Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This fortnight’s trends do not look much changed compared to the last ones. ExxonMobil, currently fourth in the list, was the most popular ticker last week. Meanwhile, Microsoft, presently third in the list, was in vogue last trending article as well, as it surpassed Apple by market capitalization. Elsewhere, British American Tobacco is first in the list, as its dividend looks lucrative. IBM, another high dividend company, trended, as it spun-off its IT services business Kyndryl.

Don’t forget to read our previous edition of trends here.

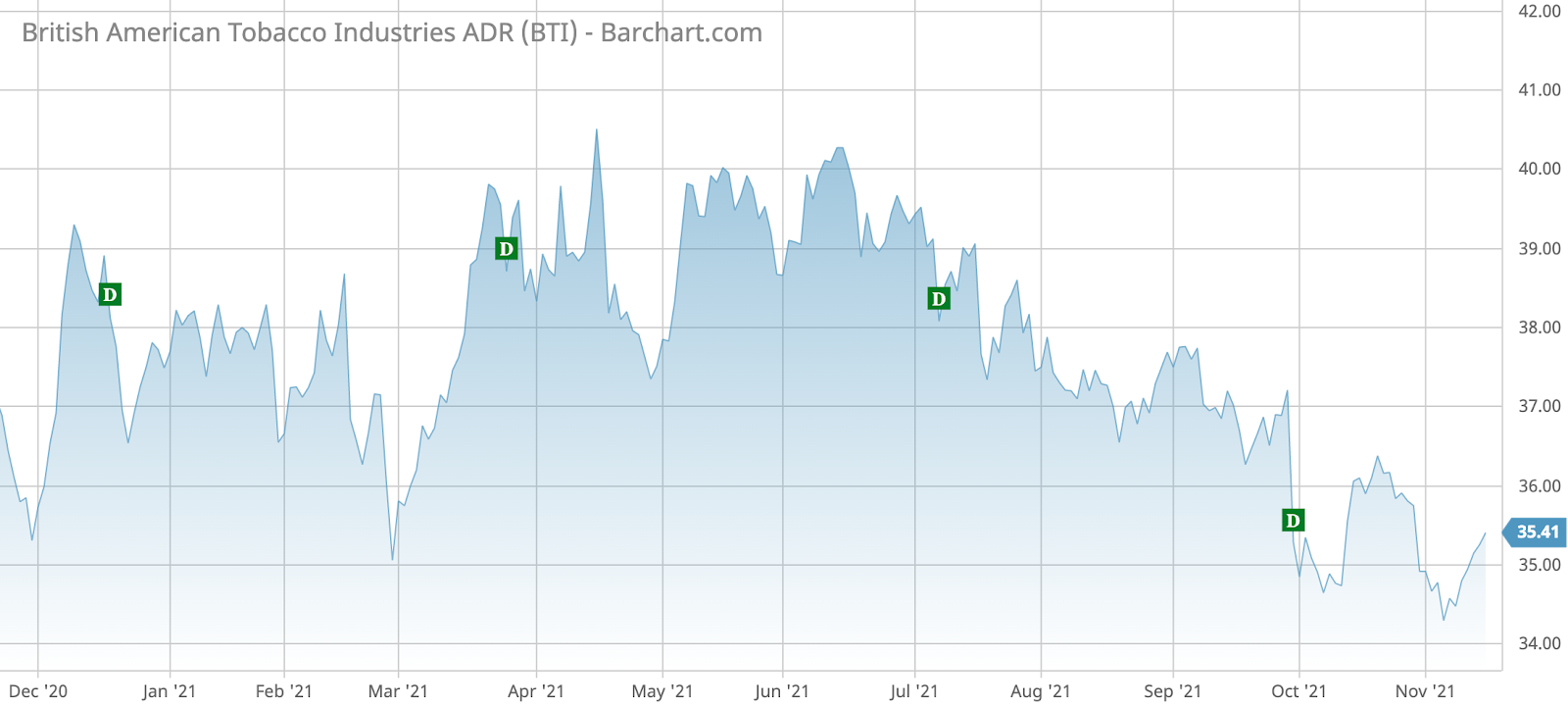

British American Tobacco

British American Tobacco (BTI) has seen its viewership rise by 19% this fortnight, taking first place in the list.

