Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into why some dividend stocks are currently trending and help you rebalance your portfolio.

Vail Resorts has taken the first position in the list as the company raised its dividend despite delivering disappointing earnings results. Toll Brothers is second after the home builder also increased its dividend. Packaging solutions provider Graphic Packaging has taken the third spot while Viatris is last in the list as it won a patent victory in court against Biogen.

Don’t forget to read our previous edition of trends here.

Vail Resorts

Vail Resorts has (MTN) has taken the first position in the list this fortnight, seeking its viewership rise 1,778%. Vail has raised its dividend by an impressive 117%, from $0.88 per share to $1.91. This results in a forward yield of 3.16%. The dividend is payable on April 14 for shareholders of record as of March 30.

Vail, a winter resorts operator that has suffered from coronavirus-related lockdowns, reported earnings per share of $5.47 for the second quarter, missing analyst forecasts by about 28 cents. Meanwhile, revenues of $906 million were around $50 million lower than expectations.

However, Vail revenues rose more than 30% from the same period last year, showing that a recovery has taken place, although it was not as strong as investors had expected. Indeed, visits to the company’s resorts were hit by bad winter weather, disruptions from the Omicron variant of the coronavirus, and labour shortages.

Vail suspended its dividend in April 2020 in order to preserve funds to deal with the pandemic. In October 2021, the company reinstated the dividend to around $0.88, or about half of what it was before the pandemic. The current dividend is the highest in the company’s history.

Check out our latest Best Dividend Stocks Model Portfolio.

Toll Brothers

Toll Brothers (TOL) has taken the second position in the list with a jump in readers’ traffic of 1,360%.

Toll Brothers has been on the radar after the homebuilder hiked its quarterly dividend by 18% to $0.20 per share, or $0.80 on an annual basis. The higher dividend will be paid on April 2022 to shareholders of record as of April 8. Toll Brothers’ dividend yields 1.6% and the company has a payout ratio of just 6.7%.

After reaching a peak in December 2021, the company’s stock has declined around 30% to trade at $50.92 apiece. However, the company’s results have continued to improve quarter-over-quarter, suggesting the correction was market-related. In the first quarter of 2022, revenues of $1.79 billion were 14% higher year-over-year. Meanwhile, net income jumped 57%. In 2021, Toll Brothers’ revenues rose 24%, although they were down in 2020.

However, Toll Brothers might hit some bumps going forward, as rising interest rates and higher prices for building materials might lead to weak demand for housing.

Still, the company’s stock looks cheap, trading at a price-to-earnings ratio of just 7, versus 22 for the S&P 500 Index median.

Graphic Packaging Holding

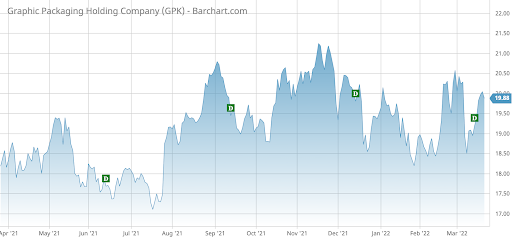

Graphic Packaging Holding (GPK) has seen an 1,100% increase in viewership, taking the first spot in the list.

Graphic Packaging has announced its regular quarterly dividend of 7.5 cents per share, yielding 1.6%. The company that provides all sorts of packaging solutions to its customers has kept the same dividend since the fourth quarter of 2016 when it had raised it from 5 cents.

For the fourth quarter of 2021, Graphic Packaging reported revenues of $1.99 billion, around $80 million higher than expectations. Meanwhile, earnings per share of $0.31 were two cents higher than forecasts. Shares in the company have been moving sideways since the beginning of the year.

The company could benefit in the near future because prices for containerboard have been rising.

Viatris

Viatris (VTRS) has taken the last place in the list this fortnight – on par with Graphic Packaging – with a jump in viewership of 1,100%.

Viatris has received a boon in its fight with Biogen over the patent for Tecfidera, a drug used to treat multiple sclerosis. Biogen, which holds the patent to produce the drug, appealed a court decision that invalidated the company’s patent covering Tecfidera. Viatris launched a generic equivalent of Tecfidera in August 2020, putting at risk the lucrative business of Biogen.

With the court’s decision, Viatris will be able to commercialise the generic multiple sclerosis therapy.

Viatris, a near-$13 billion market capitalization company, pays an annual dividend of $0.48 per share, resulting in an yield of 4.46%.

The Bottom Line

Vail Resorts has more than doubled its dividend, despite posting relatively weak results. Toll Brothers has also increased its dividend as the homebuilder has been benefiting from strong demand for housing. Graphic Packaging has beaten expectations and it could continue to benefit from higher pricing for containerboard. Viatris will be able to continue commercialising a generic drug treating multiple sclerosis after a court upheld a prior court decision that Biogen’s patent covering Tecfidera is invalid.

Be sure to check out Dividend.com’s News section where we publish the latest trends on income investing.