Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Three of this week’s trending companies have increased their dividend payment to shareholders. Alexander & Baldwin took first spot in the list after it hiked its dividend, thanks to a solid earnings beat. IDEX was second after the company announced an acquisition. Mercer International and Shoe Carnival were third and fourth, respectively, after both companies announced an increase in their dividend.

Don’t forget to read our previous edition of trends here.

Alexander & Baldwin

Alexander & Baldwin (ALEX) has taken first spot in the list, with an impressive surge in viewership of 1,700%.

The Hawaii-based real estate company’s earnings rebounded from the coronavirus pandemic, with its net operating income higher than before the pandemic. The company reported $35 million in net income in the full year of 2021, compared with $5.5 million in 2020. The company’s commercial real estate operations, largely focusing on grocery retail stores, saw both its revenues and net income jump to $173 million and $110 million, respectively. The net income was offset by losses in the company’s materials and construction operations, which lost $40 million in 2021.

The strong results have allowed the company to raise its dividend by 5.6% to 19 cents per share, bringing it back to pre-pandemic levels. The company had cut its dividend in the fourth quarter of 2020 by 4 cents to 15 cents, and then increased it in the following quarter to 18 cents.

The company’s dividend yields 3.3%, which is lower than the real estate average yield of 4.5%. Shares in Alexander & Baldwin have jumped 6% over the past 30 days, extending 12-month gains to 35%.

Source: Barchart.com

Check out our latest Best Dividend Stocks Model Portfolio.

IDEX

IDEX (IEX) is second in the list with a jump in traffic of 1,000%. IDEX, which manufactures fluid and metering solutions for a range of industries like aerospace, agriculture and automotive, has been in the news after it announced the acquisition of KZValve, a Greenwood, Nebraska-based company that specializes in manufacturing electric valves and controllers.

IDEX has been recovering from the coronavirus pandemic strongly, with revenues and net income expanding by double digits in 2021 and surpassing pre-pandemic levels. The company’s stock has not reflected improved financials, however, declining about 16% year-to-date. The drop was likely spurred by general market conditions, as the S&P 500 is also down 4.4%.

IDEX has been paying out an annual dividend of $2.12 per share in the past five quarters. The last time the company raised its dividend was at the end of 2020, when it increased from 50 cents per quarter to 54 cents. IDEX’s dividend yields 1.12% versus 2.4% on average for industrials.

Source: Barchart.com

Mercer International

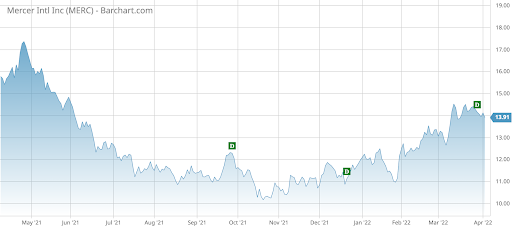

Mercer International (MERC) has taken the third spot in the list, seeing an increase in viewership of 800%. Mercer, one of the world’s largest producers of market pulp, has raised its dividend after reporting record results for the fourth quarter of 2021 and the full year. The company increased its quarterly dividend by 15% to 7.5 cents, which will be paid on April 6 to shareholders of record on March 30.

Mercer reported $1.8 billion in annual revenues for 2021, up from $1.42 billion in the previous year. Meanwhile, the company reported an operating EBITDA of $478 million compared with $192 million in the year prior. The strong results were possible thanks to strong demand for pulp and lumber as well as higher energy prices. The company expects supply interruptions in Canada and Scandinavia to support prices for pulp and paper in the coming period.

Mercer shares are up 15% since the start of the year but remain down around 11% for the past 12 months.

Mercer pays out 16% of its earnings to shareholders, and its yield is 2.2%.

Source: Barchart.com

Shoe Carnival

Shoe Carnival (SCVL) has taken the fourth spot in the list with an advance in viewership of 700%.

Shoe Carnival, an American retailer of footwear, has increased its quarterly dividend by 29% to 9 cents per share, thanks to record results and a strong balance sheet with almost no debt. Net sales in the fiscal year ended January 29, 2022, came in at $1.33 billion, versus $976 million during the same period last year. Meanwhile, net income jumped 868% to $155 million. The improvement in sales and profitability was due to higher foot traffic during the period and a store modernization program, which ran in 2021.

Shoe Carnival has a current payout ratio of just 8%, and its dividend yields 1.2%. Shares in Shoe Carnival lost 5% over the past five days, extending year-to-date losses to 26%.

Source: Barchart.com

The Bottom Line

Alexander & Baldwin upped its dividend after its earnings rebounded from the coronavirus pandemic. Manufacturing company IDEX announced a new acquisition in a quest for expansion of its electric valves market. Mercer boosted its dividend after the company’s earnings benefitted from strong demand for pulp and lumber and solid prices. Shoe Carnival’s store modernization program brought benefits, with sales and earnings jumping to a new record.

Be sure to check out Dividend.com’s News section for the latest news on dividend investing.