British American, the world’s premier tobacco company, has received a boost after the U.S. Food and Drug Administration (FDA) finally authorized R.J. Reynolds’ vaping device Vuse, the first e-cigarette to receive such authorization in the U.S. The FDA said that the use of Vuse could help existing smokers reduce their consumption of traditional cigarettes. R.J. Reynolds is wholly owned by BTI.

Despite the authorization, BTI is still likely to continue to struggle with falling sales. Overall, it is believed that the growth in the e-cigarettes market is not enough to offset the decline in traditional cigarettes. This means that BTI might struggle to grow organic sales for the foreseeable future.

British American’s dividend currently yields a hefty 8% on an annual basis. However, this return has been erased by the poor performance of its stock price, which is down by 8.4% for the past 12 months and has declined 40% over the past five years.

Source: Barchart.com

Check out our latest Best Dividend Stocks List here.

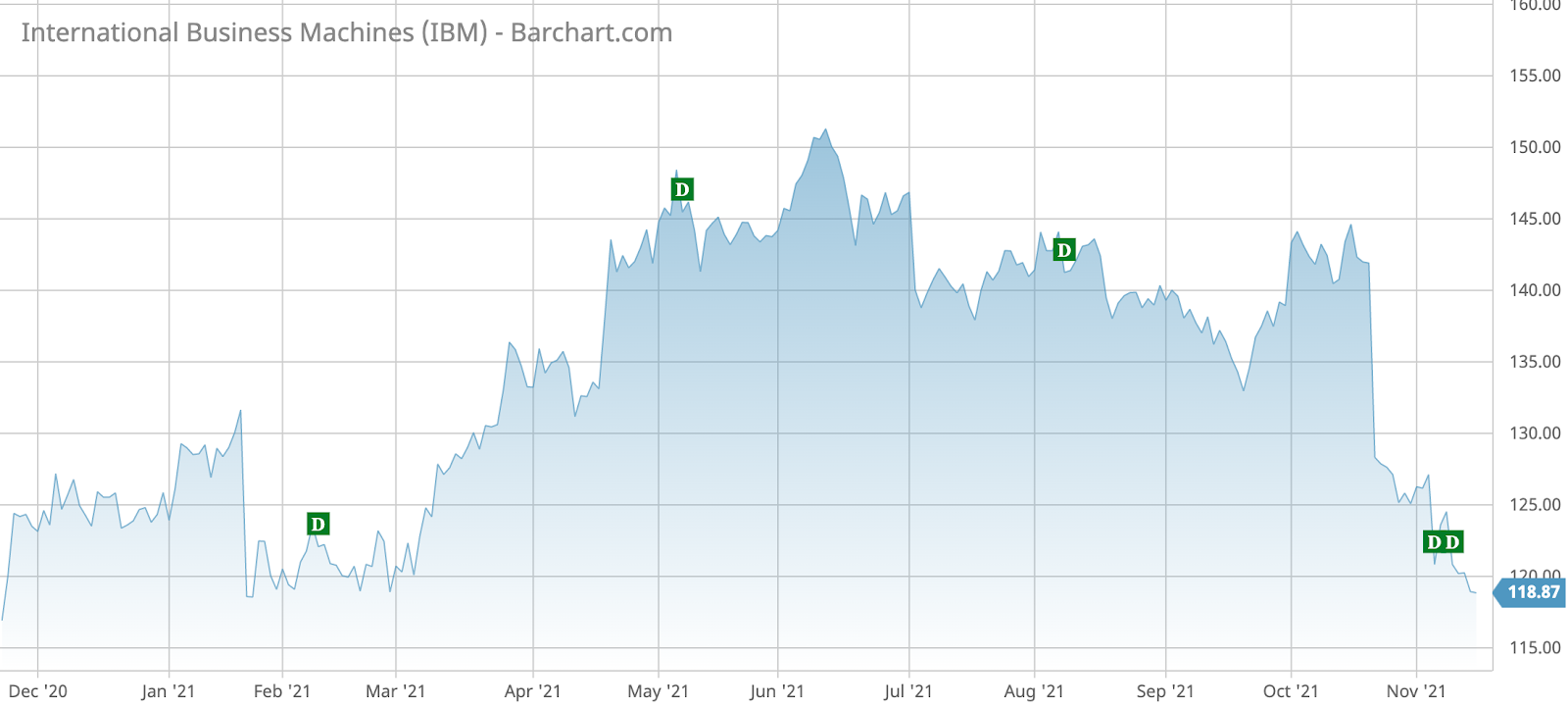

IBM

Technology behemoth IBM (IBM) is second in the list with a rise in viewership of 10%. IBM’s dividend yields a strong 5.5% annually, but the company has struggled for a while to grow both its revenues and profitability, and its stock also underperformed.

In a bid to reverse the decline, IBM recently completed the spin-off of its services segment Kyndryl, which was responsible for 25% of revenues.

IBM hopes that Kyndryl, whose relevance as an IT maintenance operator has fallen as customers shifted to cloud services delivered by Microsoft (MSFT) and Amazon (AMZN), will be better positioned to grow on a stand-alone basis as it can strike partnerships with cloud vendors. Indeed, on November 12, 2021, Kyndryl announced a global partnership with Microsoft, hoping it will lead to multi-billion dollar market opportunities for both companies.

Post spin-off, IBM will be betting on artificial intelligence (AI) and security, among other initiatives, in order to put the company back on a growth trajectory.

Source: Barchart.com

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.

Microsoft

Microsoft (MSFT) has taken the third spot in the list, seeing its viewership increase by 5%. Microsoft was the second-most popular ticker in the last trends article.

