Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This fortnight, all four companies that generated top viewership numbers raised their dividends. Haverty Furniture was first in the list after the company increased its dividend by 12%. Everest Re Group was second as the insurer hiked the dividend payout by more than 6%. Packaging Corporation of America announced the highest dividend increase from the pack. Last in the list is Mid-America Apartment Communities, which bumped its dividend by 15% recently.

Don’t forget to read our previous edition of trends here.

Haverty Furniture

Haverty Furniture (HVT) has taken the lead position this fortnight, seeing its viewership climb 683%.

The furniture retailer reported rising sales and profits in the first quarter of 2022, allowing it to reward shareholders with a dividend increase. The company owning 121 locations across the U.S. has said its sales increased by more than $3 million in the latest quarter to nearly $239 million. Meanwhile, Haverty’s pre-tax income jumped slightly to $25.7 million. The company said its general costs increased due to higher compensation and benefit costs, as well as an increase in distribution and delivery costs.

Haverty hiked its dividend by 12% during the quarter from 25 cents per share to 28 cents. The dividend is payable on June 17 to shareholders of record as of June 2. The company has never missed a dividend payment since 1935. Its dividend currently yields nearly 4%, which is higher than the 1.9% for the consumer discretionary average yield.

Shares in Haverty have declined nearly 40% this year, but remain up 37% to pre-pandemic levels.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

Everest Re Group

Everest Re Group, a Bermuda-based provider of reinsurance and insurance products, (RE) has placed second this fortnight, seeing its viewership surge 533%. Despite posting weaker results in the first quarter of 2022, Everest Re’s board approved a dividend increase to the tune of 6.4%.

The company said its net income fell from $342 million in the first quarter of 2021 to $298 million this year’s quarter. Shareholders’ equity declined $811 million to $9.5 billion due to unrealized net losses on fixed-income investments.

Everest Re, however, increased its dividend for shareholders from $1.55 per quarter to $1.65. The payout yields 2.3% compared to financials average yield of 3.2%. Everest Re has also rewarded investors with strong stock price performance over the past 12 months, with the stock advancing nearly 10% amid a market rout.

Source: Barchart.com

Packaging Corp of America

Packaging Corp of America (PKG) has taken the third spot this fortnight, generating a 448% increase in viewership. Just like the two other dividend stocks this week, Packaging Corp increased its dividend by 25% to an annual payout of $5 per share. The dividend will be paid on July 15 to shareholders of record as of June 15.

Packaging Corp again reported strong results in the first quarter of 2022, with revenue jumping 18% year-over-year to $2.14 billion. The company reported similar sales increases in the four previous quarters. Packaging Corp’s net income jumped 52% to $254 million as the company was able to increase prices in its packaging and paper segments and find cost improvements. The company recognized that it incurred higher transportation costs during the quarter.

Packaging Corp shares have risen 8% over the past 12 months and fared relatively well during the most recent market selloff. The stock is down just 5% from a peak reached in mid-April.

The company’s dividend yields 3.15%, compared with 2.8% for materials average yield.

Source: Barchart.com

Mid-America Apartment Communities

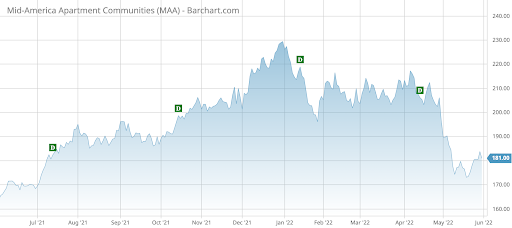

Mid-America Apartment Communities (MAA) has seen its viewership rise 443% during the past two weeks, taking the last position in the list. Mid-America has recently benefited from strong demand for apartment housing in the Southeast and Southwest regions of the U.S., with the occupancy level at a strong 95.9%.

In the first quarter of 2022, Mid-America’s funds from operations (FFO) per share jumped 20% year-over-year to $1.97. Revenues jumped 12% to $476 million, the highest growth rate in at least the last five quarters.

The strong results have allowed Mid-America to increase its dividend by 15% to a quarterly $1.25 per share. The dividend is payable on July 29 to shareholders of record on July 15. The company has been increasing its dividend for the past 14 years.

Shares in Mid-America are up 11% over the past 12 months, although they remain down 20% since a peak was reached in late 2021, potentially representing a good entry opportunity for an investor.

Source: Barchart.com

The Bottom Line

Haverty Furniture increased its dividend thanks to another set of strong results. Despite weaker performance during the latest quarter, reinsurer Everest Re hiked its payout to shareholders. Packaging Corp of America benefited from ongoing strong demand for packaging and paper, posting solid financial results and rewarding investors with a dividend hike. Mid-America Apartment Communities has benefited from solid demand for rental housing in Southeast and Southwest America and also raised its dividend.

Be sure to check out Dividend.com’s News section for trending news around income investing.