increase 15%. AbbVie has trended as the stock yields an attractive 3.6% compared with the pharma average of 1.6%. Its stock, meanwhile, has steadily advanced over the past five years and is up 3% so far this year.

However, AbbVie faces a patent cliff in 2023. Humira, its top selling drug for years, is expected to see sales decline 37% as its patent expires and competition begins to sell drugs at much lower prices. The company’s management expects Humira sales to stabilize in 2024. Two other immunology drugs, Skyrizi and Rinvoq, are promising, with sales growing strongly in 2022. Together, the two drugs brought in around $7.8 billion in revenues last year, less than half what Humira generates now.

AbbVie increased its dividend at the start of the year by 7 cents to $1.48 per share. This was a smaller increase than in 2022 and 2021.

Enterprise Products Rides High on Robust Demand for Oil

Enterprise Products Partners (EPD) has taken the last position in the list with a small jump in traffic of 6%.

Enterprise Products shares are only now reaching pre-pandemic levels, as demand for oil and natural gas transportation has remained strong. Since reaching pandemic lows in early 2020, the company’s stock has surged 92%.

Revenue advanced 43% in 2022, allowing Enterprise Products to continue to increase its dividend. Enterprise Products announced a dividend hike of 5% on April 5 to 49 cents per unit. The dividend will be paid on May 12 to shareholders of record as of April 28. The dividend yields a strong and attractive 7.3%.

But there are risks. In the event of a recession or downturn, demand for oil and natural gas is likely to drop, which will put the company’s earnings at risk.

The Bottom Line

Procter & Gamble has raised its dividend as the company’s revenues rose thanks to price hikes for key products. Cisco Systems also hiked its dividend, as the company expects revenues to grow by the high teens this year. AbbVie has a solid dividend and stock performance, but it faces a patent cliff this year. Enterprise Products Partners stock has outperformed over the past year, and dividend has been strong, but earnings are at risk in the event of a recession.

Be sure to check out Dividend.com’s News section for the most trending news around income investing.