And for good reason. In addition to recently becoming the largest company in the world by market capitalization, Microsoft is already moving into Meta’s territory. Facebook (FB) made a splash after it recently changed its name to Meta in order to focus on creating the metaverse.

Microsoft is already creating the metaverse for the office set-up. Microsoft will roll out metaverse features to its 250 million Teams customers, which will allow for a more immersive virtual experience. Among others, users will be able to generate avatars and animations of themselves.

Compared with Meta, Microsoft has taken a more incrementalist approach to building the metaverse, but it might be the right one, given customers’ needs to adapt to new things.

Microsoft’s dividend yields 0.7%, and it has been rewarding investors with impressive stock price performance.

Source: Barchart.com

ExxonMobil

ExxonMobil (XOM) is last in the list with a small increase in viewership of just 3%. The oil major trended first last week.

After years of declining operational performance and stock returns, Exxon now seems to be benefitting from some strong momentum, fueled by rising oil prices. Since reaching a low at the end of 2020, shares are now up more than 96%, outperforming peers like BP (BP), Shell (RDS-B) and Chevron (CVX).

The strong performance has boosted management’s confidence that it can reach its targets of doubling earnings – from $15 billion in 2017 to $31 billion in 2025. The profits will largely be used for shareholder returns like dividends and buybacks and investments in lower-carbon technologies.

Exxon pays a dividend of $3.52 per share, amounting to a yield of 5.47%.

Source: Barchart.com

The Bottom Line

British American Tobacco has seen its vape product authorized for use by the Food and Drug Administration (FDA), but the presumed healthier alternative to smoking is not believed to offset the decline in sales of traditional cigarettes. IBM is hoping that spinning off its services business will allow both stand-alone companies to thrive after a decade of disappointing returns. Microsoft is launching its own version of the metaverse that is likely to compete with Meta, the owners of Facebook. Finally, ExxonMobil appears confident it will double its earnings by 2025.

Want to generate high income without undertaking too much risk? Check out our complete list of Best High-Yield Stocks.